The Philippine Labor Code is lengthy and for non-lawyers, complicated to read and understand. However, every entrepreneur must learn about this law and apply its provisions to their business. Our first Philippine Labor Code infographic focuses particularly on rules for companies who offer internship programs and/or employ handicapped employees.

Update: The second article from our Labor Code series discusses Working Conditions and Rest Periods. Find it here.

Poor Working Conditions

We’ve heard one too many stories in the news about employees who encounter work-related accidents that are being unjustly fired. These people are subject to poor working conditions with health and safety risks. They stage protests and go on strikes, sacrificing a day’s worth of pay. All this just to prove the value they bring to their employer.

This is only one of many unjust treatments that affect workers in the country. What these companies fail to realize is that employees are essential in making their business grow and prosper. More than workers, they are individuals who should be treated fairly and with respect.

The Philippine Labor Code Protects All Workers

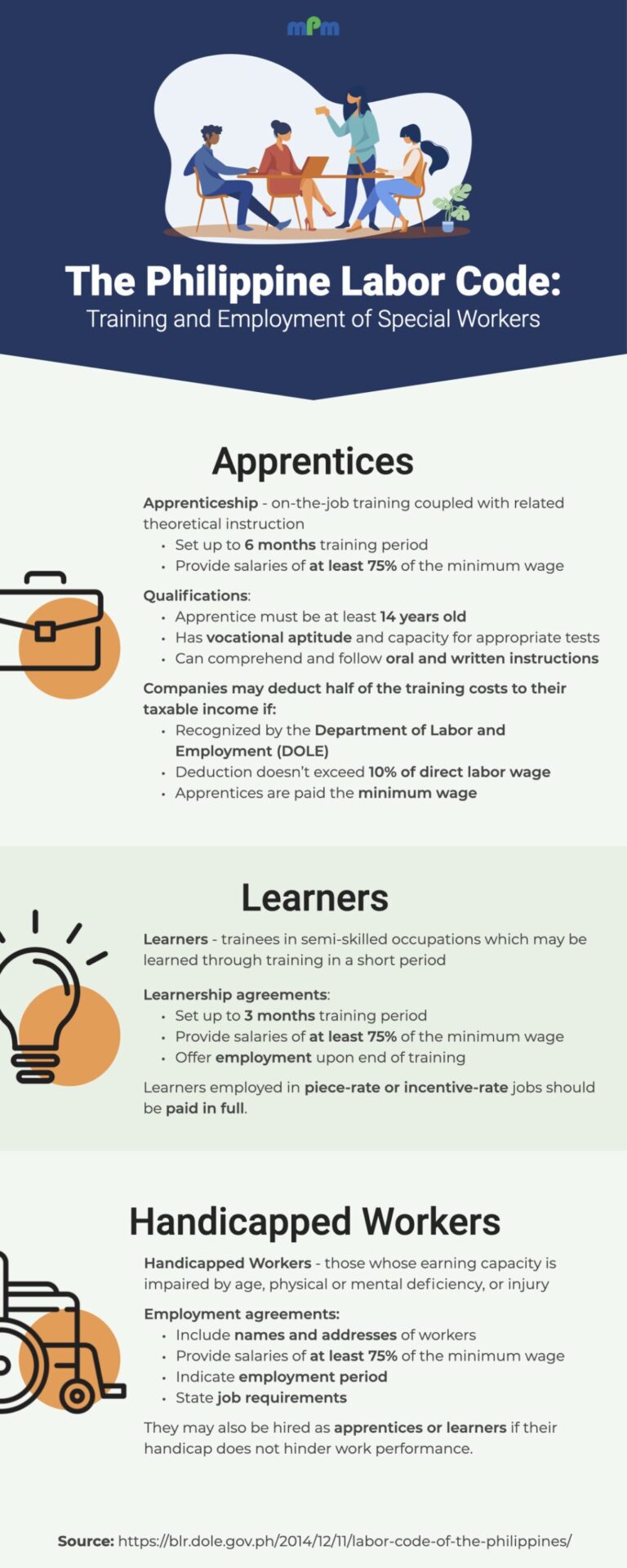

The Labor Code of the Philippines makes sure that employees are protected from these kinds of unjust treatment. The infographic below summarizes key points from the law to help you audit your own business and find new ways to further improve your employees’ experience at work.

We kickstart this Philippine Labor Code infographic series by focusing on the code’s second book. It details agreements between companies and their interns, trainees, and employees with special needs.

Infographic: Training and Employment of Special Workers

Up Next: Working Conditions and Rest Periods

This feature is part of an ongoing Philippine Labor Code infographic series detailing its key points that are relevant to businesses. The next one will summarize the mandated working conditions and rest periods based on the code.

Make sure to visit our Facebook Page to get updates on our succeeding posts!

[…] to businesses in the Philippines, MPM’s payroll system is fully compliant with the Labor Code. With the system in place, there’s no need to memorize all 32 different pay rates. If your […]