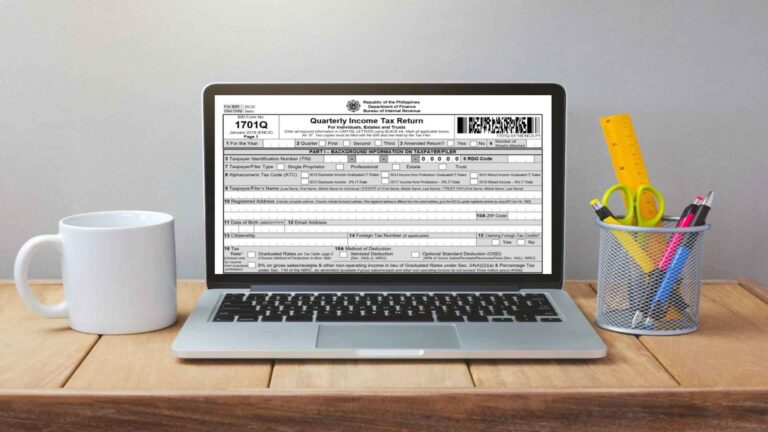

BIR Form 1701Q is a tax return needed for filing and/or payment quarterly by individual taxpayer Continue Reading

Accounting and Bookkeeping Tips

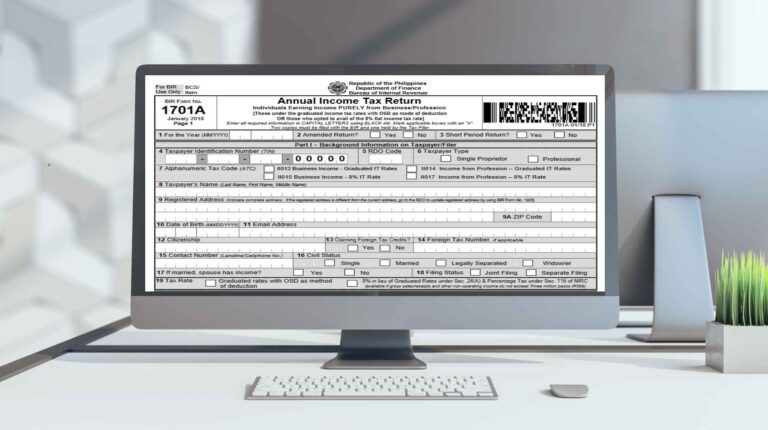

BIR Form 1701A Annual Income Tax Return for Individuals

Being your own boss can be a fulfilling and rewarding path because of its limitless potential Continue Reading

Loose Leaf Books of Accounts: Annual Submission

All registered taxpayers doing business, self-employment or practice of profession need to comply Continue Reading

2021 Year-End Compliance Reminders

This article refers to a specific tax year. For the most up-to-date and evergreen guide, please Continue Reading

Ease of Paying Taxes (EOPT) Act – HB 8942

Lask week, I've attended a zoom conference on Digitalization Preparedness of Business Owner's Small Continue Reading

BIR Form 0605 Annual Registration Fee

(Important Update: Effective January 22, 2024, per Republic Act No 11976 Ease of Paying Taxes (EOPT) Continue Reading

How to Use eBIRForms?

Preparing and filing tax return can be a little bit intimidating task to do, especially if you are Continue Reading

BIR Form 2551Q – Guide to Non-VAT Taxpayer

BIR Form 2551Q Quarterly Percentage Tax Return is one of the tax returns filed by Taxpayers Continue Reading

2020 BIR Form 1604C, 1604F and Alphalist Deadlines

This article refers to a specific tax year. For the most up-to-date and evergreen guide, please Continue Reading

Sales Invoice vs Billing Invoice

(Important Note: This article is written prior to the implementation of Republic Act No. 11976 Continue Reading