Choosing between employment or freelancing isn’t just a career decision - it affects income Continue Reading

Other Business Tips

Do You Still Need an Accountant If You Use an Accounting Software?

In today’s digital age, many business owners are shifting from manual bookkeeping to digitalize Continue Reading

How to Register Invoice per RR 7-2024?

Republic Act No. 11976 - Ease of Paying Taxes (EOPT) Act and Revenue Regulation (RR) No. 7-2024 Continue Reading

Philippine Holidays in 2024

Plan ahead for your 2024 travel goals! Philippine holidays for 2024 are now out!In October 13, 2023, Continue Reading

BIR Tax Penalties for Failure to File and Pay Taxes

When you are busy running and managing a business or self-employment it is easy to overlook the Continue Reading

Importance of Bookkeeping for Self-Employed Freelancers and Professionals

Self-Employment, such as freelancing and practicing profession, has been changing the landscape of Continue Reading

Benefits of Cloud-Based Accounting Software

Keeping accounting records and filing tax returns can be one of the most tedious, time-consuming, Continue Reading

BIR RMC 131-2022 – Using Official Email Address in Filing Tax Forms

In recent months, the BIR have issued two memorandums which emphasizes the need to use official Continue Reading

Non-VAT Freelancers Guide to BIR Tax Compliance

Driven by ease in availability of technology and the comfort of working from home, many are leaving Continue Reading

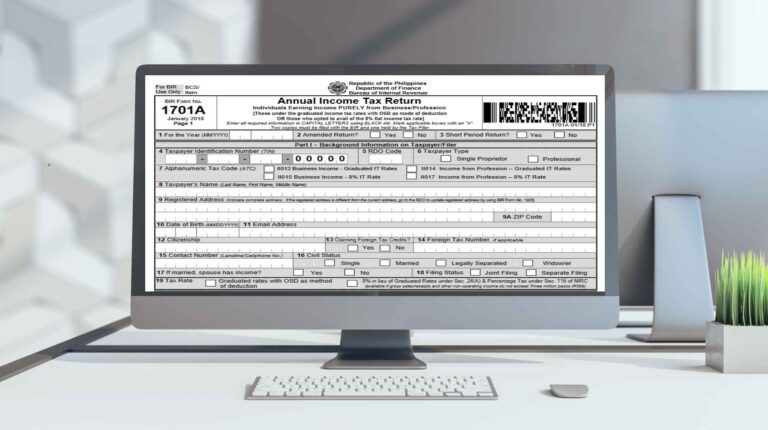

BIR Form 1701A Annual Income Tax Return for Individuals

Being your own boss can be a fulfilling and rewarding path because of its limitless potential Continue Reading