Preparing and filing tax return can be a little bit intimidating task to do, especially if you are not an accountant or have no background with Philippine Taxation Law.

Fortunately, the Bureau of Internal Revenue (BIR) have started doing tax awareness campaign which aim to educate business owners and self-employed with their tax obligations. But aside from these numerous tax campaigns, in around 2013-2015, they’ve introduced a deskstop software called eBIRForms.

Prior to the mandatory use of eBIRForms, most taxpayer uses BIR Form which are downloadable in BIR website. The BIR Form are often in excel format where you need to manually edit and fill-up details in the correct number or box.

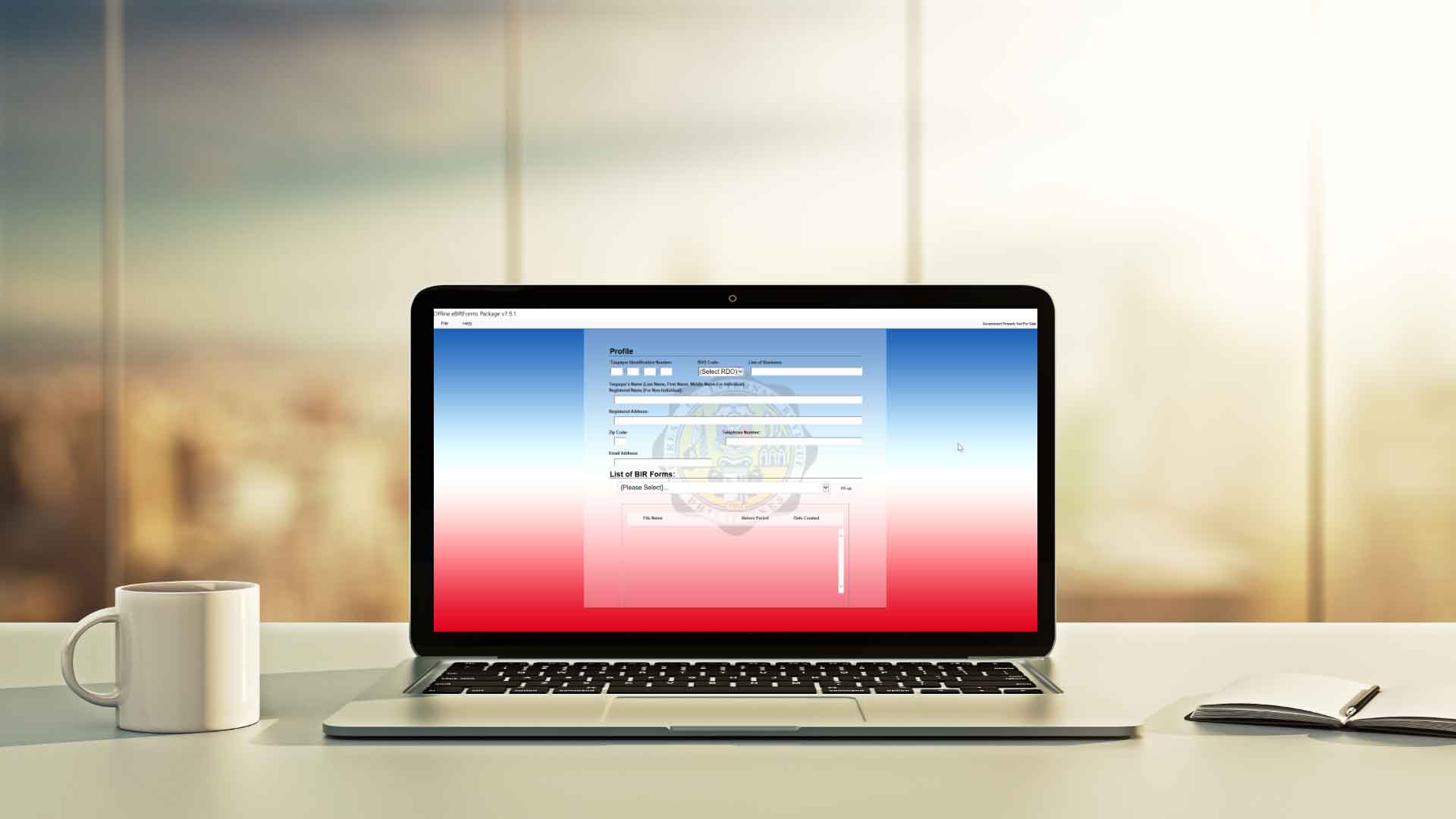

As such, for someone who’ve experienced preparing tax returns using the downloadable BIR Form in excel format, mandatory use of eBIRForms is a positive news. However, back in its early transition to mandatory use, eBIRForms met couple of backlashes due to system errors. But nowadays, eBIRForm is functioning quiet effectively. In fact, there are times when many of the new forms are first made available in eBIRForm compared to the other filing system which is eFPS, electronic filing and payment system.

What is eBIRForms?

eBIRForms is a desktop software developed by the Bureau of Internal Revenue (BIR) to provide taxpayers a convenient and easy way of preparing and filing tax returns.

eBIRForms provides automatic tax computation and online filing of tax return instead of the traditional way I mention above where you need to manually fill-up the form and manually compute the corresponding tax. At the same time, it facilitates online filing and payment of tax return instead of going to the BIR Office or Authorized Agent Banks (AABs).

Who is Required to Use eBIRForms?

If your company is not included in the list of taxpayers mandated to use Electronic Filing and Payment System (eFPS), then you can use this eBIRForms in filing your tax returns.

However, here is a guide to know if you are mandated to use eBIRForm:

- Top Withholding Agents (TWA)

- Accredited Tax Practitioners on all its client-taxpayer

- Accredited Receipt/Invoice Printers

- One-Time Transaction Taxpayers (ONETT) on real properties

- No Payment or No Transaction Tax Filing

- Government Owned or Controlled Corporation (GOCC)

- Local Government Unit (LGU) except barangay

- Cooperatives registered in NEA and LWUA

If you are not included in the above list, you may still volunteer to use eBIRForms instead of doing it manually.

When do you use eBIRForms?

If mandated, eBIRForms must be used in all tax return filing needed for your business or self-employment.

Deadline of filing of tax returns are different depending on which tax return you are filing. But here’s a basic guide applicable to doing business or self-employment:

Monthly

Note: Deadline is the following month.

- Every 10th – Withholding Tax (BIR Form 0619E, 0619F, 1601C)

- Every 20th – Value-Added Tax (BIR Form 2550M)

Quarterly

Note: Deadline is the month after the close of the quarter.

- Every 25th – Value-Added Tax (BIR Form 2550M) or Percentage Tax (BIR Form 2551Q)

- Every 30th– Withholding Tax (BIR Form 1601EQ, 1601FQ)

- Income Tax

- If Individual (BIR Form 1701Q) – Every May 15, August 15, November 15

- If Non-Individual (BIR Form 1702Q) – Every May 29, August 29, November 29

Annually

Note: Deadline is the year following the close

- Every January 31 – Annual Registration Fee (BIR Form 0605)

- Every January 31 – Withholding Tax (BIR Form 1604F, 1604C)

- Every March 1 – Withholding Tax (BIR Form 1604E)

- Every April 15 – Income Tax (BIR Form 1701, 1701A, 1702RT, 1702MX, 1702EX)

How to Use eBIRForms?

Below are steps in using eBIRForms:

1. Download the latest package from the BIR website or thru this link: (https://www.bir.gov.ph/index.php/eservices/ebirforms.html)

2. Install the software and click the eBIRForms icon to open the software.

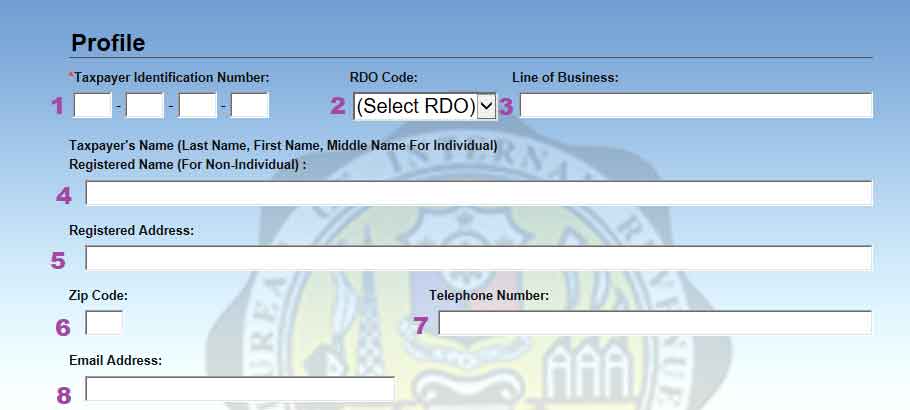

3. Fill-out the required details as shown below.

- Items 1 to 6 should be based on your BIR Form 2303 or Certificate of Registration

- Item 7 is for the active contact number

- Item 8 should be an active email address, since BIR confirmation receipt will be sent in that email upon filing

4. Select the BIR Form you are going to file from the dropdown list then click Fill-Up.

5. Fill-out the required details in the form. Make sure that you are filing the correct Form and Period, as well as the correct information and amount.

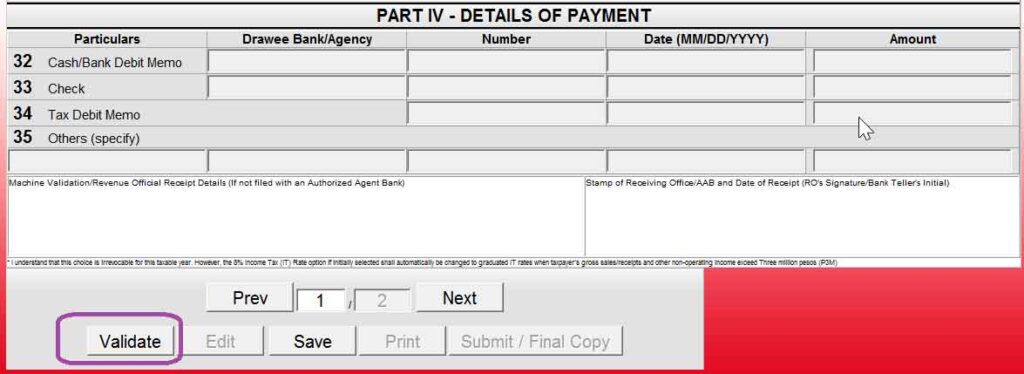

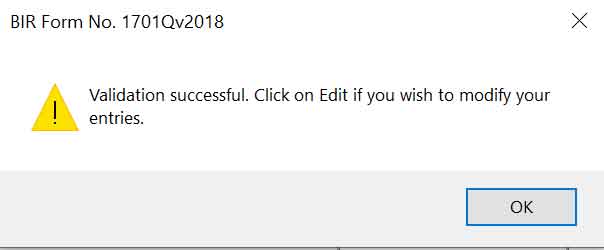

6. After filling out all required information, click Validate on the lower portion of the eBIRForms. Normally, eBIRForms will show prompt message when there are items missed. Just complete all missed items prompted by eBIRForms until it’s successfully validated.

Once validation is successful, click Save. Save the form to store information in case the eBIRForms will have connection error and lose all the information you’ve already input. Also, it gives you time for review before submitting.

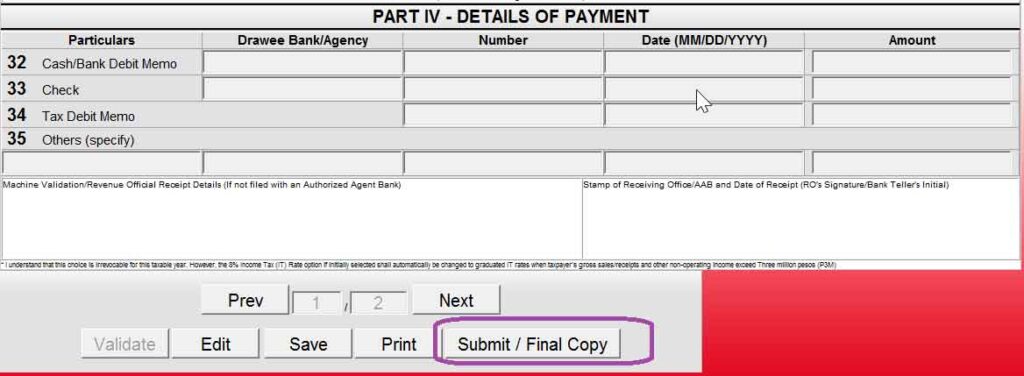

7. Do second review of the form to be filed, then proceed clicking Submit/Final Copy. Make sure that you have stable internet connection when submitting so you can successfully file.

8. Once done filing, save the successfully filed tax return using eBIRForms for safekeeping.

9. To prove successful filing using eBIRForms, you will receive an email with title Tax Return Receipt Confirmation. Save a copy of the tax return receipt confirmation reply together with the filed tax return. This will be your proof that you successfully filed the tax return.

10. Lastly, after successful filing using eBIRForms, you may now proceed with payment of tax return either via AABs over the counter or online payment facilities.

Filing in eBIRForms is easy if you know how to fill-out the details of each tax returns based on your transactions, but if you think you’re not sure on your filing, we have a Cloud-Based Tax Accounting Software to help you with automatic record keeping and filing of tax return. Visit here for details.

Important Note on eBIRForms and Tax Form with Required Attachments

Certain BIR Forms, such as BIR Form 2550Q, 1601EQ, 1601FQ, 1701Q, 1702Q, 1701, 1701A, 1702RT, 1702EX, 1702MX, have required attachment and needs to be submitted separately in BIR using eSubmission. These attachments cannot be submitted using eBIRForm. As such, you need to prepare these using different BIR softwares such as the following.

eBIRForms for Mac Users

As of the date of this writing, eBIRForms can only be installed on Windows operating system. For Mac and Linux users, you will need to run a virtual machine running Windows OS inside your Mac or Linux in order to install and use eBIRForms.

eBIRForms Alternative

If you are looking for an alternative and automated way of filing your tax forms and the required attachments without entering your data multiple times, a good alternative is MPM Accounting Software. You will only need to enter your data once and all required BIR forms, attachments and other financial reports will be automatically prepared and submitted.

Leave a Reply