One of the most common payroll mistakes businesses make is incorrectly computing an employee’s daily rate. This matters a lot, especially if the employee is monthly paid which means your employee receives a fixed monthly salary and you deduct absences or add overtime pay. Getting the daily rate right affects several key parts of payroll, so let’s break them down.

Why the Correct Daily Rate Matters?

1. Accurate deductions for absences, tardiness, and undertime

When you need to deduct for absences or late hours, you want to ensure the amount is fair and accurate. A wrong daily rate leads to either over-deducting or under-deducting.

2. Proper tax computation

Minimum wage earners in the Philippines enjoy tax exemptions. To confirm if an employee qualifies, you need the correct daily rate as a basis.

3. Correct overtime computation

Overtime pay starts with the hourly rate, which comes from the daily rate. If the daily rate is wrong, every overtime computation after that will also be incorrect.

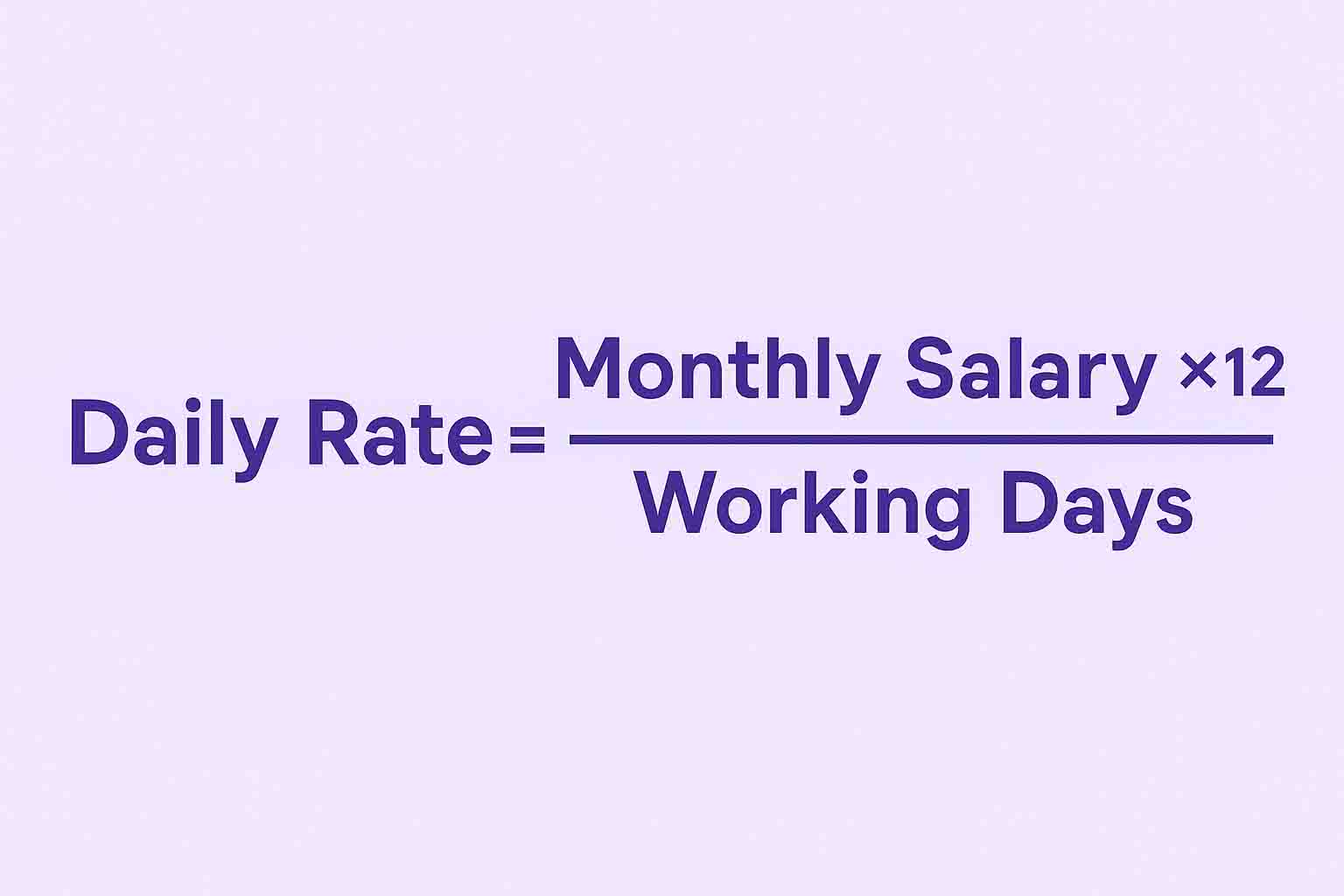

The Standard Formula for Daily Rate

Many companies follow this formula:

Daily Rate = (Monthly Rate × 12 months) ÷ Total Working Days in a Year

You may see other formulas, but this one is widely used and easy to verify.

How to Determine the Working Days in a Year?

This is usually where confusion starts. The simplest way to compute working days:

- There are 52 weeks in a year.

- If the employee works Monday to Friday, that is 5 days × 52 weeks = 260 working days.

- Some companies use 261 for leap years or depending on their internal policy.

- The same numbers are often referenced in Bureau of Internal Revenue (BIR) guidelines.

Example 1: Employee works 5 days a week

Monthly salary: ₱16,000

Working days: 261

Daily Rate = (₱16,000 × 12) ÷ 261 = ₱735

This ₱735 daily rate becomes your basis for determining if the employee is a minimum wage earner. If the rate exceeds the minimum wage assigned to your region, the employee becomes taxable (assuming no other exemptions apply).

At the time of this writing, ₱695 is the current minimum wage rate for the non-agriculture sector in the National Capital Region which means this employee is above minimum wage earner and may be taxable depending on the employees actual income and where it belong in the BIR Tax Table.

Example 2: Employee works 6 days a week

Using the same monthly salary but with a 6-day workweek:

5 days × 52 weeks = 260

Add Saturdays (52 days)

Total = 312 working days

Daily Rate = (₱16,000 × 12) ÷ 312 = ₱615.38

With a daily rate of ₱615.38, the employee falls below the NCR minimum wage. In this case, the employee should not be taxed and may even need a salary adjustment to meet the required minimum wage.

Where to use the daily rate?

Other than it is use to determine whether the employee is taxable or not, the daily rate determines:

- Absence deductions

- Overtime pay

- Night differential

- Holiday pay adjustments

- Rest day payments

- Used and unused leave payments

- Hourly rate which is a factor in the computation of lates, undertime and more

A small mistake in daily rate computation can snowball into repeated payroll errors, especially when overtime accumulates over several cutoff periods.

Payroll Accuracy Builds Trust

Employees rely on correct and timely pay. When computations are clear and consistent, it reinforces trust and reduces payroll disputes. If you want to increase the accuracy of your payroll while spending less manpower in preparing it, you should consider automating it with MPM Payroll.

BHONG says

can you gave me a salary distribution based on DOLE for a roving guard with vehicle

teresa magtibay says

mam my i know how is the proper computation of salary .

sample the one month salary is 8000 how much her daily rate and if shes late for 10 min. how much i deduct it.

tnx

Roma says

How will I know how much is my tax in every cut off? if example i’m earning 17,000 a month? thank you.

Jayl Rosario says

if an employee only works 10 months a year, shall i use 10 as “number of months in a year” or still 12? thank you very much.

jeff says

how to compute the withholding tax of under minimum wage and not under minimum wage? thanks

Pacita says

Hi,

What if the employee is working in a compressed week, he is working monday to friday for a total 48 hours. His daily rate is computed monthly rate x 12 / 31. He started sept 15 and our semi monthly payroll for 2nd half cut-off is sept 11-25, how many days we have to deduct from his gross pay? Is it two day for sept 11-12 or including Sept 13 for a total of 3 days. Thanks.

Jaycee says

I am a new sole proprietor and I want to hire an assistant for P350 per day (net of sss, Philhealth and Pag-ibig benefits) which I can only afford to pay as of now… how should his monthly payslip computed? and how much should i remit to SSS, PH & Pag-ibig?

Thank you.

nelmarie java says

a health personnel rendered his service 48 hours a week. how much will he get in a week?

Akash Nimodiya says

Is monthly wage rate calculated in Philippines ? If yes, can you send me that document as attachment to mail

Dj Marmolejo says

In 10,500 how much my daily income. Except sundays because its my dayoff.

Jerick Allan Dimaano says

Hello good day. I’m Jerick, web developer and working with a small company. Our salary are given every 15th and last day of the month. Saturdays and Sundays are our day off. We have a monthly fixed salary like even if we only work for 10 days or 11 days in a certain cutoff period we received the same amount every time. Our cutoff periods are 26-10 given on 15th and 11-25 given on the last day of the month.

Our Boss wants to change the payroll dates from every 15th and last day of the month to every 7th and 22nd day of the month and also the cutoff period from 26-10 to 1-15 and 11-25 to 16-last day of month. He said the reason for the change is to make it easier for them to do the book keeping, something like that.

So to make the adjustments happen, our company will do like this, knowing that today is December 11, 2014 when I sent this letter.

-On Monday December 15, 2014 the company will give us our salary from November 26 to 30 2014 and they said it is computed for 3 days only, because Nov 29 and 30 are saturday and sunday.

-Then on December 22, 2014, we will get our salary for the period of December 1-15, 2014.

My question is, Is it right that we will only receive 3 days amount for Nov 26 – 30?

Marja Echano says

Hi, tanong ko lng regarding sa monthly fixed rate. pag nakuha ko n yung daily rate assuming na 10,000 a month tpos we are working for mondays to saturdays , including special non-working holidays. yung daily rate n nakuha ko yun n gagamitin or kinuha lng daily rate for the deductions of absences and overtime?

10000 x 12 / 303= daily rate?

Tama po ba? kasi kasama yung special non-working nmin.

Thank you.

robert maglaque says

good day po. tanong ko lang po dito po company namin ang computation ng salary dati at (monthly salary÷ 25.25) ngayon po (monthly salary÷26) naguguluhan po ako sa binigay niyong fomula. monday to saturday po pasok ko. salamat and god bless

lester tan says

what computation if it falls in the month of february…

Jonathan Santiago says

panu naman po yung daily rate! kapag meron pong holiday and special hoidays po.

arnel D. Red says

Ako ay security guard,tanong ko lang po kung tama sang binibigay na salary mula sa agency ko.ang contracts po ng company’s sa agency nmim ay 16,000,ang binibigay lang po ng agency ko na salary ko ay 10,000 don pa po binabawas an sss .magkano po ba dapat any tamang salary ko mula as agency ko. SG.red po.type po and godbless you all,ASA po ako satullong nyo.

Sheena says

Hi, ask ko lang kung tama ba na kahit ang basis ng wage computation namin eh sa factor 261 days (daily wage earner) kapag hindi pumasok ang employee on special non working holiday eh hindi paid. Pero based on the salary above minimum earner ang employee. Diba applicable lang ang “no work, no pay” sa minimum wage earner? ngkataon lang na ang basis ng computation ng salary eh sa 261 days factor?. I confused and i need a valid reason and link na maiiexplain ko sa supervisor. It’s unfair kasi sa employee na hindi bayad ng regular day sa SP Non working kahit above minimum/ fixed rate salary ang employee.

Lia B. says

what if an employee is a monthly paid employee and her salary is 14000, working 5 days a week. does it mean that if i compute for her daily rate and it falls below the minimum daily rate then i have to adjust her monthly salary ?

neslie says

Hi..ung father ko ndi fixed ang salary kasi per byahe sya..1600 per byahe kasi trucking driver sya..married pero unemployed ang mother ko..exempted ba sya o taxable?highest na byahe nya 8 lowest is 2 pero ang deduction ng company more than 1k..tama ba un?thanks

carlo taladtad says

sir’/mam’ ask ko lng po diba dun sa sample nyu kung panu malalaman ung daily rate ng employees” is 10000x(days of work)/? ?? san nyu po n a kuha ung divider?? answer plzz.. asap”