Due to the COVID-19 pandemic that spread across the world, many countries have imposed quarantine (or lockdown) measures and have forced most of us to stay-at-home. Aside from the worries on the economic/financial impact of possible business closures and unemployment due to lockdown, many accountants and business owners have also started to worry about how they will file, pay and submit the awaited annual income tax and audited financial statement that was originally due April 15 of each year.

Fortunately, our Bureau of Internal Revenue (BIR), understand the circumstance and have given extension on the deadline of filing and payment of Annual Income Tax Return, from April 15 to June 14, 2020, as per BIR Revenue Regulations No. 11-2020.

In addition, to avoid mass gathering in taxpayer’s respective BIR Regional District Office (RDO), the BIR also gave an option to file and submit, the Annual Income Tax Return, Audited Financial Statement and Other Required Attachments for the year ended December 31, 2019, via BIR’s AFS eSubmission or eAFS, instead of having it “RECEIVED” stamp in the RDO, as per BIR Revenue Memorandum Circular No. 49-2020. Deadline for submission is on or before June 30, 2020, as per BIR Revenue Regulations No. 11-2020.

In this article, we will guide you on how to use the eAFS to file and submit your 2019 Annual Income Tax Return, Audited Financial Statement and Other Required Attachment.

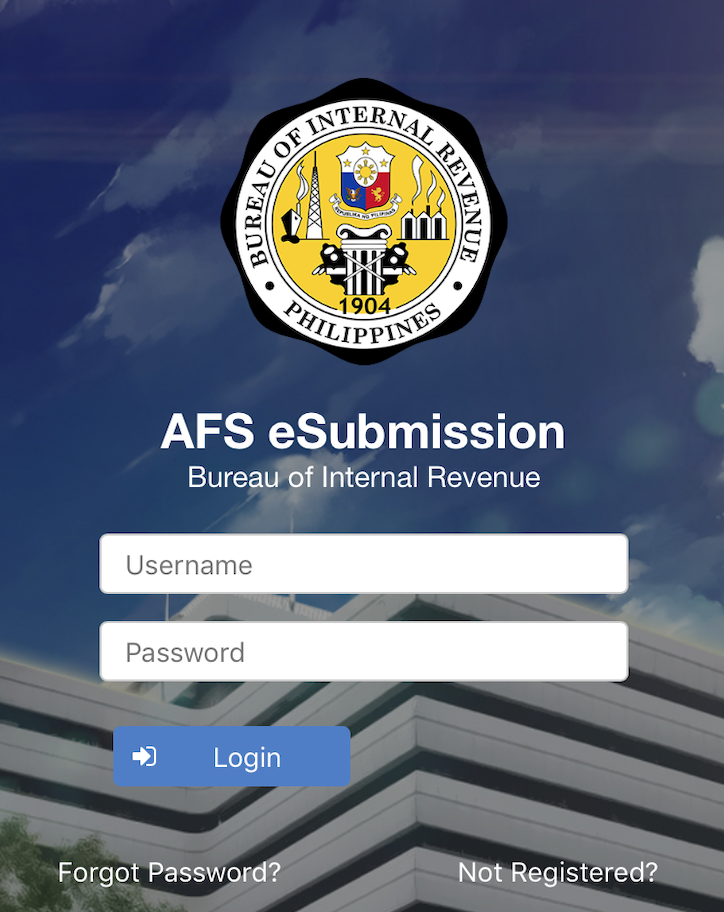

Step 1 – Visit the eAFS website, https://eafs.bir.gov.ph/eafs/

Step 2 – Register and create your account by clicking “Not Registered”.

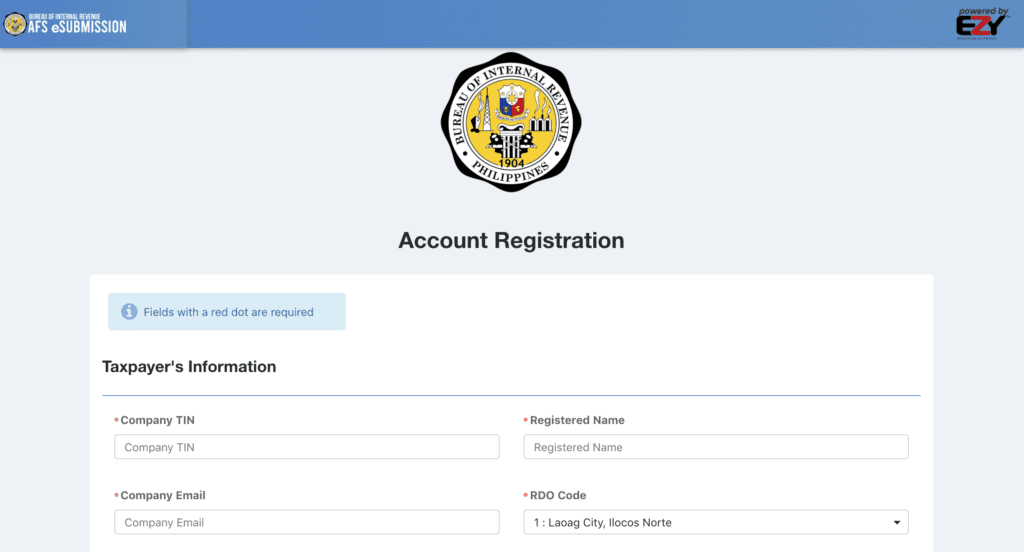

Step 3 – Complete the Account Registration by filing up the following information:

- Company TIN

- Registered Name

- Company Email

- RDO Code

- SEC Number (if Corporation/Partnership and optional)

- Authorized Representative’s Name

- Authorized Representative’s TIN

- Authorized Representative’s Email Address

- Authorized Representative’s Contact Number

- Username

- Password

Then click “Submit”

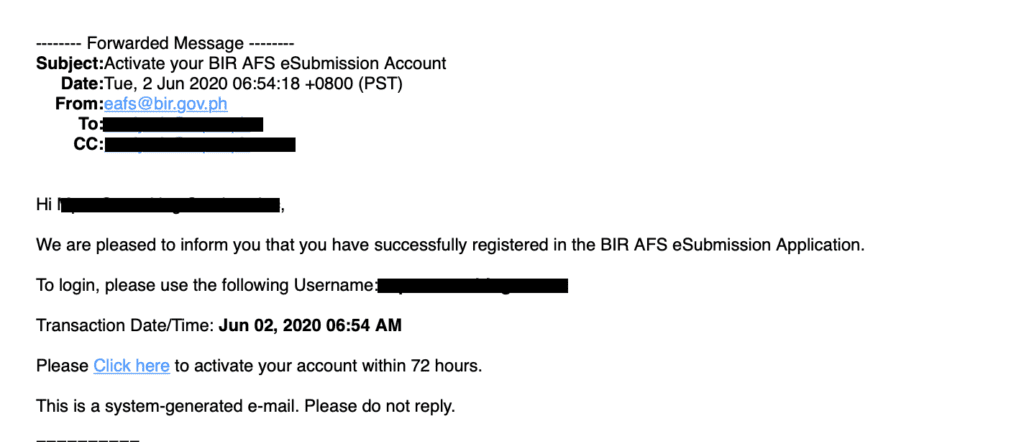

Step 4 – Check your registered email for “Activate your BIR AFS eSubmission Account” message from the BIR. Click the activation link sent within 72 hours to activate your account

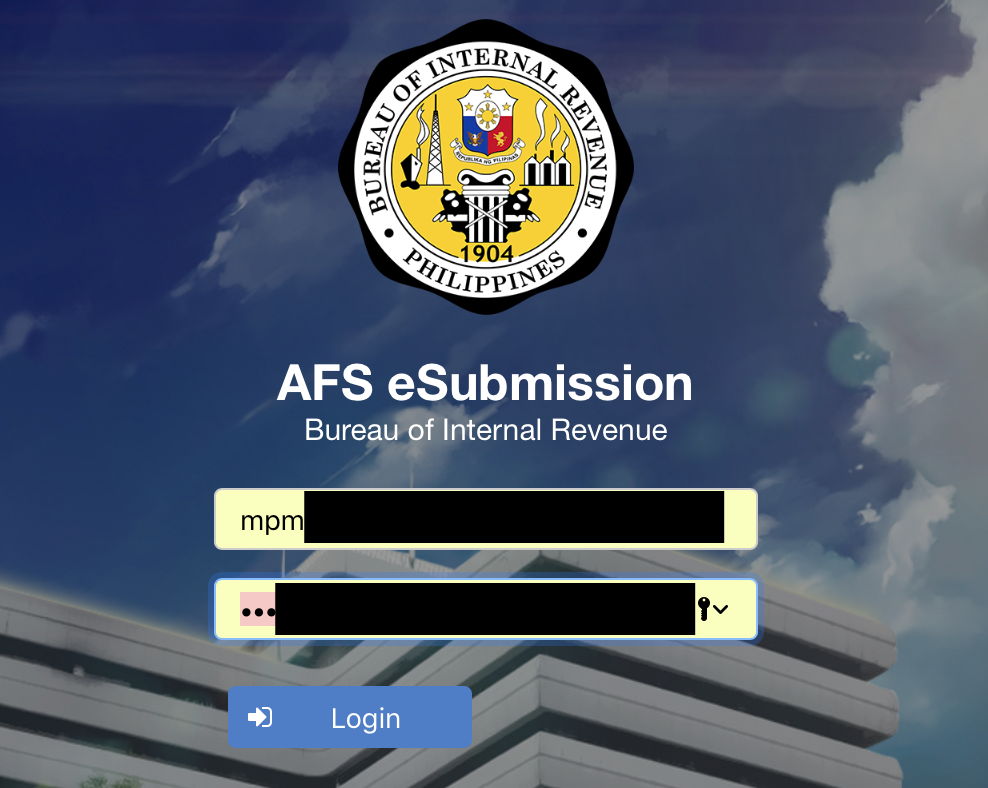

Step 5 – After activation, you can now log-in by typing your created USERNAME and PASSWORD the press “Log-In”

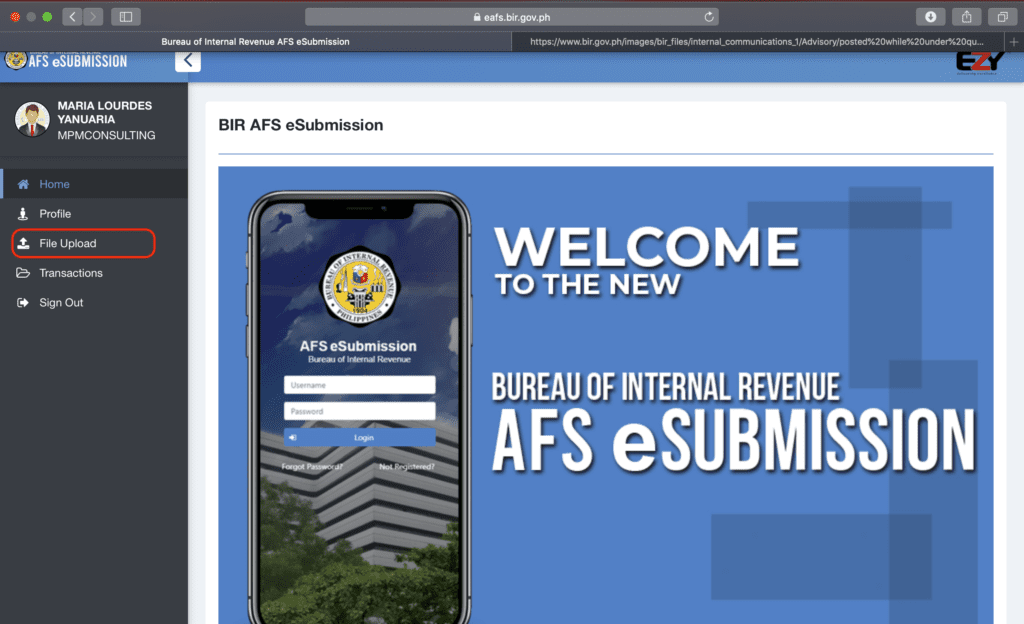

Step 6 – In the home page, go to the left side bar and click “FILE UPLOAD”

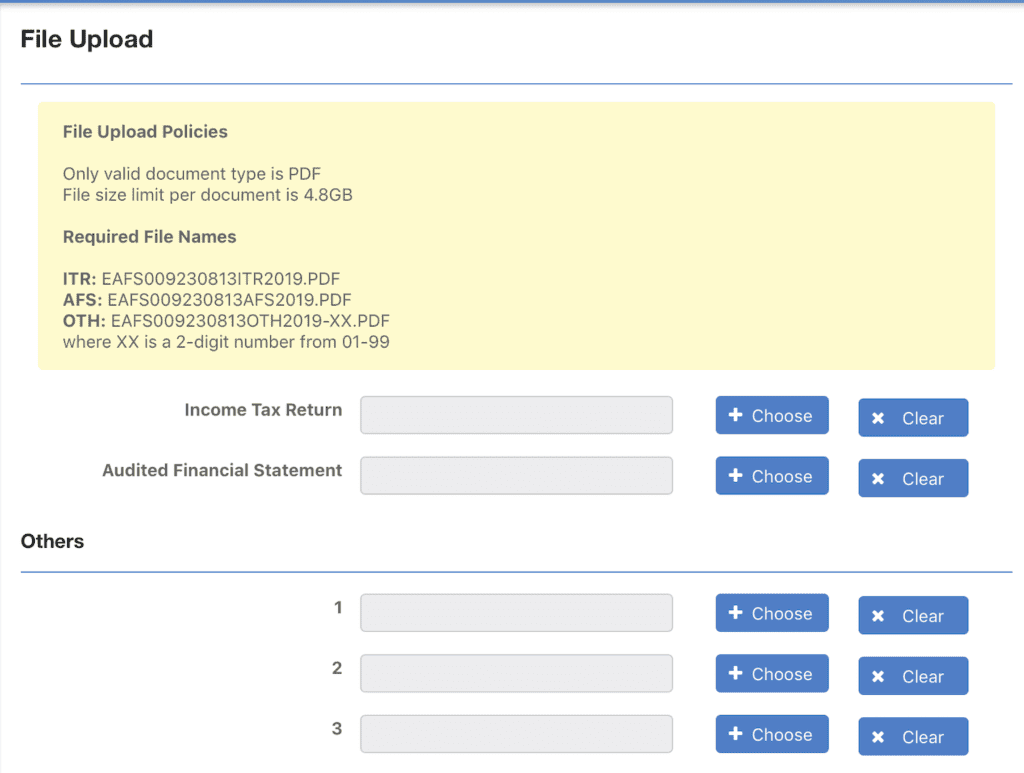

Step 7 – Upload the following documents:

- Income tax return

- Audited Financial Statement

- Other Required Documents such as Certificates of Withholding Tax, Previous Tax Payments, etc.

But before you upload, make sure to save it in PDF file, and follow the required file name such as below:

File 1 => Income Tax Return

FILE NAME: must be EAFSXXXXXXXXXITR2019.PDF

Note: XXXXXXXXX represents the TIN Number. Example your TIN is 039839099 file name will be: EAFS039839099ITR2019

File 2 => Audited Financial Statements

FILE NAME: must be named EAFSXXXXXXXXXAFS2019.PDF

XXXXXXXXX represents the TIN Number. Example your TIN is 039839099 file name will be: EAFS039839099AFS2019

File 3 and succeeding => Other Required Attachment

FILE NAME: must be named EAFSXXXXXXXXXOTH2019-XX.PDF

XXXXXXXXX represents the TIN Number. While -XX represents Series Number of File. Example your TIN is 039839099 file name will be: EAFS039839099OTH2019-01, EAFS039839099OTH2019-02, etc.

Other Important note:

- PDF file size must not exceed 4.8GB

- Follow the file name required

- To remove attached file, click “Clear”

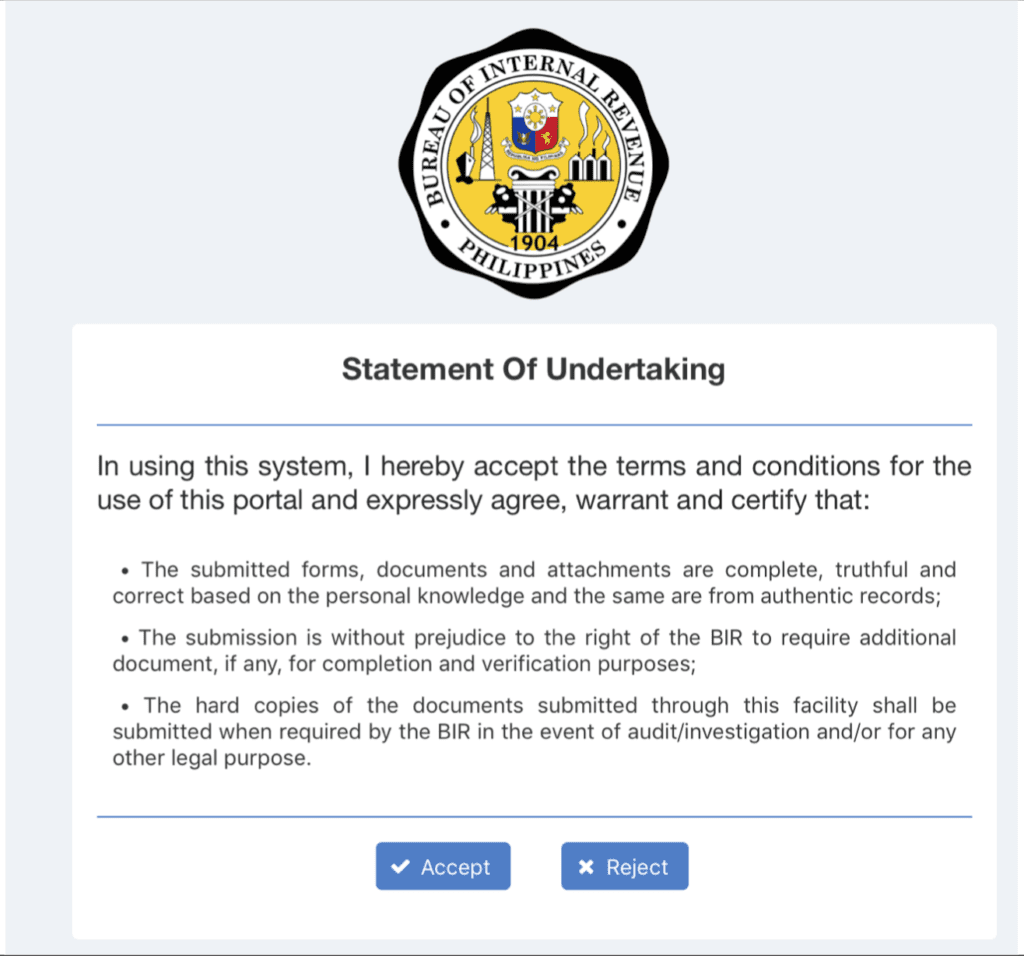

Step 8 – Once you have uploaded all documents, click SUBMIT. The Statement of Undertaking appears. Read and click “Accept” to proceed.

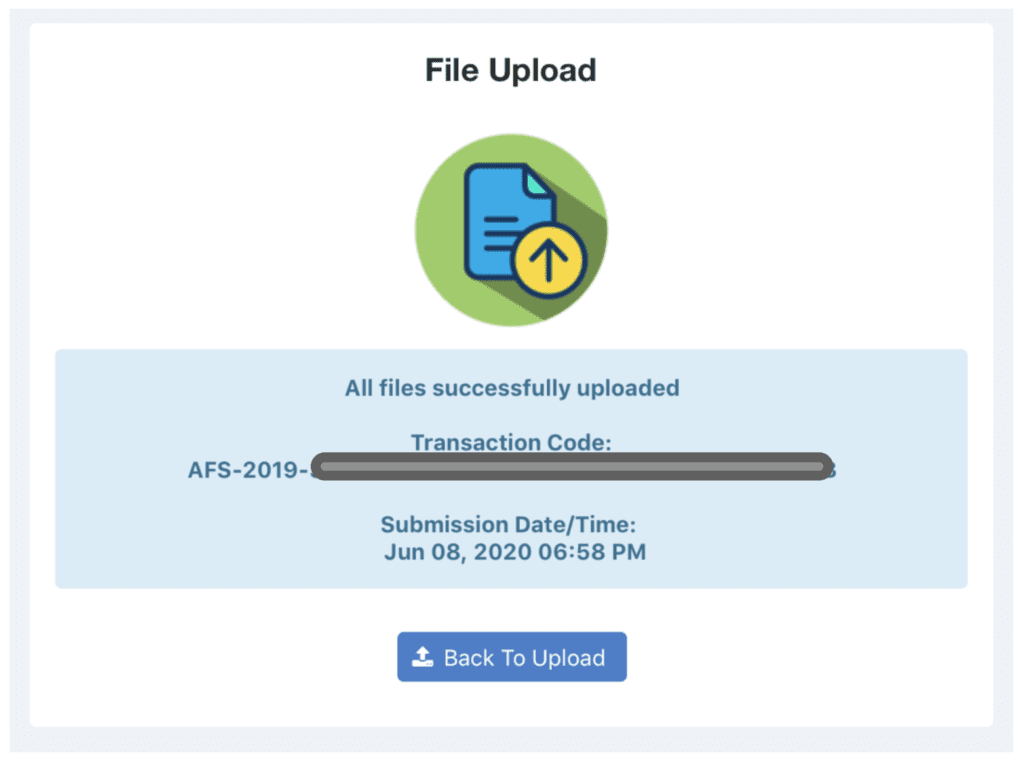

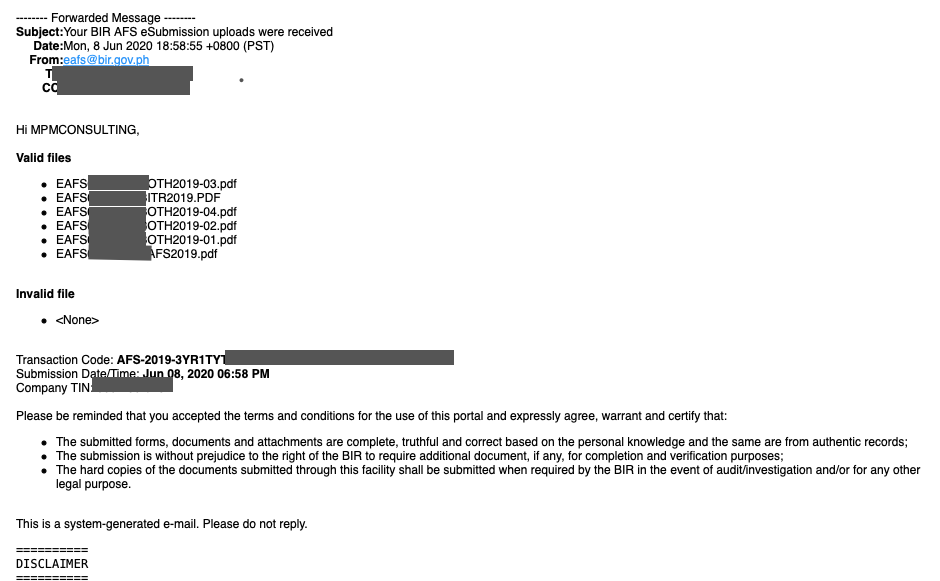

Step 9 – Save and/or Print the successful submission message that will appear in your screen and will be emailed to your registered email, as proof of submission.

This initiative of BIR to create and implement eAFS – AFS esubmission is really helpful for us taxpayers especially in this time of COVID-19 pandemic. We highly encourage you to use BIR eAFS in order to limit the need to go out. With BIR eAFS, you Stay at home but still able to comply with your obligations as business owner and taxpayer without incurring penalties.

For full details and guide in filing Annual Income Tax Return and Audited Financial Statements for Year 2019, read RMC 49-2020,click here.

Arlene says

hi,

we have registered 3 cos. yesterday, but we cant open the link of the account … all invalid User ID or Password, how come all 3 is invalid?

heavenpurebright@yahoo.com

summitprime@yahoo.com

heavensent0515@yahoo.com

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Please check your emails if you received an “activation” email from BIR.

jong cayton says

mam it also happened to me. when i open the click here in your activation email this message appeared account activation failed. link has already expired. 30 minutes after i registered….within the 72 hours limit…please explain

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Kindly try to register again. If still unsuccessful, you may email bir at contact_us@bir.gov.ph

ariane says

Hi pwede po ba magupdate ng profile sa eAFS once nasubmit na?

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

in my experience, no. and there’s no clear guidelines how to update it. but i presume you have to contact bir for update.

Sheila Marie says

Hi, just want to know if you were able to update the profile information in your account?

Kathy says

Hi Miss Ariane, napa update niyo po ba profile sa eAFS?

Nica says

Good day, ma’am!

We have successfully registered to eAFS however, when we click the link, it says that ‘Account Activation Failed’

Link has already expired

Note: We clicked the link right away upon receiving email from BIR.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Kindly try to register again. If still unsuccessful, you may email bir at contact_us@bir.gov.ph.

Rochie says

Thank you for this guidelines. Just want to ask if pwede po bang accountant(outsourced) ng company ang ilagay as Authorized representative? Thank you.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

It should be the person who is responsible to operate and manage the company’s operations or finances such as the Owner, President and/or Treasurer.

Mheann says

hello po. kaya po ba ma-edit yung nilagay sa field na Authorized representative? yung details po kasi ng auditor ang nailagay ko. Kung uulitin ko po ang pag register, is it possible? salamat po.

Erika says

Is an individual taxpayer with an 8% required to submit Audited Financial Statements? How is it done? I used to file on my own. Thank you!

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Audited Financial Statements are not required for Individual Taxpayer availing 8% and have gross annual sales of less than P3,000,000.00

Erika says

Hello po ulet, nag-file po ako using ebirforms before…yun pong sa area na income tax return sa eAFS, pa’no po kung maraming pages yung itr ko? ano pong filename ang gagamitin ko sa ibang pages? ano naman pong filename ang gagamitin ko sa email confirmation at receipt? pati po ba yung sa 1st quarter gagawan po nito?

thank you po!

Alvin Cahucom says

Hello, question. Will SEC accept this without BIR Stamp? Are there any requirements from SEC that we need to monitor for this mode of filing?

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Yes, as you are in compliance to the BIR RMC 49-2020 that states, “This circular is being issued to provide options to taxpayers in the submission of the filed 2019 Income Tax Return and its required attachments. Accordingly,taxpayers may opt to submit said requirements through the Revenue Collection Officers (RCOs) or through the on line eAFS.”

You may refer to the following SEC Memorandums in relation to Annual Filing of AFS: MC 18 s.2020, MC 17 s.2020 & MC 11 s.2020

Gwen says

Hello. I am currently preparing income tax returns for multiple individual taxpayers. How do I register all of them by using only one authorized tax representative email address? Also since they are individual taxpayers, their company and personal email addresses are the same. Eafs however does not allow the same email addresses for both company and tax representative.

Josel says

Good day po! Ma’am I am uploading my four 2307 files to OTHER section. However I confused whether I need to save the three files (ebir form filed online, Email notification, and LBP receipt for taxpayment) in one pdf document only before uploading it to ITR section. Is this correct procedure ma’am. Hope to receive your reply soon.

Josel says

Cont’d. (please refer to my earlier comment)

… I mean whether I need to save the SCANNED COPIES three files (ebir form filed online, Email notification, and LBP receipt for taxpayment) in one pdf document ….

Josel says

Cont’d. (please refer to my earlier comment)

… I mean whether I need to save the SCANNED COPIES three files (ebir form filed online, Email notification, and LBP receipt for taxpayment) in one pdf document ….

Josel says

Good day po! Ma’am I am uploading my four 2307 files to OTHER section. However I confused whether I need to save the SCANNED COPIES of the three (ebir form filed online, Email notification, and LBP receipt for taxpayment) in one pdf document ONLYbefore uploading it to ITR section. Is this correct procedure ma’am. Hope to receive your reply soon.

Josel says

Good day po! Ma’am I already uploaded my four 2307 files to OTHER section last week. However I am still confused whether I need to save the SCANNED COPIES of the three files * (ebir form 1701A filed online, Email notification, and LBP receipt for tax payment) in one pdf document ONLY before uploading it to ITR section. I haven’t done it yet. Is this correct procedure ma’am. Hope to receive your reply soon.

Kerry Lawagan says

Hi, can I use eAFS to submit my 1700 (no-payment), 2316, and Tax Return Receipt Confirmation (for filling my 1700 using eBIRForms).

RMC 49-2020 only mentions 1702 or 1701.

Thanks!

gigie says

Hello can i use my account to submit my sister’s ITR

rhed says

bakit po ayaw magregister need pa ng representative ano ilalagay ko po eh ako lang sa name ko magfile?

zen says

we filed via ebirforms online and paid via epay. magsusubmit po ba ulet dito sa eafs? thank you po.

Hya says

Hi! I scanned my ITR per page since our scanner cannot do multiple pages in one file. How will I upload it since you only left one field for the ITR file? Can I save it per page and do EAFSXXXXXXXXXITR2019-XX for the filename where the last XX represents the page number? And upload multiple files for the ITR?

The same goes with the AFS.

Thank you.

Irwin Paredes says

I just want to ask. If a business has zero (0) tax for the filing year, does the ITR and AFS need to be submitted through eAFS?

Therese says

do i still need to file the hardcopy to BIR after filing thru eafs? If yes, when should I file? Is it once the state of public health emergency has been lifted?

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

As per RMC 49-2020, no, it’s in lieu of BIR Stamping. I’m not sure what happens after the quarantine has been lifted

Sean Fredrich says

Hi, will eAFS accept multiple taxpayers in a single account? Thank you

Elinore V Pesino says

Hi! I have tried uploading the PDF of my Annual ITR a couple of times since yesterday. I followed the file names- just copied and pasted. The system always gives me a remarks of INVALID FILE NAME FORMAT.

Question 1- Do we really need to do this even if we have no tax dues?

Question 2- What if soon, I will apply for a loan requiring an Annual ITR, do I need to have a hard copy and present to BIR for stamping, or this electronic submission would be acceptable?

*Its already 10:15 PM. What if I was not able upload it until 11:59PM, would I be fined for late submission/ non-submission?

Thank you!

den says

hi paano po ang gagawin kasi sa afs maraming pages na na scan ganun dn sa itr pag nag upload naman isa lang ang kinukuha may specific lang ba na kinukuha sila kapag mag upload ng file or ung ibang attachment ng afs sa oth ko na sya iaattached

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

kindly merge your pdf into one file

Raph says

Hi! For the Authorized Tax Agent/Representative, can this be just the director/treasurer of the company or does it have to be a CPA or is there a separate registration for it?

Thank you!

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

It can be an officer of the company such as the Treasurer or President.

Kat says

Hi Mam, what should I put in Registered Name if individual? Is it the Company Name or Taxfilers Name? Thank you!

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Taxpayer’s Name

Ma. Helena N. De Los Reyes says

Good day po.

Eafs can be used even just using android phones or tablet?

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

I haven’t tried. But I think it’s doable as long as you have the PDF documents in your android phone or tablet since it’s web-based.

LYNETTE PANO says

Valid file

•

Invalid file

•EAFSxxxxxxxxxxITR2019.pdf

Warning: Please resubmit the invalid file in the expected PDF format.

Transaction Code: AFS-2019-NYRMNNZV0CCBL9C78PNRNNWTY02TNMYVMT

Submission Date/Time: Jun 14, 2020 06:51 PM

Company TIN: xxx-xxx-xxx

tuwing magsusubmit po ako invalid po ang lumalabas nakapdf naman at tama ang format. Ano ma’am ang mali sa ginawa ko?

thanks..

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

thank you for leaving a comment. please re-check the 9-digit TIN you encoded or the file size of the pdf.

JAN says

HI Maam, I have file my ITR 1701A thru EBir forms with no payment. Shall I submit the ITR and the forms 2307 thru EAFS?

Whose name will be the authorized rep ,? Can I use mine?

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi Jan, thanks for leaving comment. You can submit 2307 dat file in esubmission. If you don’t have Audited Financial Statement, there’s no need to submit via EAFS.

Glynis says

Good pm

Upon registration, mali po ang nalagay na email(not accessible) ,do we need to wait 72 hrs to register again? or we need to call BIR

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

You need to contact BIR to update.

irene yap says

I have the same problem of Lynette Pano. Even if the files are in PDF format, invalid PDF format daw.

I followed the file name as required but I don’t know why it is invalid. Is it because the pdf word that follows is not capitalized ex. EAFS000312977ITR2019.pdf instead of EAFS000312977ITR2019.PDF.

Automatic ang lumabas when you save a pdf file, it is filename.pdf. Please advise. Thanks

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Please check the file size, it shouldn’t be above 4.8GB, if not, kindly try using a different web browser. If still with error, please contact BIR.

cj says

Hi! Paano mo magedit ng information? Gusto ko po sanang baguhin ang Authorized Tax Agent/Representative’s Profile. O kailangan pong gumawa ng bagong account. Thank you.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

You need to contact BIR for any update

Jully-an says

Please help po, I encoded the wrong TIN number of the The Tax payer and it’s already activated.

How can I change it? Thank you for you help.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Try registering the correct TIN.

cj says

Hi! Paano po magedit ng account information? Gusto ko po sanang baguhin yung Authorized Tax Representative. Or kailangan ko magregister ulit? Thank you.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

You need to contact BIR for any update

Clarisse says

Hi! Paano po magedit ng account information? Gusto ko po sanang baguhin yung Authorized Tax Representative. Or kailangan ko magregister ulit? Thank you.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

You need to contact BIR for any update

PAB says

Hi,

Am I correct in my understanding that in if I electronically filed, only the email confirmation is required to be uploaded (i.e., not the actual return)? Thanks.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Please refer to Step 7 for the required documents needed to be uploaded.

Rea says

Ma’am, once naka register na po NG is ang tax payer pwede po ba mag add uli ng another tax layer o mag pa register uli? Ask lang po salamat.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

You can only register a TIN once. Any update after that you have to contact BIR.

Kat says

Hi, it is stated that you can only register once in eafs using TIN and Email Address, will it be possible to register again using another Email Address?It is still not yet activated using the previous email address. Thank you!

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

It’s only one time registration for each TIN. Kindly contact BIR to report that you haven’t received activation email

May Rose says

Hi,

Panu kaya ang gagawin nagkamali ng input ng email address wlang activation link na dumating.,

Ang RDO is Tagbilaran RDO 084 medyo malayo ang RDO.,

Please help.,

Thanks.,

Mei

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Kindly contact BIR to report. They’re the only who can help in updating records.

Jhoanna Dela Cruz says

I havent received any email for verification.2 times na po ako nag registered..

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Kindly contact BIR to report.

NICA says

Hi. We’ve registered wrong RDO. How to edit profile in eafs?

Thank You in advance

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Kindly contact your BIR RDO on how to update incorrect RDO No. encoded.

Jules says

Hi there. Our FS is FY March 31, 2020. Can we also submit via eAFS? Kasi when we tried to upload the files and edited the file name to xxxx2020.pdf hindi siya nag uupload. I think yung pwede lang is xxx2019.pdf. Any idea? Thank you.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

I think it’s only for December 31, 2019. You may contact bir hotline for fiscal year submission.

Joy Lamigan says

Hello po may error po sa TIN number sa eafs, pano po yun? anong gawin?

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi, you need to contact BIR for any error.