BIR Form 1604C, also known as the Annual Information Return of Income Taxes Withheld on Compensation, is one of the most important year-end tax reports for employers in the Philippines. It summarizes all compensation payments and the corresponding withholding taxes deducted from employees for the entire calendar year.

Whether you’re a bookkeeper, HR practitioner, payroll processor, or business owner, this guide will help you understand how Form 1604C works, who must file it, and how to ensure full compliance with BIR requirements.

- What is BIR Form 1604C?

- Who are Required to File BIR Form 1604C?

- When is the Deadline to File and Pay BIR Form 1604C?

- How to Compute the Amount of Tax on BIR Form 1604C?

- How to Fill Out BIR Form 1604C?

- How to File BIR Form 1604C?

- How to Pay BIR Form 1604C?

- BIR 1604C Editable PDF

- Final Tips for Accurate BIR Form 1604C Filing

What is BIR Form 1604C?

BIR Form 1604C is the annual tax return filed by employers to report:

- Total compensation paid to employees for the year

- Total taxes withheld and remitted using Forms 1601C

- Employee-level details (submitted via the Alphalist of Employees)

It finalizes the employer’s withholding tax obligations on compensation, ensuring alignment between monthly filings and year-end totals.

Submitting 1604C is mandatory for compliance and often cross-checked during BIR audits.

Who are Required to File BIR Form 1604C?

You must file BIR Form 1604C if your business:

✔ Deducts and withholds compensation tax from employees

✔ Has employees who receive taxable salaries, benefits, allowances, or incentives

✔ Files monthly Forms 1601C

This includes:

- Corporations

- Partnerships

- Sole proprietors

- Government offices

- Nonprofit organizations

- Cooperatives with taxable compensation

Even if the business had no employees for part of the year, filing is still required if compensation was paid at any time during the year.

When is the Deadline to File and Pay BIR Form 1604C?

The deadline to file BIR Form 1604C is January 31 of the following year.

Example:

For taxable year 2025, the deadline will be January 31, 2026.

Is there a payment involved?

There is no tax payment attached to Form 1604C itself because the taxes should have already been remitted monthly through BIR Form 1601C (Withholding Tax on Compensation).

However, penalties may apply for:

- Late filing

- Failure to attach the Alphalist

- Wrong or incomplete data

- Mismatched totals compared to 1601C filings

How to Compute the Amount of Tax on BIR Form 1604C?

The form itself does not compute additional tax. Instead, it summarizes:

- Total compensation paid for January–December

- Total withholding tax deducted for the year

- Total tax already remitted via BIR Form 1601C

- Annualized tax adjustments (either refund or additional withholding)

Key computations include:

- YTD compensation: Total taxable income paid to each employee

- YTD withholding: Total tax withheld based on the BIR withholding tax table

- Annualization adjustments:

- Additional tax withheld (if monthly withholding was insufficient)

- Tax refund to employee (if withholding exceeded the annual tax due)

Your payroll system should generate:

✔ Year-end withholding summary

✔ Taxable income totals

✔ Annualization results

✔ Alphalist of employees (with correct TIN, employee details, earnings, deductions and tax details)

If you’re using MPM Payroll, these reports are computed automatically and exported in BIR-ready format.

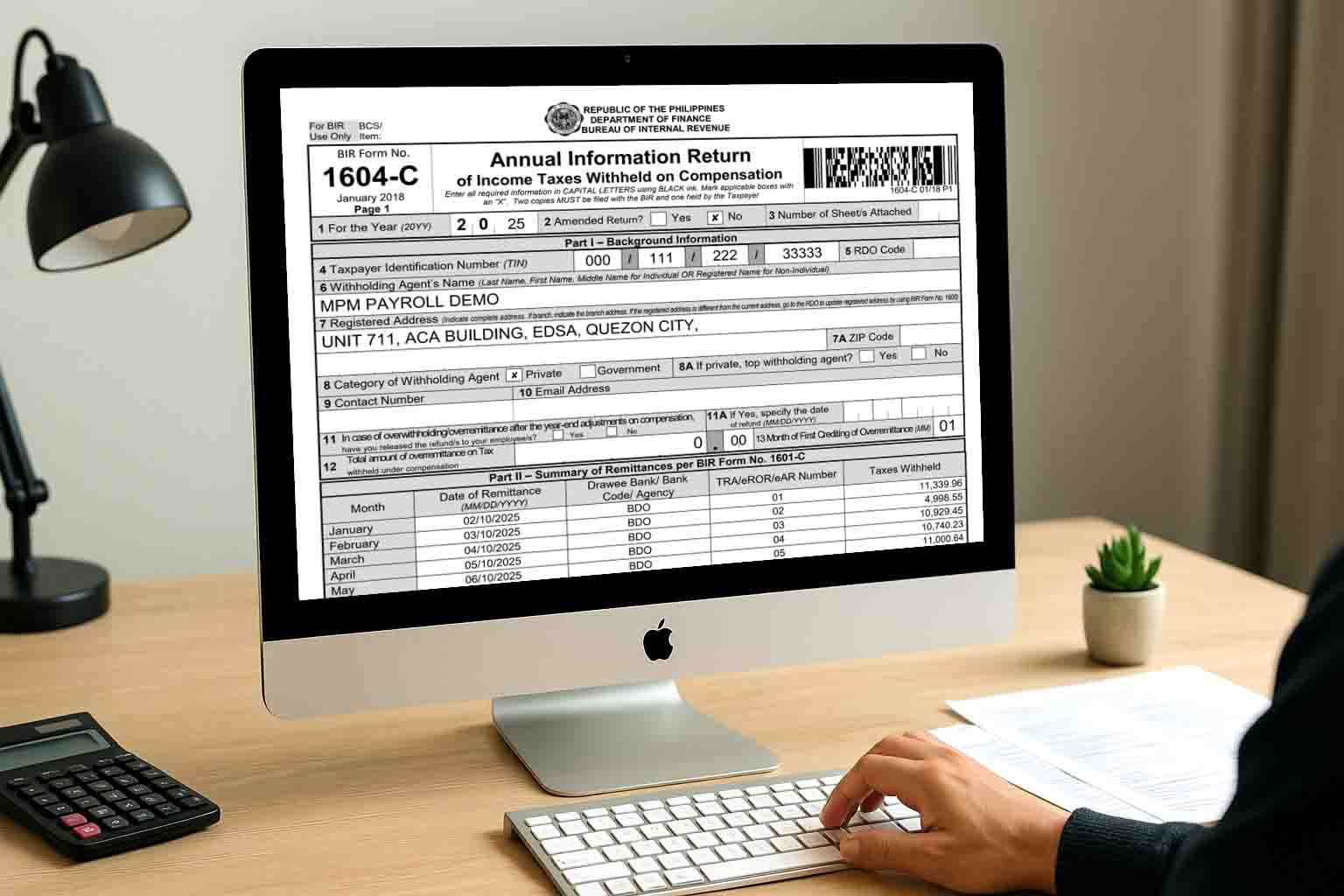

How to Fill Out BIR Form 1604C?

BIR Form 1604C has several sections:

1. Background Information

Includes:

- Employer’s TIN

- RDO code

- Registered name

- Line of business

- Employer category (private, government, etc.)

2. Summary of Compensation and Taxes Withheld

Breakdown of:

- Total employees

- Total compensation paid

- Taxable compensation

- Non-taxable/Exempt compensation (13th month, de minimis, etc.)

- Total tax withheld

- Total tax remitted during the year

3. Annualization Results

Indicates:

- Taxes refundable to employees

- Additional taxes withheld due to annualization

4. Required Attachments

You must attach the following Alphalist of Employees:

- Schedule 1: Employees with taxable compensation

- Schedule 2: Employees with no taxable compensation

The Alphalist must be generated in DAT file format using the BIR’s prescribed layout.

How to File BIR Form 1604C?

Filing is done electronically through any of the following platforms:

1. eFPS (Electronic Filing and Payment System)

For enterprises enrolled in eFPS:

- Log in to your eFPS account

- Select Form 1604C

- Encode totals

- Upload the DAT file of the Alphalist

- Submit

2. eBIRForms

For non-eFPS or small businesses:

- Open the Offline eBIRForms Package

- Select Form 1604C

- Fill out the form

- Validate and submit online

- Create the Alphalist via the BIR Alphalist Data Entry Module, validate and submit it via email to esubmission@bir.gov.ph

3. BIR eTsp or Authorized Tax Software Providers

Alternatively you can easily file this via BIR authorized Tax Software Providers like MPM Accounting Software for easier and more automated way of filing.

How to Pay BIR Form 1604C?

There is no direct payment for 1604C.

However, ensure that all withholding taxes for the year were already remitted monthly via Form 1601C

If there were under-withheld amounts during annualization

The additional tax must be paid using:

✔ Form 1601C (usually as part of December payroll withholding)

Payment channels include:

- Landbank Link.Biz

- DBP Pay Tax Online

- UnionBank Online / Mobile App

- Authorized Agent Banks

BIR 1604C Editable PDF

If you need a PDF to make your 1604C more presentable, you can download our BIR Form 1604C editable pdf.

Final Tips for Accurate BIR Form 1604C Filing

- Make sure the Alphalist totals match your 1601C filings and BIR Forms 2316

- Check employee TINs

- Perform tax annualization before year-end payroll cutoff

- Ensure no negative values or rounding inconsistencies

- Use a reliable payroll system to avoid human error

If you want to automate your 1604C and Alphalist preparation, MPM Payroll can handle all computations and generate BIR-ready reports in one click. If you want to automate it further by automating the filing and more, you can use MPM Accounting in conjunction with MPM Payroll.

Leave a Reply