The first COVID-19 case in the country was reported last January 30, 2020. Eight months since then, cases are still growing, yet quarantine protocols are slowly being lifted. Unfortunately, with several businesses crippled by the pandemic, most have no choice but to push for normal operations to stay afloat. Due to this scenario, the Department of Labor and Employment (DOLE) has continuously published several workplace guidelines to protect employees from COVID-19. Learn about these requirements in this article and discover more business changes that you can employ.

Enhanced Community Quarantine (ECQ) in the Philippines

The chances are, like most businesses, your operations were disrupted when the Enhanced Community Quarantine (ECQ) protocol was enforced on a national level. Under ECQ, only essential businesses are allowed to operate at full capacity—those dealing with food, health, transportation, utilities, media, and similar industries. The rest have to make do with remote work arrangements or worse, halt operations.

With quarantine protocols easing out, more and more companies are starting to bring employees back to the workplace. After all, business owners and displaced workers alike need to earn cash to pay for their accumulating bills.

If you are currently deliberating whether your business is ready to resume full operations, check out the following guidelines, and make the necessary preparations.

DOLE Guidelines For COVID-19 Control

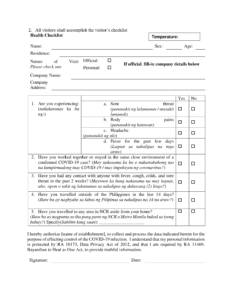

The file below details DOLE’s COVID-19 guidelines for health and safety measures in the workplace. Furthermore, it identifies the duties of both businesses and employees in minimizing the spread of this disease. Make sure to download the last image and make your employees and visitors fill out on a daily basis!

Take note that these guidelines mostly apply to businesses that need to go back to the office to resume operations. At the end of the day, a remote work arrangement is better if your team can efficiently perform their duties while at home. Remember, in times of crisis, it pays to look for ways to stay safe.

Read further below for DOLE’s take on alternative work arrangements.

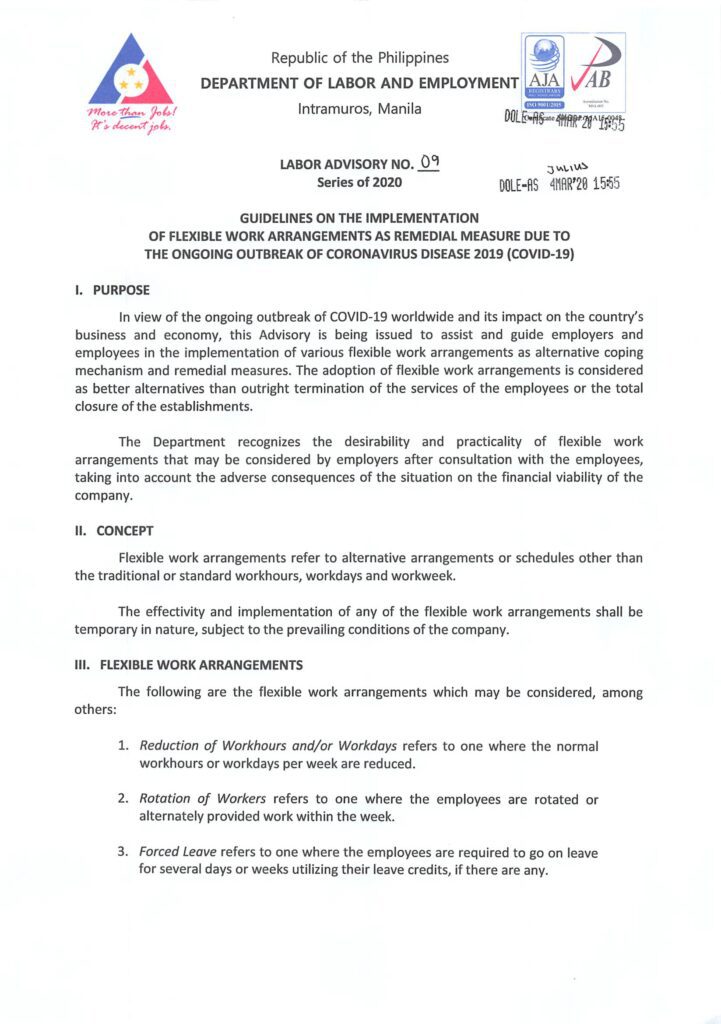

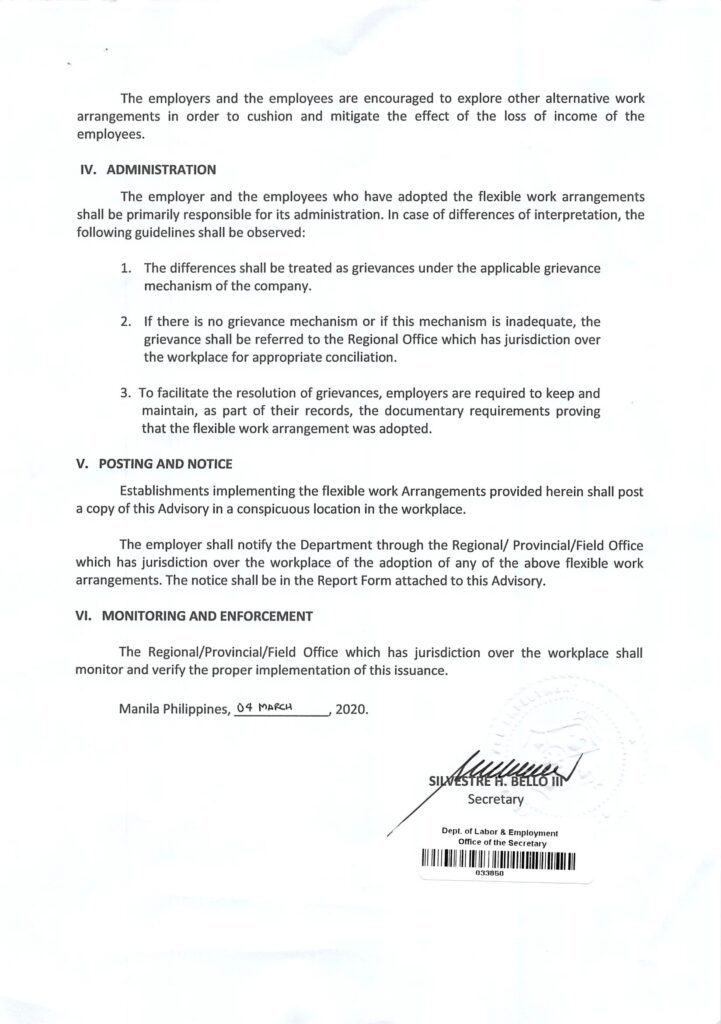

DOLE COVID-19 Guidelines on Flexible Work Arrangements

If alternative work arrangements are feasible for your business, here’s what DOLE has to say:

DOLE’s COVID-19 guidelines encompass both remote and office workers. Make sure to follow their prescribed health and safety procedures when opening up your workspaces.

Business Changes to Prevent COVID-19 Transmission

Aside from strict enforcement of the health guidelines from DOLE, we zone in on internal changes that you can implement to prevent the further spread of COVID-19. These business tips protect your employees and can efficiently improve your operations too! Get to know these suggestions below.

Digitize Communications

Whether online or offline, it goes without saying that communication is essential for both teamwork and collaboration. Instead of discouraging it, companies need to find alternatives that work best for the majority. To minimize physical employee interaction, utilize technology for office communications.

Make sure to decide on one to two options for your team. After all, it can be difficult to manage different chat platforms at once. Common online apps include Slack, Messenger, Viber, and other similar messaging apps. Aside from these options, email, text, and phone calls also work, especially for employees who are not as tech-savvy.

Use a Cloud-Based HR Platform

Centralized platforms like MPM Payroll automate several human resource aspects that are usually done manually. In this pandemic, programs like this not only simplify HR tasks but more importantly, provide a safe way for continuous HR operations.

Some benefits of MPM Payroll include:

- Easily access digital 201 Files

- Approve overtime, leave, remote work, and schedule change requests

- Monitor your employees’ attendance—for both remote and office workers

- Provide employees with digital payslips, leave monitoring, and attendance logging

Deposit Salaries Directly to the Bank

This COVID-19 pandemic is constantly challenging the way that businesses work. Although direct bank deposits are common practice for corporations, most small businesses still give out cash payments. Talk to your employees (through the channels above, perhaps?) and ask them if they are comfortable with online banking. This way, you can eliminate the need for bank deposits and even encourage online transactions for their personal expenses.

It is important to highlight how communicating with your team is key. If the majority of your employees are uncomfortable with digital transactions, then feel free to skip this tip! After all, we want to create safe solutions that work for you.

Encourage Clients to Pay Digitally

Expanding your payment methods makes it safer for both you and your clients to build business relationships. In this modern world, cash comes in several forms. Gone are the times when the only option to pay for a good or service is through cold, hard cash. We now have debit cards, online banking, and digital wallets.

Aside from cash, another option for digital payment is through credit. Credit card merchants take a small percentage off of your transactions but extend your customers’ purchasing power—something they will surely appreciate. Evaluate which of these options work best for you and let your clients know!

Settle Employer Contributions Online

Thanks to the government’s modernization efforts, employers can safely file SSS, PhilHealth (PHIC), and Pag-IBIG (HDMF) contributions through online channels. Watch the videos from our Facebook Page for step-by-step guidelines to get started in digitally transacting with these agencies.

Business in the Time of COVID-19

Let’s face it: no one was prepared when the pandemic struck, and up until now, companies are swimming in murky waters. Despite this, many entrepreneurs still strive to care for their employees while keeping the business afloat at the same time.

For more articles on business resilience, make sure to check out our blog here.

What other business policy changes have you made to ensure your employees’ safety? Let us know through the comments section below. We love to hear from you!

Leave a Reply