All business establishments registered with the Bureau of Internal Revenue (BIR) are required to maintain and keep a record of their day to day transactions. Such record is referred to as “books of accounts” or “accounting books”.

In general, the accounting books being registered to the BIR depends on the nature and size of the business. To know more about this requirement, please read our article, What are the Books of Accounts?

One of the books being registered in the BIR is called the Purchase Journal.

In this article, we will discuss what is a purchase journal, the benefit of using a purchase journal, and the basic steps in writing a purchase journal.

What is a Purchase Journal?

A purchase journal is used to record and summarise all purchases made in a given month or period.

Purchases can be merchandise inventory for resale, materials used to render a service, raw materials used in manufacturing, and other types of purchases in connection with the nature of the business.

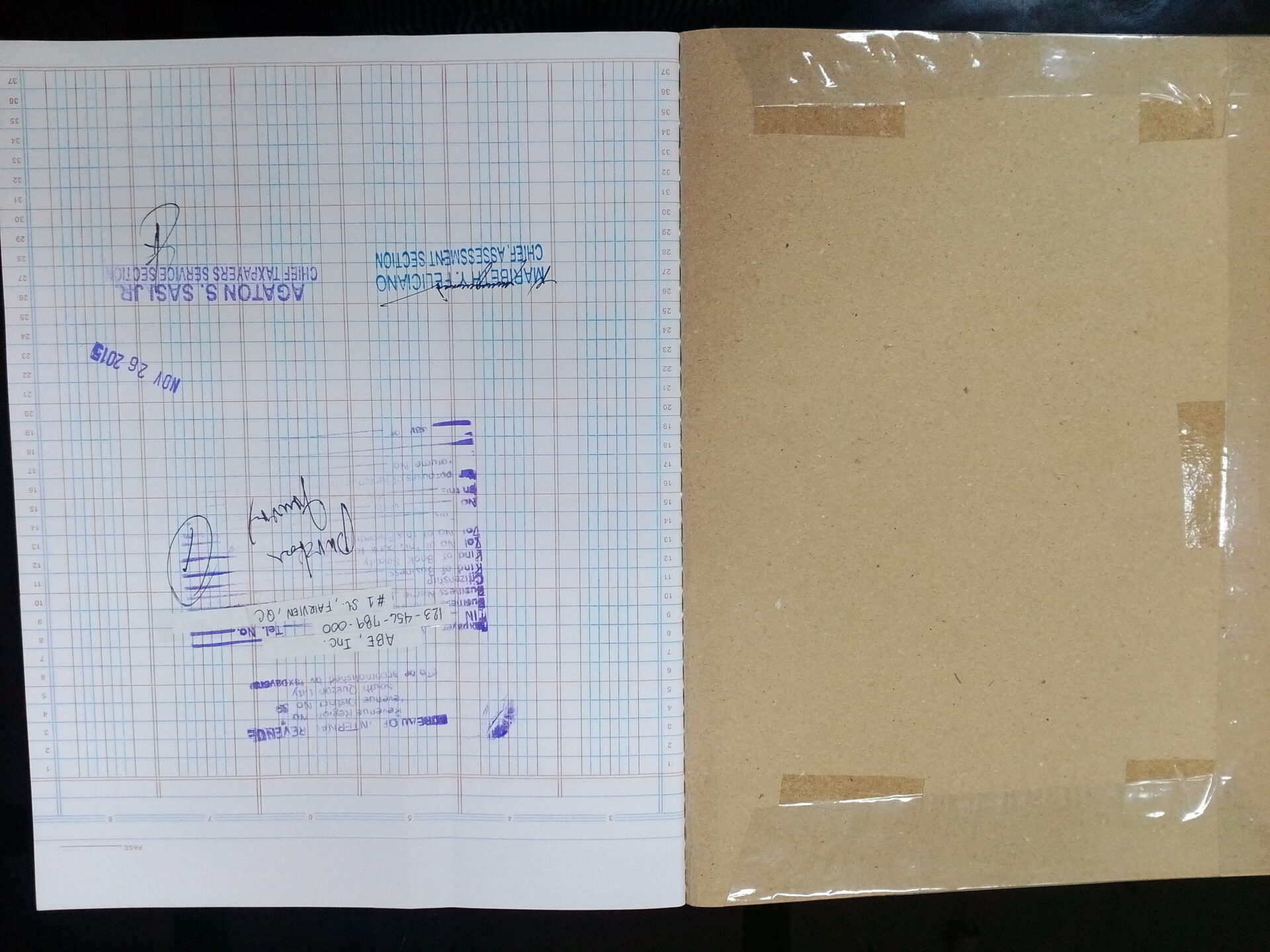

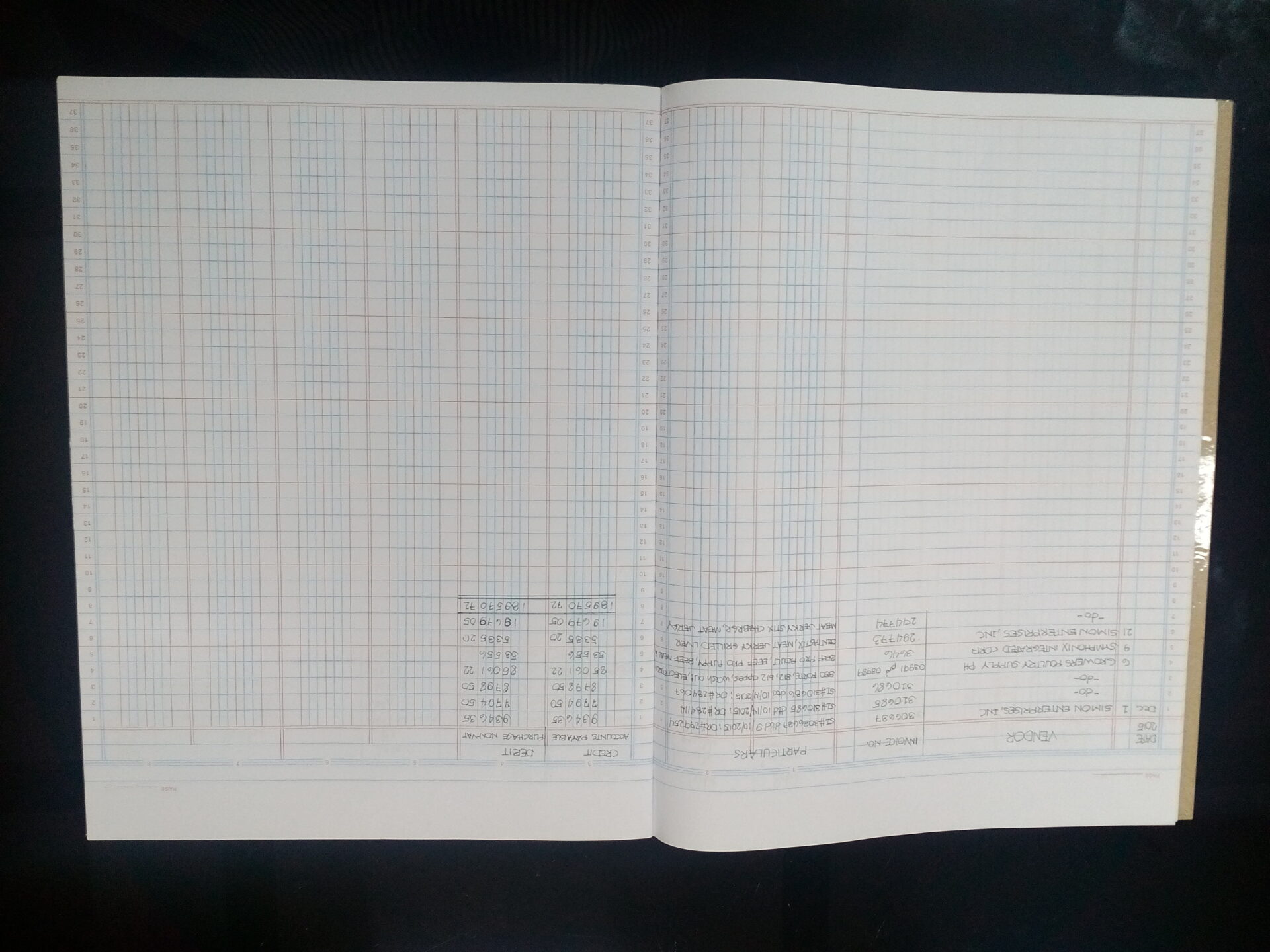

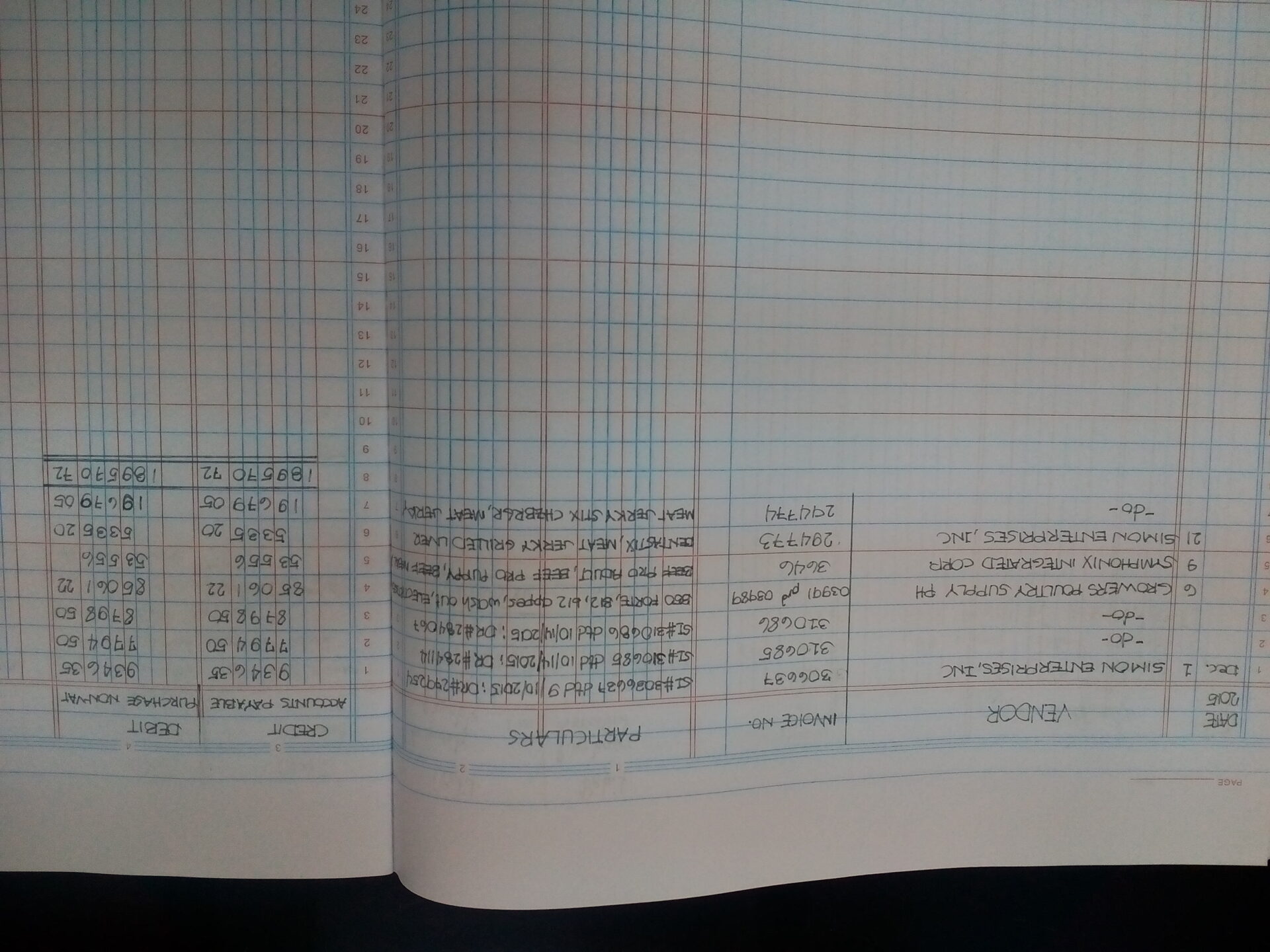

Sample: BIR Registered Manual Purchase Journal

Below are the sample images of a BIR Registered Manual Purchase Journal Book.

Front

Inside – 1st Page with BIR Stamp as proof registration

Inside with Handwritten Content

How to Write a Manual Purchase Journal?

When writing the manual purchase journal book, put the following basic information for every purchase entry. Recording should be one purchase document, one entry. You may add or delete information as you see fit.

- Date – this refers to the month, day and year when the purchase was made. Example: Dec 21, 2015

- Vendor Name – this refers to the name of the supplier or vendor where the purchased merchandise was bought. Example: Simon Enterprises Inc.

- Invoice Number – this refers to the series number of the vendor’s sales invoice. Example: SI No. 294773

- Particulars – this refers to the description of items or goods purchased. Example: Dentaxtix, Meat Jerky, Grilled Liver, etc.

- Amount and account credited – this refers to the account title that will be used in recording the purchase. In general, the account credited is either cash account (if paid in cash) or accounts payable (if still unpaid). Example: Accounts Payable account was credited in the amount of P5,335.20

- Amount and account debited – this refers to the account title that will be used in recording the purchase. In general, the account debited is purchase account (if expense method) or merchandise inventory (if asset method). Example: Purchases account was credited in the amount of P5,335.20

- Total – this refers to the total balances of amount debited and credited at the end of the month or period. Example: Total is P189,570.72 for both debited and credited account

Sample Manually Written Purchase Journal

Please note that BIR registered manual books should be handwritten, preferably, with no erasures.

What are the types of source documents for purchases?

In order to validate the purchase transaction recorded, you must have and keep the original invoice document issued by the vendor or supplier. Preferably, the invoice must indicate the name of your company.

Source documents such as collection receipt, delivery receipt and purchase order may serve as an additional proof but should not replace the need for asking an invoice.

When do you write the purchase journal?

It is recommended that you write the purchase journal as purchase transaction happens.

In general, the purchase journal book must be recorded and reconciled at least every month.

Where do you write and keep the purchase journal?

It is important to note that book of accounts, including the purchase journal, must be written and kept in the business premise.

The books of accounts, including the purchase journal, may need to be presented to BIR upon tax mapping or audit.

The suggested number of years to keep the books in your business premise is at least 10 years.

Benefits of a Purchase Journal

To encourage the use of a purchase journal, here’s some of the basic benefits:

- To have a monitoring of your purchases during a given period

- To facilitate preparation of Inventory List at the end of a given period

- To facilitate preparation of Aging Report for Accounts Payable Trade

- It gives you information how much you are spending on purchase of merchandise inventory

- It gives you quick information on the details of your suppliers and/or vendors, and how frequent you buy from them

- It gives you information on the terms of your payable and when they are due for payment

I hope this article has been helpful for you to know what is a purchase journal, and it has guided you to be able to do basic writing of a purchase journal.

Lourdes D. Tado says

I am a late registered. . My books of accounts are registered feb 23. When do i start my entries in the journal? Thank you

Maria Lourdes M. Yanuaria, CPA says

Hi Ms Lourdes, thank you for leaving a comment. Normally, writing of books starts once it is registered in the BIR.

Queen says

Can I have you thoughts? On the purchase journal, is it all the purchases or there is a specification or limited as to what should be put on purchase journal? How about the petty cash funds? Thanks in advance!

Maria Lourdes M. Yanuaria, CPA says

Normally, what’s recorded in the purchase journal are purchase of inventories not yet paid or on credit. But you may also use it as place to record all purchase of inventory, may it be paid in cash, petty cash or on credit. As long as it summarises all your purchases. Hope this helps.