If you are a person doing freelancing, self-employment or practicing profession, or you own a business offering services, you should get a Bureau of Internal Revenue (BIR) registered official receipt invoice in the Regional District Office (RDO).

(Note: Original article was written in June 2022. Updated in May 2024 based on changes from RA 11976 – Ease of Paying Taxes Act (EOPT), BIR Revenue Regulations No. 7-2024, Revenue Memorandum Circular 14-2024 and 53-2024.

Per RR 7-2024 and RA 11976, Invoice is now the primary evidence to account for sale of goods, properties, service and/or leasing properties. This includes Sales Invoice, Commercial Invoice, Cash Invoice, Charge/Credit Invoice, Service Invoice or Miscellaneous Invoice. It is categorized into two: VAT Invoice (if VAT Registered) and Non-VAT Invoice (if Non-VAT Registered). As a primary document, it is mandatory to register Invoice if you are a freelancer or self-employed.

Official Receipt is now a supplementary document and no longer the primary evidence for sale of service or leasing of properties. As a supplemental document, you may or may not register an official receipt depending if you are using it or not in the course of your self-employment or freelancing.)

The official receipt invoice will be your primary sales document which you will issue and give to your customer whenever you receive payments or make a sale.

When you have a BIR registered official receipt invoice, it shows you, or your company, as a legit business that whom a client can trust.

Keep in mind also that not having a BIR registered official receipt invoice, or if you use of non-registered official receipt invoice, is a criminal offense that is punishable via payment of penalties and imprisonment under the Tax Code Section 264, as follows:

- Failure or refusal to issue

official receiptinvoice and/or issuing incorrect information in thereceiptinvoice — punishable with fines of P1,000 up to P50,000 and imprisonment of 2-4 years.

- Printing of

official receiptinvoice without authority of BIR, printing of double or multiple set ofofficial receiptsinvoice, printing of unnumbered and without your information such as Name/TIN/address, and/or printing of fraudulentofficial receiptinvoice — punishable with fines of P500,000 up to P10,000,000 and imprisonments of 6-10 years.

To avoid these legal fines and consequences, you must register an official receipt invoice in the BIR and issue the said BIR registered official receipt invoice to your customer whenever you make a sale.

In this article, I will discuss the steps on how to get a BIR Registered Official Receipt Invoice.

1. Register and get a BIR Form 2303 – Certificate of Registration in BIR RDO

If you already have BIR 2303, you may proceed to the next step.

If not yet, you must first do this step by filing either of the following BIR Form in the BIR Regional District Office (RDO) where your business is registered.

- BIR Form 1901 – if individual, click here to download the latest version of BIR Form 1901 January 2024.

- BIR Form 1903 – if non-individual, click here to download the latest version of BIR Form 1903 January 2024.

Bring a photocopy of your BIR Form 2303 when you register an official receipt invoice, as BIR may request it.

2. File and pay BIR Form 0605 – Annual Registration Fee

Next, file and pay BIR Form 0605 – Annual Registration Fee in any of the RDO Authorized Agent Bank (AAB) or ePAY channels such as Myeg, Gcash, etc.

If you already have BIR 0605, you may do to the next step. If not yet, you must first do this step. You can read this article on how to do this, click here

Bring a photocopy of your latest BIR Form 0605 when you register an official receipt, as BIR may request it.

You may now skip this part. Per RMC 14-2024, effective January 22, 2024, the BIR will cease collecting Annual Registration Fee (ARF). As a result, business taxpayers are exempt from filing BIR Form 0605 and paying the P500 ARF for new business and annual renewal.

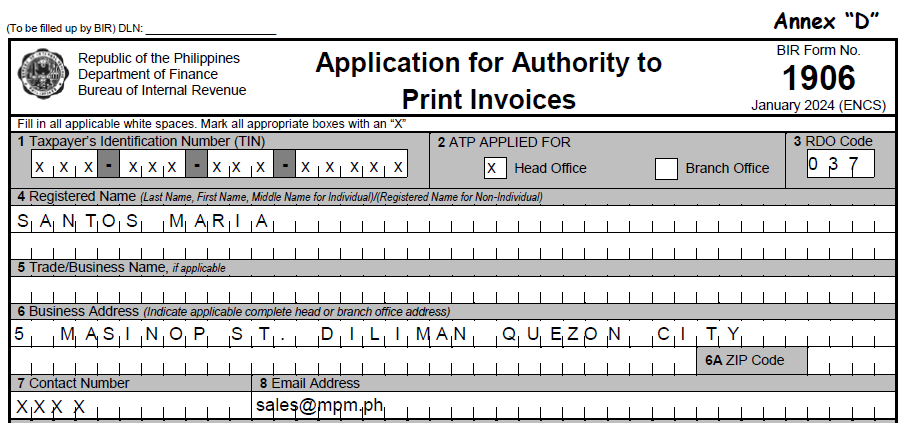

3. Fill-out BIR Form 1906 – Application for Authority to Print (ATP) Receipts and Invoices

BIR Form 1906 is the form you use when you apply for an official receipt invoice in the BIR.

First, fill-out the form with your taxpayer’s information like what is in your BIR Form 2303.

In the said form you need to also fill-in the following information:

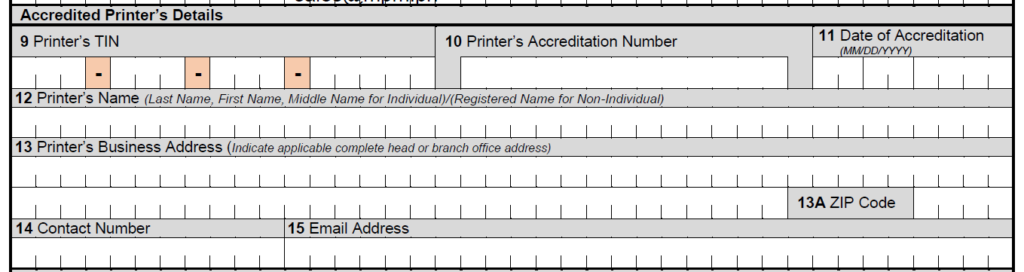

a. Information about the Accredited Printer

You need to choose an accredited printer who will print your Official Receipt invoice booklet. You can find a list of BIR Accredited Printer, click here.

But, to make the application easier, you may get the official receipt invoice from printer recommended by your BIR RDO in the BIR New Business Registration Counter.

If you choose to have it printed in BIR, you may skip this part of the form. The BIR RDO will fill up the information.

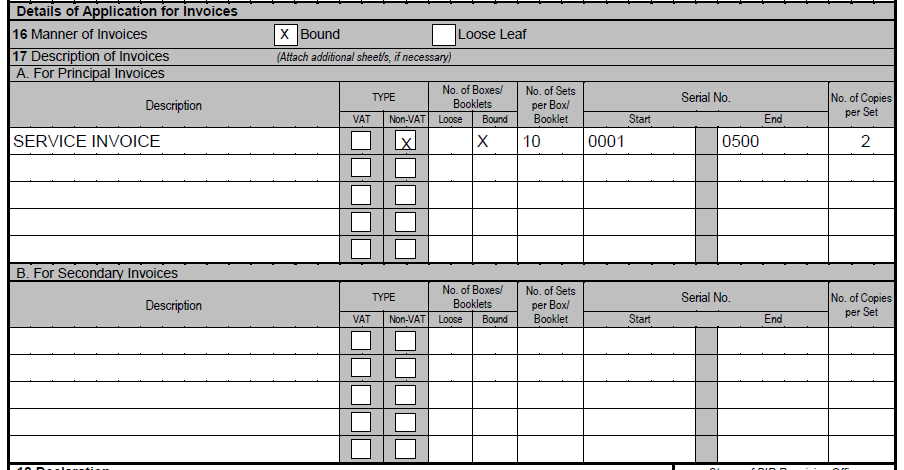

b. Information about the Official Receipt Invoice

In the primary document, type official receipt invoice, such as service invoice, and then check if:

- you are VAT or Non-VAT registered.

- you want looseleaf or bound. The easier is bound. There are more requirements if you apply for looseleaf.

In addition, decide and write the following:

- Number of booklets you wish to print. The minimum is ten (10) booklets

- Number of copies per set. The choices are duplicate or triplicate. The common is duplicate.

- Serial number starts with 001 ends with 500 for first time application. And then when you apply for a re-printing or new sets of

ORInvoice booklets, just continue the series from the last printed booklet.

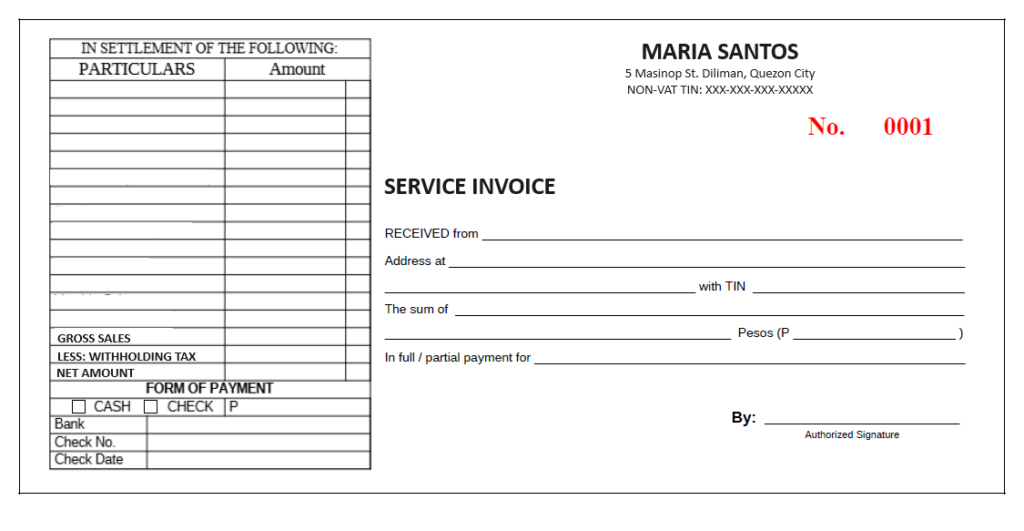

4. Prepare sample format of the Official Receipt Invoice

The next step is to prepare a sample format of the Official Receipt Invoice. Below is an example:

You can also get a sample Official Receipt Invoice from the accredited printer you chose or in your BIR RDO New Business Registration Counter.

5. Submit your application form and the requirements to your BIR RDO

Once all the forms and requirements are ready and complete, process the application in the BIR RDO where you registered your business, freelancing, self-employment, or practice of profession.

The BIR RDO will then assess your application. If all is well, they will receive and give you a copy of BIR Form 1906 with received stamp. And will require you to return to pick-up the printed Official Receipt Invoice booklets.

6. Pickup your printed BIR Registered Official Receipt Invoice booklets

Coordinate and pick-up your printed official receipt invoice in your BIR RDO.

Once you have the official receipt invoice registered in BIR, make sure to store it in your business premise. The validity of the official receipt invoice is only up to five (5) years if unused.

You just learn how to get BIR registered official receipt invoice. If you liked this article, please share it.

suzette santos says

Hi Ma’am, Good Day!

I just want to ask, what if I already had cash register with BIR permit. It is necessary to apply for authority to print?

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi, normally yes. To be able to issue manual receipt and/or invoice if requested by customer. Hope this helps.