Republic Act No. 11976 – Ease of Paying Taxes (EOPT) Act and Revenue Regulation (RR) No. 7-2024 mandates that all taxpayer engaged in business or self-employment, including practice of profession and online sellers/earners, whether selling goods/properties or selling services/leasing of properties, shall use invoice as the primary sales document.

On April 11, 2024, the Bureau of Internal Revenue (BIR) released RR No. 7-2024 which details the changes in the tax rules on invoicing requirements made by EOPT Act.

(Important Update: On June 13, 2024, the BIR released Revenue Regulations No (RR) 11-2024 which amended some of the provisions of RR 7-2024 on compliance with invoicing requirements. It changed some of the items mentioned in this article. Will be mentioning the updates on parts of this article but a new article about RR 11-2024 will also be published in our website.)

Prior to the implementation of EOPT, sellers of services and leasing of properties are mandated to use Official Receipt as the primary sales document. However, upon effective date of RR No. 7-2024, the Official Receipt will no longer be the primary sales document, instead sellers of services and leasing of properties must register and use invoice.

The effective date of RR No. 7-2024 is 15 days following its publication. Since the BIR published RR No. 7-2024 last April 11, 2024, the estimated effective date is April 27, 2024. (Important Update: April 27, 2024 effective date was clearly stated in RR 11-2024).

However, to give the taxpayers ample of time to transition and register invoice, the BIR gave additional 30 days to register invoice by submitting Inventory List of unused Official Receipts to be used as Invoice. The 30 days deadline is estimated to be on or before May 27, 2024. (Important Update: The deadline for compliance with submission of “Inventory List of Unused Official Receipt to be used as Invoice” was extended by RR 11-2024. The deadline was moved from May 27, 2024 to July 31, 2024.)

In this article, I will discuss the ways to register invoices in compliance with RR No. 7-2024. For detailed information about RR No. 7-2024, you may download it here. (Important Update: I will also put the important changes and update made by RR No. 11-2024, you may download it here.)

Two Ways to Register Invoice per RR 7-2024

Per RR No. 7-2024, there are two ways to register invoice. The two options are as follows:

(Important Update: Will also reflect the changes made by RR No. 11-2024)

Option 1 – Convert Unused Official Receipt to be Used as Invoice

Continue using any remaining unused Official Receipt and convert it as invoice but only until December 31, 2024. (Important update: Per RR 11-2024, it now includes Billing Statement and Statement of Account or Charges. And the deadline is updated from until December 31, 2024 to until fully consumed).

However, to be allowed to do this, you must do both the following:

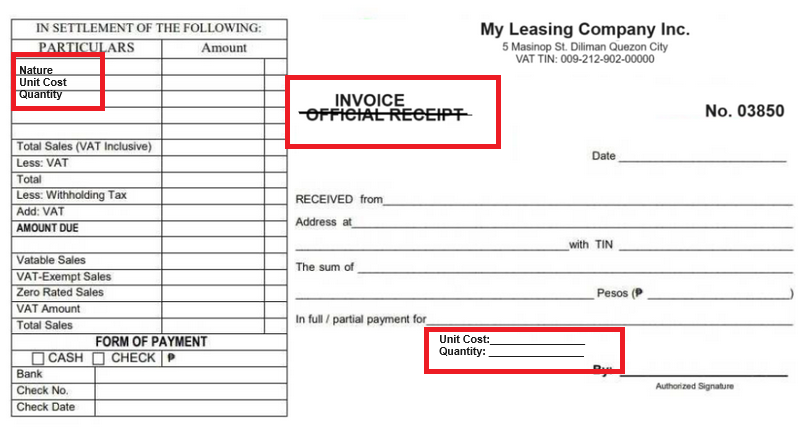

a – Strike through the word Official Receipt and Stamp Invoice

If the you choose to convert any unused Official Receipt & use it as Invoice, you must strike through the word Official Receipt and stamp Invoice.

(Important Update: Per RR 11-2024, items previously not shown, such as the unit cost, quantity and description or nature of sold goods/services, must be stamped in the converted Official Receipt, Billing Statement, Statement of Account or Charges.)

See sample below:

These unused official receipt series/booklets, with stamped “Invoice,” may be issued to your customers only until December 31, 2024. (Important Update: Per RR 11-2024 the deadline is updated from until December 31, 2024 to until fully consumed.)

After which, you must register and apply for Authority to Print (ATP) Invoice (BIR Form 1906). You may proceed to Option 2 if you want to know how to apply for ATP.

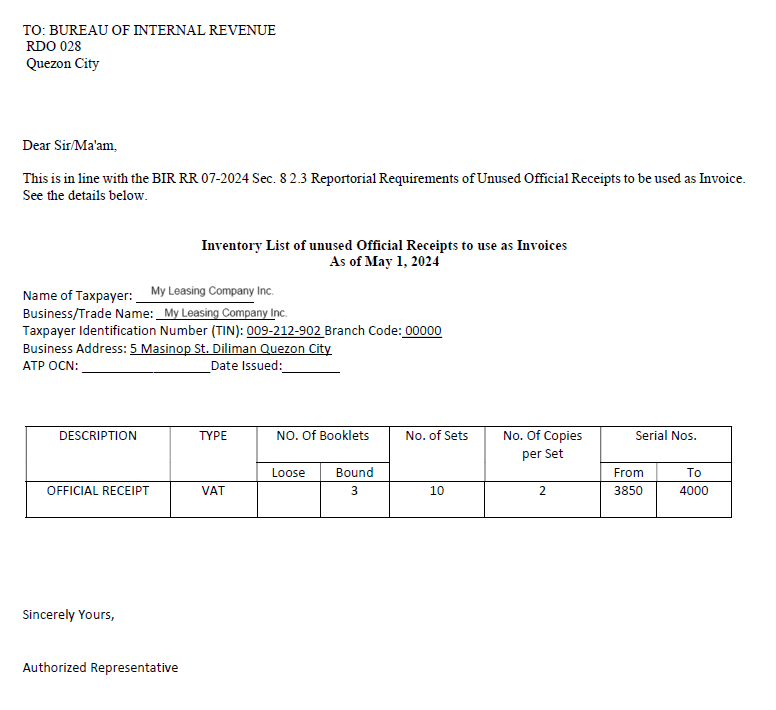

b – Submit in BIR RDO an Inventory List of Unused Official Receipt

Aside from stamping the world Invoice on the face of the Official Receipt, you must also submit an Inventory List of Unused Official Receipt to be Used as Invoice to your BIR RDO. (Important update: Per RR 11-2024, it now includes Billing Statement and Statement of Account or Charges)

The inventory list shall include details such as the following:

- Type of Document: OR

- Type: VAT or NON-VAT

- No. Of Booklets:

- No. Of Sets:

- No. Of Copies per set:

- Series No. From:

- Series No. To:

Below is a sample:

You must submit this inventory list to your respective BIR RDO and have it received stamped. Please note that some BIR RDO may have specific inventory list format that they accept. The sample above is just a general sample.

When submitting the inventory list of unused OR to be use as Invoice, be ready to include the following documents for verification:

- unused OR series/booklets mentioned in the inventory list.

- photocopy of your BIR Form 2303 – Certificate of Registration (COR)

- signed Special Power of Attorney (SPA), if individual, or Secretary Certificate, if corporation, in case you will ask a representative to submit in your behalf.

Remember that both a & b must be done to be allowed to continue using Official Receipt as Invoice upon effective date of RR 7-2024 until December 31, 2024. (Important Update: Per RR 11-2024, the deadline for submission of the inventory list of unused OR to be converted as Invoice was extended from May 27, 2024 to July 31, 2024. Also, the until December 31, 2024 deadline in using converted OR was changed to until fully consumed.)

Option 2 – Apply for Authority to Print (ATP) Invoice – BIR Form 1906

Since the first option is only valid until December 31, 2024, and you still need to apply for authority to print invoice and use registered invoice starting January 1, 2025. (Important Update: Per RR 11-2024, the until December 31, 2024 deadline in using converted OR was changed to until fully consumed. As such, you only need to apply for a new sets of invoice when you only have few pages of your converted OR.)

If you do not want the hassle of stamping your Official Receipt with the word Invoice and submit Inventory list, you can skip Option 1 and choose this Option 2, which is to apply for Authority to Print (ATP) Invoice.

The downside of this choice, however, is that you may not be able to meet the deadline with the possibility of volume of application in BIR and delayed availability of the invoice.

Should you choose this choice, or you will apply for Authority to Print Invoice in the future, you may follow these steps:

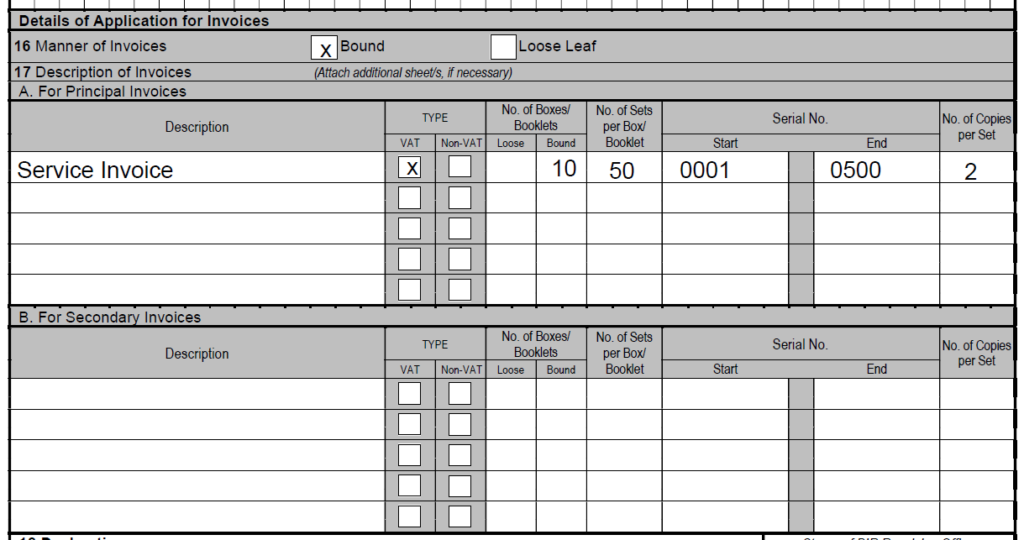

a – Fill-up BIR Form 1906 Application for Authority to Print (ATP) Invoice

You may download the BIR Form 1906 here.

Below is a sample filled-up Details of Application for Invoices on BIR Form 1906 – Authority to Print (ATP) for Service Invoice:

b – Prepare the following supporting documents when you submit your application:

- Photocopy of BIR Form 2303 – Certificate of Registration.

- Photocopy of earlier BIR Form 1906 – Authority to Print Receipt/Invoice including sworn statement.

- Booklets of Unused Official Receipt for Shredding/Replacement with Invoice.

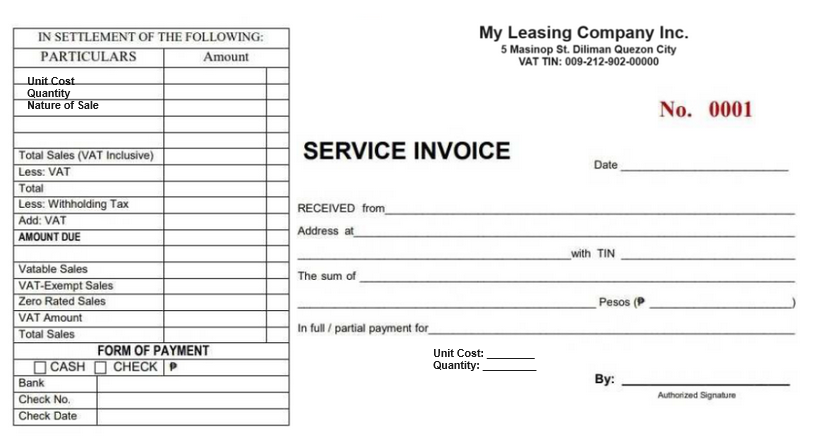

c – Sample Invoice with your company details.

Prepare and print a sample invoice with your company details.

You may ask the accredited printer, or your BIR RDO, for the sample invoice applicable to your nature of business.

Below is a sample of service invoice only:

d – Submit your application and required documents to your BIR RDO

Submit your application and other supporting documents with your BIR RDO for evaluation and processing.

Once your application is accepted, go back to your BIR RDO after a few days or weeks to pick up your printed Invoice booklets.

That’s it! You have learned how to register invoice per RR No. 7-2024 (Updated by RR 11-2024). Once you register your invoice, start issuing it to your customer instead of the Official Receipt.

Lastly, do not forget to do your record keeping in your BIR registered books of accounts and do your tax filing/payment. You can do efficient bookkeeping and automated tax form filing with MPM Accounting Software. Register for 30 days trial here: www.mpm.ph/tax

I hope this article has been helpful for you to learn how to register invoice per BIR RR No. 7-2024 (Updated by RR 11-2024) and the EOPT Act. Feel free to leave a comment and share it with anyone whom you think will receive help from it.

Eduardo Alaba, Jr. says

Hi Ms Yanuaria,

I currently have OFFICIAL RECEIPTS for my hotel, will have them strike through and stamped “INVOICE.”

My question is, when we apply for an Authority to Print from the BIR, what Invoice should our hotel use, Service Invoice or Sales Invoice?

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi,

Thanks for leaving a comment.

You may use the strike-through Invoice (Previously OR) only until December 31, 2024. It’s advisable to register a new sets of Invoice before December 31, 2024 deadline so you wont have to line up in BIR RDO. Or once the strike-through invoice is fully consumed.

Normally the BIR use Service Invoice for service business. But service invoice and sales invoice are both acceptable as long as there’s a word invoice.

Hope this helps

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi, just an update to this reply, there’s now a new RR 11-2024 amending some of the provisions of RR 7-2024. One of which is that the strike-through invoice (previously OR) can now be used until fully consumed. They’ve removed the until December 31, 2024 clause of RR 7-2024 in RR 11-2024.

RAQUEL S. TAGNIA says

Hi Ms. Yanuaria,

Currently, we are issuing Service Invoice and Sales Invoice after we served and deliver our service and goods respectively. Upon collection, we issue OR for service and CR (collection receipt). Is this practice still acceptable?

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi, with the new EOPT law, RR 7-2024, and RR 11-2024, the Invoice (whether Service Invoice or Sales Invoice) is primary proof of sales. While Receipt (whether OR or CR), are considered supplementary proof of collections. I think what you’re doing is correct.

Didi says

Hi, un sample converted O.R. nyo po na may stamp ng unit cost, quantity and description or nature of sold goods/services sa table under particulars ay acceptable po ba ang ganito sa lahat ng RDO?… Nag-email na po ako sa RDO 43 pero wala pa po silang confirmation about this. Nakapag-submit na ako ng inventory report at may stamp na ring Service Invoice.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi, currently the BIR has not released an official format of the new invoice. They just gave guidelines. Just make sure the required information stated in the rules are there in your converted OR to invoice. Hope this helps

Edgardo Gallardo says

Is there a fee to convert or strike out OR to service invoice

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

There’s no fee if you will convert your OR to invoice.

Sally says

Is it possible to have one certificate of registration if the business type is on foods services and retailing at the same.

Brenda says

Hi Ma’am just for clarification, once we converted our Official Receipt to Service Invoice regardless of Cash Sale or Credit, do we need to issue Acknowledgement Receipt when we collected the payment of client with credit terms.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi, thank you for leaving a comment. Issuing receipt is optional if needed in the sales process. Normally it’s only needed if credit sales and not on cash sales. Hope this helps