Outsourcing bookkeeping and tax filing is one of the smartest decisions a business owner can make - Continue Reading

Accounting and Bookkeeping Tips

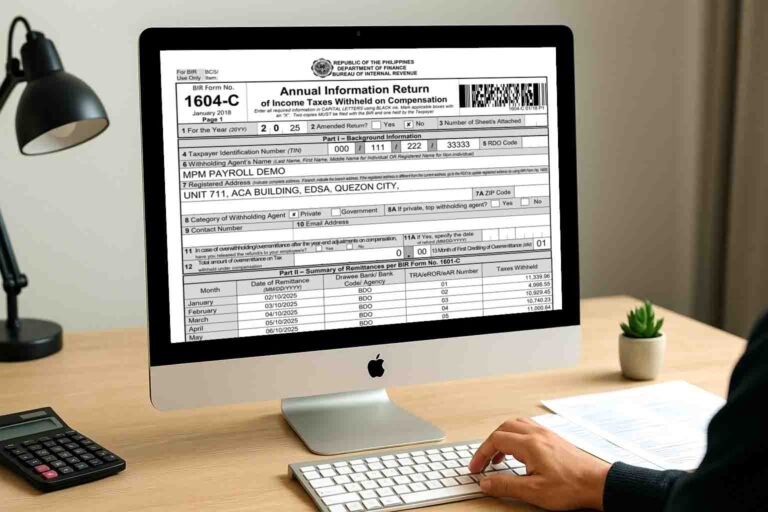

BIR Form 1604C

BIR Form 1604C, also known as the Annual Information Return of Income Taxes Withheld on Continue Reading

MPM Accounting as Alternative to eBIRForms

The Bureau of Internal Revenue (BIR) provides eBIRForms as a free tool for taxpayers to file their Continue Reading

Do You Still Need an Accountant If You Use an Accounting Software?

In today’s digital age, many business owners are shifting from manual bookkeeping to digitalize Continue Reading

Annual Income Tax Return (AITR) Filing Guide for Philippine Taxpayers

The Annual Income Tax Return (AITR) must be filed and paid within the deadline prescribed by the Continue Reading

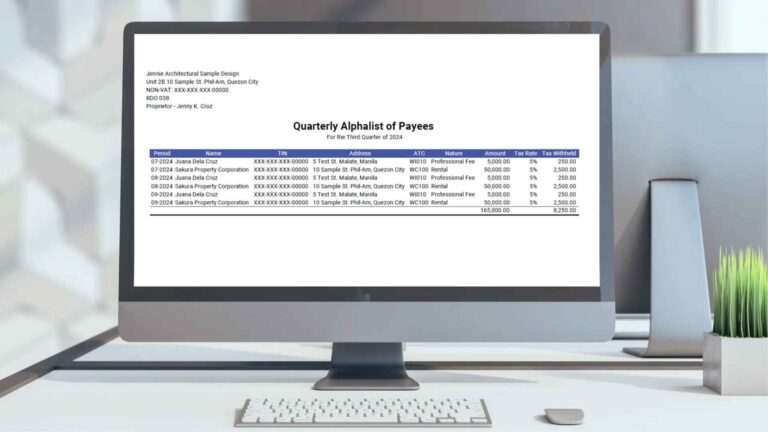

Quarterly Alphalist of Payees (QAP) for BIR Form 1601EQ

As a business owner and self-employed duly registered in the Bureau of Internal Revenue (BIR), it Continue Reading

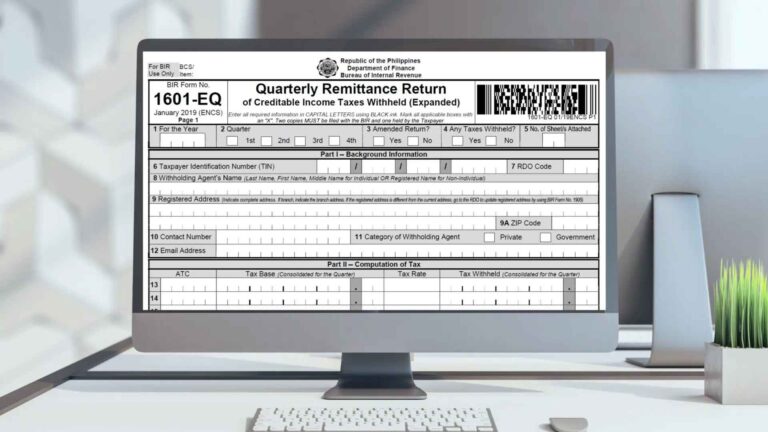

BIR Form 1601EQ: Quarterly Withholding Tax Expanded Return

BIR Form 1601EQ is the Quarterly Remittance Return of Creditable Income Taxes Withheld Continue Reading

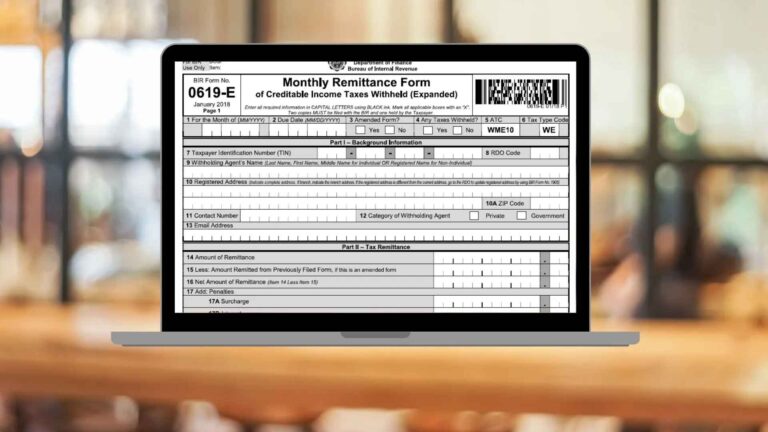

BIR Form 0619E: Monthly Expanded Withholding Tax Return

BIR Form 0619E Content Outline What is BIR Form 0619E? BIR Form 0619E is a Monthly Continue Reading

RR 6-2024: Imposition of Reduced Interest and Penalty for Micro Small Taxpayers

This article is about Revenue Regulation No. 6-2024 or RR 6-2024 - Implementing Imposition of Continue Reading

RR 8-2024: Implementing on Classification of Taxpayers

Another revenue regulation is published by the BIR to implement the changes or amendments made by Continue Reading