We may not be aware of it, VAT (Value Added Tax) is part of our life, we are paying it regularly. VAT is everywhere, it’s in the most of the goods or services we purchase.

Take for an instance, whenever we go to the salon to get our hair done, when we dine in a restaurant, watch a movie, when we buy clothes, when we gas up our car, and many more, VAT is included in what we pay.

Despite the fact that VAT is everywhere, many of us are not aware of what VAT really is.

In this article, we’ll share with you the basics you need to learn about VAT.

What is VAT (Value Added Tax)?

VAT stands for Value Added Tax. VAT is a type of sales tax which is levied on consumption on the sale of goods, services or properties, as well as importation, in the Philippines.

To simplify, it means that a certain tax rate (0% to 12%) is added up to the selling price of a goods or services sold. It is also imposed on imported goods from abroad.

Who are required to be VAT Registered?

- Any person or entity who, in the course of his trade or business, sells, barters, exchanges, leases goods or properties and renders services subject to VAT, if the aggregate amount of actual gross sales or receipts exceed One Million Nine Hundred Nineteen Thousand Five Hundred Pesos (P1,919,500.00).

- A person required to register as VAT taxpayer but failed to register

- Any person, whether or not made in the course of his trade or business, who imports goods

What are the Types of VAT and Tax Rate?

1. VATable- 12%

- On sale of goods and properties – twelve percent (12%) of the gross selling price or gross value in money of the goods or properties sold, bartered or exchanged

- On sale of services and use or lease of properties – twelve percent (12%) of gross receipts derived from the sale or exchange of services, including the use or lease of properties

- On importation of goods – twelve percent (12%) based on the total value used by the Bureau of Customs in determining tariff and customs duties, plus customs duties, excise taxes, if any, and other charges, such as tax to be paid by the importer prior to the release of such goods from customs custody; provided, that where the customs duties are determined on the basis of quantity or volume of the goods, the VAT shall be based on the landed cost plus excise taxes, if any.

2. VAT Zero-Rated – 0%

- Zero-rated is a sale, barter or exchange of goods, properties and/or services subject to 0% VAT pursuant to Sections 106 (A) (2) and 108 (B) of the Tax Code.

- Zero-rated is usually pertaining to export sale of service or those zero-rated as approved by special laws such as PEZA or Economic Zone registered companies.

3. VAT Exempt – 0%

- A sale of goods or transactions is considered VAT Exempt if it falls under SEC 109 – Exempt Transactions.

- Normally VAT Exempt transactions are basic necessities such as agricultural products, tuition fees, lending activities, real properties, books, transportation, etc.

What is the BIR Form for VAT?

There’s two types of VAT Return

- Monthly – BIR Form 2550M is used to filed monthly VAT. Example: For the month of August

- Quarterly – BIR Form 2550Q is used to file quarterly VAT. Example: For second quarter (April to June)

What is VAT RELIEF?

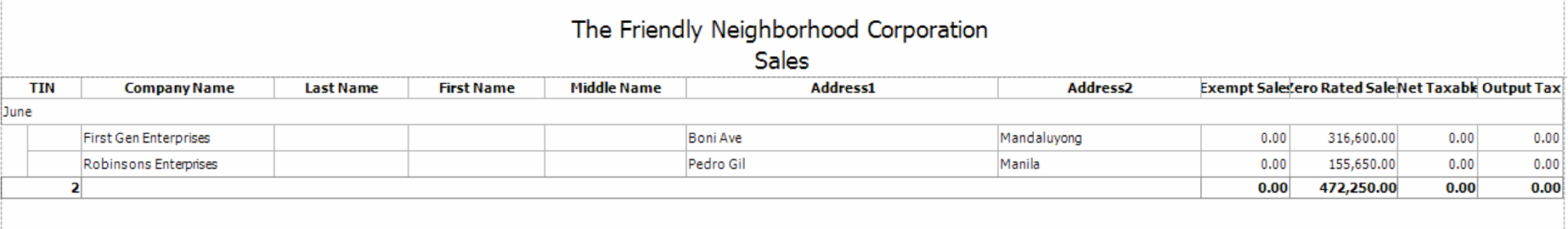

Reconciliation of Listing for Enforcement (RELIEF) is a BIR program or software used to submit Quarterly Summary Lists of Sales and Purchases (SLSP) which is a required attachment to BIR Form 2550Q – Quarterly VAT.

Example: Summary list of sales and purchases (SLSP) or VAT Relief

VAT Relief is usually submitted in DAT file and sent via email to esubmission@bir.gov.ph

When is the Deadline for Filing and Payment of VAT?

- For the monthly VAT return, deadline is every 20th of the following month of the applicable month. Example: For July VAT return, the deadline is August 20.

- For the quarterly VAT return, deadline is every 25th of the following month of the applicable quarter. Example: For the second quarter ending June 30, the deadline is July 25

What is the Penalty for Non-Filing or Late Filing?

- For failure to file, keep or supply a statement, list or information required on the date prescribed shall pay and administrative penalty of One Thousand Pesos (P1,000.00) for each such failure, unless it is shown that such failure is due to reasonable cause and not to willful neglect; and

- An aggregate amount to be imposed for all such failures during a taxable year shall not exceed Twenty-Five Thousand Pesos (P25,000.00).

Leave a Reply