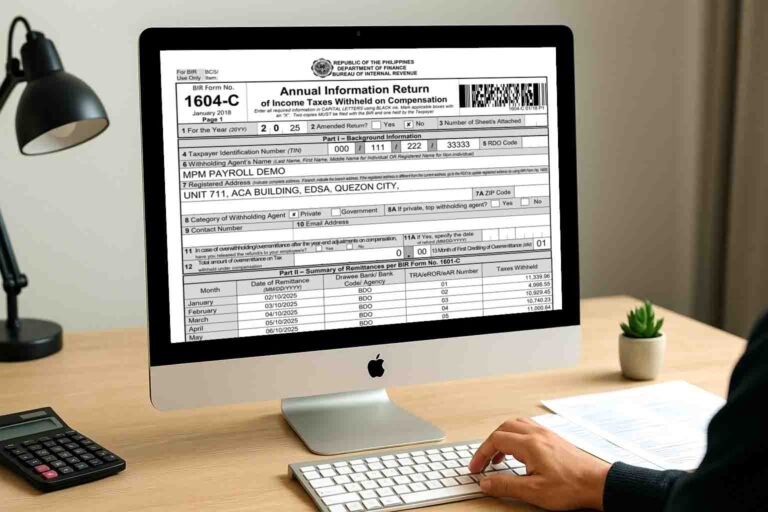

BIR Form 1604C, also known as the Annual Information Return of Income Taxes Withheld on Continue Reading

Tax Compliance Tips

BIR Tax Table

Keeping up with the latest BIR tax tables can feel like scanning the night sky for constellations Continue Reading

MPM Accounting as Alternative to eBIRForms

The Bureau of Internal Revenue (BIR) provides eBIRForms as a free tool for taxpayers to file their Continue Reading

Annual Income Tax Return (AITR) Filing Guide for Philippine Taxpayers

The Annual Income Tax Return (AITR) must be filed and paid within the deadline prescribed by the Continue Reading

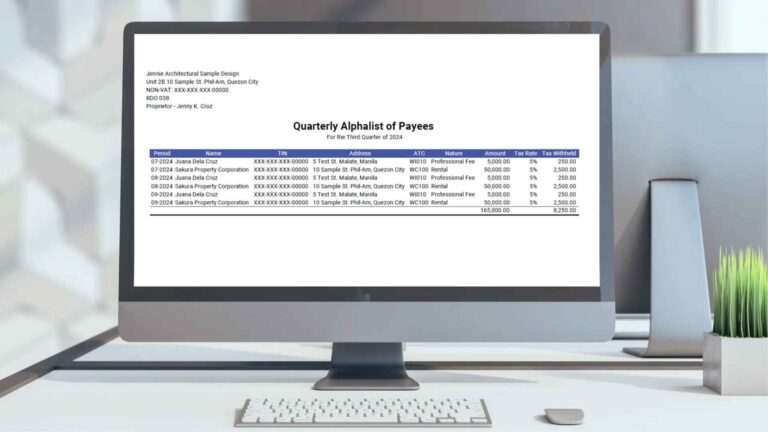

Quarterly Alphalist of Payees (QAP) for BIR Form 1601EQ

As a business owner and self-employed duly registered in the Bureau of Internal Revenue (BIR), it Continue Reading

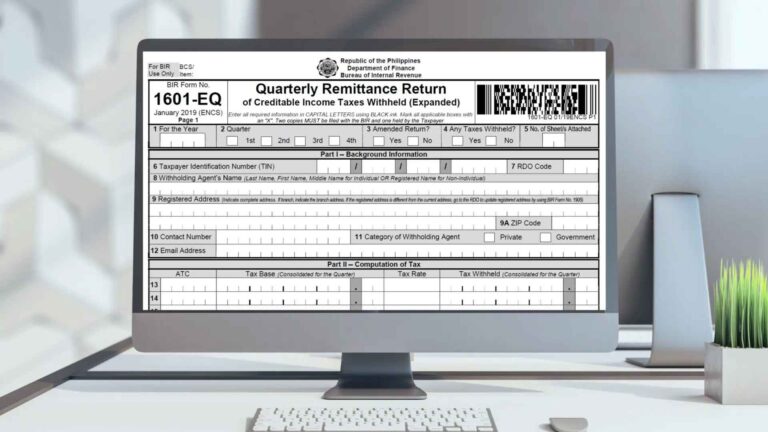

BIR Form 1601EQ: Quarterly Withholding Tax Expanded Return

BIR Form 1601EQ is the Quarterly Remittance Return of Creditable Income Taxes Withheld Continue Reading

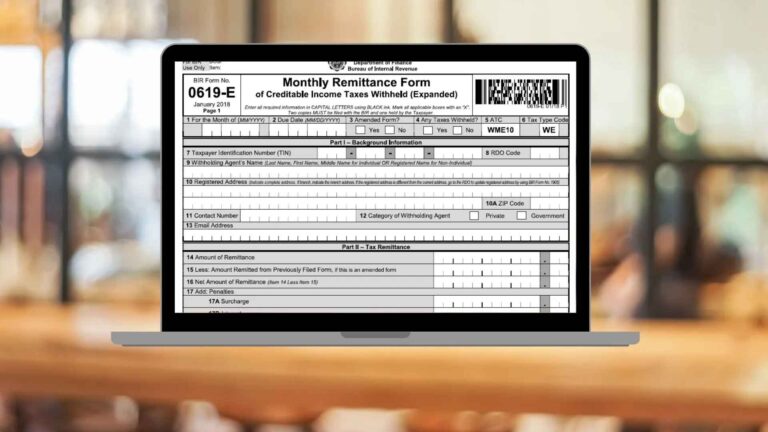

BIR Form 0619E: Monthly Expanded Withholding Tax Return

BIR Form 0619E Content Outline What is BIR Form 0619E? BIR Form 0619E is a Monthly Continue Reading

RR 6-2024: Imposition of Reduced Interest and Penalty for Micro Small Taxpayers

This article is about Revenue Regulation No. 6-2024 or RR 6-2024 - Implementing Imposition of Continue Reading

RR 8-2024: Implementing on Classification of Taxpayers

Another revenue regulation is published by the BIR to implement the changes or amendments made by Continue Reading

RR 4-2024: Amendments on Filing and Paying Taxes

Republic Act (RA) No. 11976 Ease of Paying Taxes, approved last January 2024, amended the tax code Continue Reading