Here in the Philippines, individuals and businesses alike are subject to taxes of different shapes and forms. For small businesses, freelancers, or sole proprietors, the complex nature of these taxes usually come as a burden. In this article, we highlight key information on Quarterly Percentage Tax (BIR Form 2551Q) with the aim of making filing a breeze.

Contents

- Percentage Tax in the Philippines: An Overview

- Changes Brought About by TRAIN Law

- Calculating Percentage Tax for Your Business

- Preparing BIR Form 2551 (Quarterly Percentage Tax)

- Methods for Filing Percentage Tax

- Available Payment Channels

- Deadline for Filing Quarterly Percentage Tax

- Penalties for Late or Incorrect Filing

Percentage Tax in the Philippines: An Overview

Percentage tax is a business tax for taxpayers whose annual gross sales do not exceed three million pesos (Php3,000,000.00) and are exempt from value-added tax (VAT) under the tax laws. It is often referred to as NON-VAT.

Who Are Required To File?

According to the Bureau of Internal Revenue (BIR), the following entities are subject to a quarterly percentage tax:

- Non-VAT-registered individuals or businesses selling goods, properties, or services, whose annual sales do not exceed ₱3,000,000

- Lessors of residential spaces charging more than ₱15,000 a month per unit, but whose annual rental sales does not exceed ₱3,000,000

- Small businesses engaged in the following industries/transactions:

- Vehicles for rent or hire

- Domestic and international sea and air transport carriers

- Gas and water utilities franchisees

- Radio and television franchisees whose annual income does not exceed ₱10,000,000

- Overseas communication except by public organizations and news outlets

- Banks and non-bank intermediaries

- Entities doing life insurance business

- Fire, marine, or agents of foreign insurance companies

- Operators of cockpits, cabarets, night or day clubs, boxing exhibitions, basketball games, Jai-Alai, racetracks, and music lounges

- Winnings from horse races

Changes Brought About by TRAIN Law

The Tax Reform for Acceleration and Inclusion (TRAIN) Law brought several welcome changes aiming to simplify and level the country’s tax system. It took effect last 2018, with some changes gradually rolling out even up until 2024.

How Did TRAIN Law Affect Percentage Taxes?

Prior to the passing of the law, businesses were required to file for percentage taxes monthly. With this in effect, percentage taxes will only have to be filed quarterly, saving you a few trips to your local Regional District Office (RDO). The law also introduced a new form to be used for Quarterly Percentage Taxes which is the BIR Form 2551Q (more on this later).

However, the greater change brought by the TRAIN Law is the introduction of the 8% Gross Income Tax (GIT) Rate. In summary, this gives small businesses like yours an option for a simpler tax arrangement. Instead of going through the complexities of calculating, filing, and settling your income and percentage taxes, you can opt to use a fixed rate of 8% as an alternative.

Read more: 8 Benefits of 8% Gross Income Tax Rate

Calculating Percentage Tax for Your Business

If you opted against using the 8% GIT Rate, here’s how you compute for your small business’ percentage tax. Browse the table below and see which category your business falls under. Each category has a different taxable base and tax rate. The former simply refers to the amount that is subject to percentage tax. Meanwhile, the latter dictates the percentage that you should multiply to this amount.

| Coverage | Taxable Base | Tax Rate |

| Non-VAT-registered persons | Gross sales or receipts | 3% |

| Vehicles for rent or hire | Gross receipts | 3% |

| Domestic and international sea and air transport carriers | Gross receipts on transport of cargo from the Philippines to a foreign country | 3% |

| Gas and water utilities franchisees | Gross receipts | 2% |

| Radio and television franchisees whose annual income does not exceed ₱10,000,000 | Gross receipts | 3% |

| Overseas communication | Amount paid for the service | 10% |

| Banks and non-bank intermediaries | Interest, commissions, and discounts from lending activities, income from financial leasing on the basis of remaining maturities of instruments from which receipts are derived: | |

| Maturity period is five years or less | 5% | |

| Maturity period is more than five years | 1% | |

| Dividends and equity shares and net income of subsidiaries | 0% | |

| Royalties, rentals of property, real or personal, profits from exchange and other items treated as gross income | 7% | |

| Net trading gains of foreign currency, debt securities, derivatives, etc. | 7% | |

| Other non-bank financial intermediaries | Interest, commissions, discounts, etc. treated as gross income | 5% |

| Interest, commissions, discounts from lending activities, income from financial leasing on the basis of remaining maturities of instruments from which such receipts are derived: | ||

| Maturity period is five years or less | 5% | |

| Maturity period is more than five years | 1% | |

| Entities doing life insurance business | Total premiums collected | 2% |

| Agents of foreign insurance companies: | ||

| Insurance agents for companies not authorized to transact business in the country | Total premiums collected | 4% |

| Owners of property obtaining insurance with foreign companies | Total premiums paid | 5% |

| Operators of: | ||

| Cockpits | Gross receipts | 18% |

| Cabarets, music lounges | Gross receipts | 18% |

| Boxing exhibitions | Gross receipts | 10% |

| Basketball games | Gross receipts | 15% |

| Jai-alai and racetracks | Gross receipts | 30% |

| Winnings from horse races | Winnings or ‘dividends’ | 10% |

| Winnings from double forecast/quinella and trifecta bets | 4% | |

| Prizes of owners of winning race horses | 10% |

For example, your business is engaged in the retailing of pens. This type of business falls under the first category—non-VAT-registered entities. As per the table above, to calculate percentage tax, multiply your gross sales or receipts to a 3% tax rate.

Let’s say your business earned a gross amount of P500,000 this quarter. Multiplying it by 3% gets you a total of P15,000 percentage tax due for the period.

P500,000 x .03 = P15,000

Doing this manually is relatively easy—one simple equation and you’re done. The challenge comes when your business is subject to more than one category of percentage tax. For some businesses with incomplete records, identifying total gross sales for the quarter can also prove to be difficult. Coupling these with income tax preparations and other regular job responsibilities can easily lead to unnecessary stress and overtime hours.

It’s a good thing that cloud-based platforms like MPM Accounting automates tax preparation for businesses. Integrated with books of accounts, quarterly tax deadlines come at a breeze so you can focus on running the business instead.

Learn more: MPM Accounting for MSMEs

Preparing BIR Form 2551Q (Quarterly Percentage Tax)

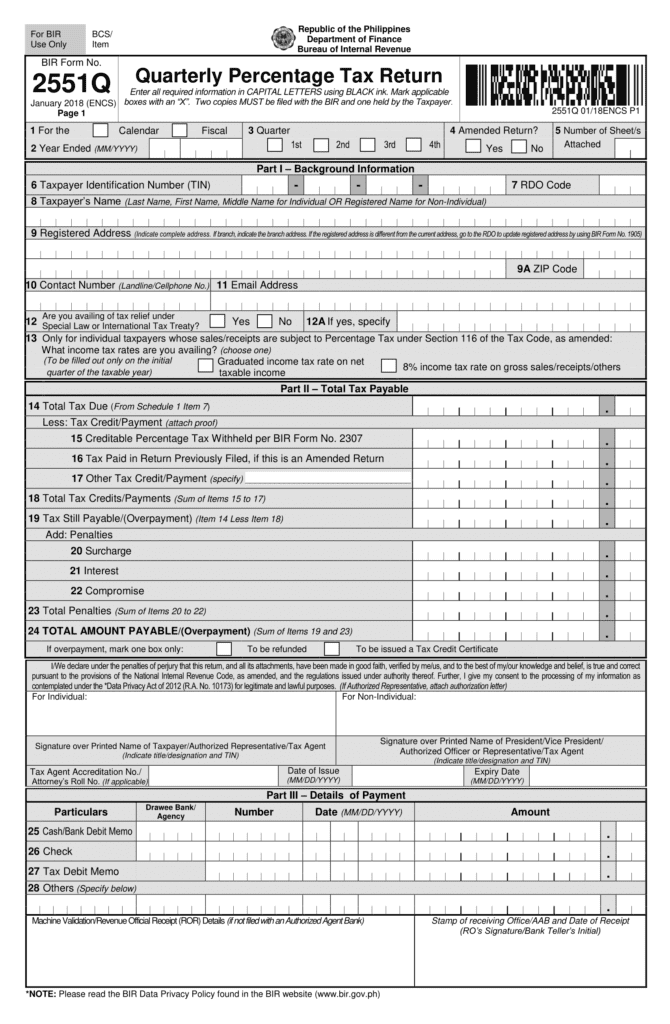

Choosing the manual route? After calculating your percentage tax for the quarter, you need to prepare BIR Form 2551Q. This is the document that you will submit to the BIR upon filing.

For sample manual copy of the form, download it here: BIR Form 2551Q

Just a side note, since 2015, it has been encouraged to do electronic preparation of BIR Forms using eBIRFORM. But nonetheless, here’s a quick guide on how to prepare the BIR Form 2551Q manually:

Page 1 of the BIR Form 2551Q:

- Part I of BIR Form 2551Q asks for basic information about you or your business—TIN, Name, Address, Contact Details, etc.

- Meanwhile, Part II summarizes your total percentage tax due. This is where it starts to get serious. Before accomplishing part, make sure to first complete Schedule 1 on the second page. Once you do, take the Total Tax Due from the said schedule and indicate this amount in Item 14.

Then, fill out the succeeding items if you have available tax credits or payments. The form specifies the necessary calculations you need to follow to get your Total Payable Amount for the quarter. - Part III, on the other hand, asks for itemized payment details based on your chosen method/s: Cash / Bank Debit Memo, Check, Tax Debit Memo, etc.

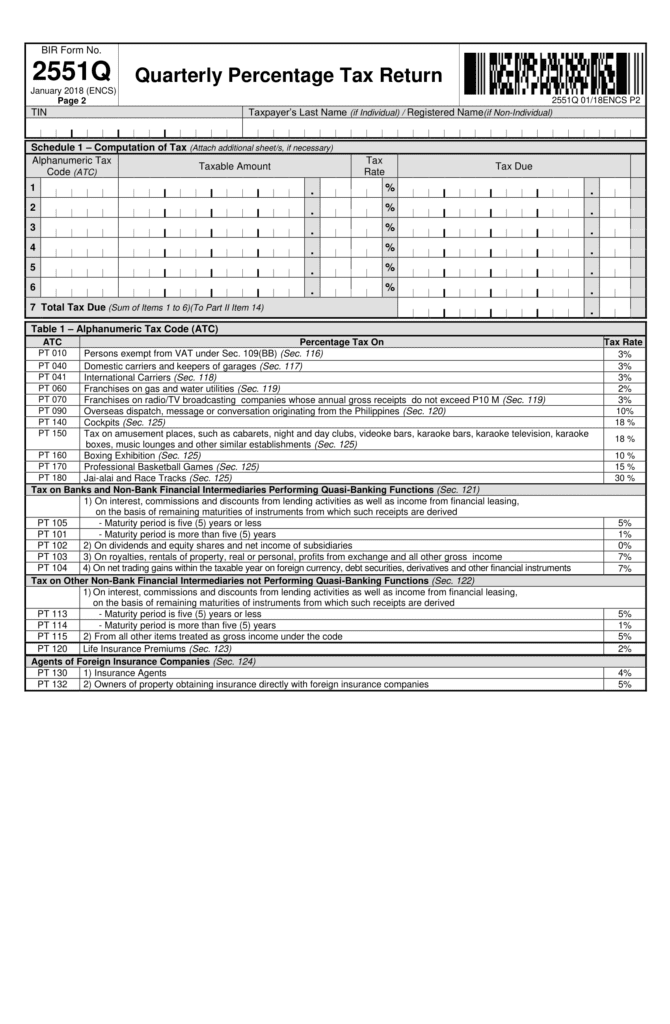

Page 2 of the BIR Form 2551Q:

- Schedule 1 asks for details about your percentage tax computation. Consult Table 1 for the applicable Alphanumeric Tax Code/s (ATC) for your business transactions. Then, compute for the total of all your percentage taxes.

- Lastly, BIR Form 2551Q’s Table 1 lists the different ATCs per category of percentage tax. These are the same ones mentioned earlier in the calculation section.

Methods for Filing Percentage Tax

In general, once the BIR Form 2551Q is filed, you will only need the following as attachments:

- BIR Form 2551Q, stamped received (if manually filed)

- BIR Tax Confirmation Receipt of Filing (if electronically filed)

- Proof of payment

But in special circumstances, if applicable, aside from the above stated, you may need to prepare the following supporting documents for your percentage tax filing:

- Certificate of Creditable Tax Withheld at Source (BIR Form 2307), if applicable

- Tax Debit Memo, if applicable

- Proof of payment and previously filed return, if amended returns

- Authorization letter, if filed by an authorized representative, if manually filed

After preparing these files, you have three options for filing:

Manual

As the name suggests, the manual method is to physically hand over your accomplished BIR Form 2551Q along with supporting documents to your local RDO. To do so:

- Print three copies of BIR Form 2551Q. You can fill it out prior to or after printing, depending on your preference.

- Visit the Authorized Agent Bank (AAB) to submit all the requirements and settle your payment.

- You should then receive a validated copy of your BIR Form 2551Q, often referred to as “RECEIVED STAMP”.

eFPS

eFPS stands for Electronic Filing and Payment System—it is the BIR’s fully digital platform for tax filing and payments via BIR’s websites (www.efps.bir.gov.ph).

Sounds great, right? A completely digital option for tax management. However, not all taxpayers can voluntary use this platform. Currently, only those who receive notification from BIR to use EFPS are allowed to register as of this writing. The basis of BIR in selection will be: a) industry and/or b) classification as large taxpayer or included in the TAMP (Tax Account Management Program) of the BIR.

Once you receive the notification letter to use EFPS from the BIR, proceed with registering in the system and submit the necessary documents to your RDO (Regional District Office). Also, coordinate to Authorised Agent Bank (AAB), or your bank who has BIR eFPS Facility, to enrol for online payment connected to BIR EFPS.

If your business is not included in the list above, it might seem that you will have to stick to the manual method of filing. Well, not really.

eBIR Forms

To cater to small businesses, BIR launched eBIRForms in 2015. It is sort of a hybrid between manual and eFPS filing. eBIRForms is an application that is available for download and offline use.

Check it out here: eBIRForms

- To use this method, download and install the package in the link above.

- Then, look for BIR Form 2551Q in the application and fill it out in the same manner as indicated above. The good thing about eBIRForms is that it helps you calculate the tax due for the amount that you declare in the form. The software also alerts you of possible errors and computes penalties for late filing.

- After filling out the form, save it. Then, go online to validate and then click submit.

- Once done filed, save a copy in your computer or print copies.

- Then proceed to settle your taxes.

Available Payment Channels

Thanks to BIR’s digitization efforts, taxpayers can now enjoy more options for settling taxes. Learn more about them below:

Over-the-Counter Payment

If you’ve been following the manual method of filing for your Quarterly Percentage Tax, then you already know how to pay for your taxes through Authorized Agent Banks (AABs)

- As mentioned earlier, after filling out three copies of BIR Form 2551Q, visit the AAB or RCO in the jurisdiction of your RDO to submit all the requirements and settle your payment.

- You should then receive a validated copy of your BIR Form 2551Q.

eFPS

Businesses who are required to use the eFPS platform should also pay their percentage taxes via EFPS.

Just a side note, ensure that the company’s bank account should be connected and registered to the EFPS prior to payment date or deadline.

- After submitting your accomplished BIR Form 2551Q through the eFPS platform, click the Proceed to Payment button.

- You will then be linked to your registered bank’s e-payment facility where you can settle your taxes.

Online Payment

Perfect for switching to paperless transactions, BIR has partnered with several platforms for online tax payment. These are:

- DBP Pay Tax Online

- GCash

- LandBank Link.biz Portal

- Paymaya

- Union Bank Web and Mobile Payment Facility

To use these platforms:

- File your taxes through eBIRForms.

- Then, select your preferred online payment channel—most likely the one where your business already has an account. Most of these platforms will ask for some of the details indicated in your BIR Form 2551Q. Supply this information and proceed to payment.

Learn more: ePay

Deadline for Filing Quarterly Percentage Tax

Quarterly percentage taxes are due on the 25th day of the month following the applicable quarter. This means you have to file them on or before the 25th of April, July, October, and January of the succeeding year, as follows:

| Period | Deadline |

| Quarter 1: January to March | April 25 |

| Quarter 2: April to June | July 25 |

| Quarter 3: July to September | October 25 |

| Quarter 4: October to December | January 25 of the next year |

Remember that it is good practice to settle your taxes early—don’t wait ’til the deadline!

Penalties for Late or Incorrect Filing

Your business can suffer penalties from the late filing of percentage taxes. Taxpayers are subject to an interest of 20%, 25% surcharge and compromise fee for:

- Failing to file quarterly percentage tax returns on or before the deadline

- Filing a return in the wrong RDO

- Failing to pay the total amount of percentage tax due

- Failing to pay the deficiency tax

- Filing a fraudulent tax return

Avoid these extra charges by triple-checking your BIR Form 2551Q and being mindful of tax deadlines.

Summary

There you go—a comprehensive guide for calculating, filing, and paying for your quarterly percentage taxes. With a variety of options to choose from, you will surely be able to find the method that works best for your business.

Thinking of saving yourself time and effort in tax preparation? Let us help. Click the button below to learn more about our products.

Nabil says

Hello. I have a question. I sell few type of products online. Beauty products, computer software. And so on. I want to separate them by registering specific names for example XYZ beauty shop . And XYZ computer shop … When I register the BIR they added one name. Is it possible to add more name to the same BIR certificate or I need to register each one alone . I register as sole proprietor

Sheryl Data says

Informative…..but I have question lng po…..una kc nakalagay sa COR ko ang mga tax type ay REGISTRATION na every year/ INCOME TAX every Quarterly at Annually at PERCENTAGE tax QUARTELY….ngaun nag file ulit ako agad ng 8% tax rate kc nalaman ko na mas pinasimple ang computation nito para sa tulad kong small owner na ksisimula palng at ayaw ng maraming hassle sa pag fill up at compute at d expert sa TAXATION at nalaman ko na sa 8% tax rate mas malaki ang take home mo sa isang small business….nung binalik sa akin ung COR ko after ko magpa update may nakalagay pa din PERCENTAGE TAX at sa ilalaim may NOTE: IFQUALIFIED AND OPTED TO AVAIL OF THE 8% INCOME TAX RATE TGE FILLING OF QUARTERLY PERCENTAGE TAX RETURNS NOT REQUIRED FOR THE CURRENT TAXABLE YEAR THE OPTION WAS MADE 8/2/20 ka reregister ko lng ng AUG. 3 sa new business ko na sari sari store..Need ko pa bang mag file nito this OCT. 25,2020 1st tym ko mag file nito at sa Nov. 15 din sa ITR nman..tnxz in advance….

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi Ms Sheryl, thank you for your reply. In general, the Percentage Tax type should be removed from your “tax type” to ensure it won’t be open case. I suggest to return to your RDO and inquire why the Percentage Tax wasn’t removed to your Tax Type and ask to re-print a COR which do not show Percentage tax in the tax type. Thank you

Cheerrrrrrrryyyy says

May consideration ba .. Kasi sunday ang october 25?

We failed to pay kanina . Kasi offline ang bank.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi Ms Cherry, thank you for your comment. I’ve emailed you. thanks

Grace Salazar says

Calendar year pa rin po ba gagamitin sa pagfile ng 2551q if yung Date of Registration ng business eh September 01, 2020? Bago lang po kasi business namin. At hindi pa po ako nakapagfile ng 2551q. di ko po kasi alam if fiscal or calendar year gagamitin. if fiscal year kelan ako first mag file ng return? if calendar year naman ibig sabihin late na ako for the quarterly returns?

RAYMUNDO CHAVEZ says

THE BIR IS REQUIRING ME TO SUBMIT ALPHALIST OF CUSTOMERS SUBJECTED TO SUPPORT THE PERCENTAGE TAX RETURNS. IS THERE A LEGAL BASIS FOR THIS REQUIREMENT?