Have you ever been in a discussion with your Finance Manager, only to be lost in a string of financial terms? You’re not alone. This happens even to good entrepreneurs who don’t necessarily have an in-depth background in business.

What separates the good from the great business people though is their drive to learn and improve. They take time to advance their knowledge by learning new things—financial terms included.

7 Most Used Business Terms

What’s the difference between Revenue, Profit, and Income? In a Thesaurus, they are synonyms, but in Accounting and Finance, they mean different things. In this article, we’ll first be dealing with these commonly interchanged words, removing the confusion surrounding them.

Then, we will move towards Capital, Equity, and Bootstrapping—words that are often mentioned when connecting with investors. This is particularly helpful if your business is in the process of scaling, needing additional capital to further grow.

Revenue

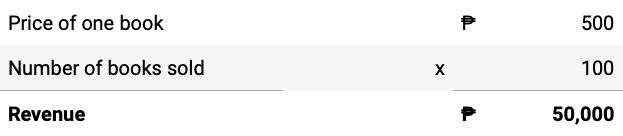

Revenue refers to the total amount of sales from products and/or services of the business. To get this number, you just have to add your sales amount in a given period.

Let’s have an example. Last April, you launched a brand new book and sold 100 copies worth ₱500 each. Multiplying these numbers, we get your Revenue for the month that is ₱50,000.

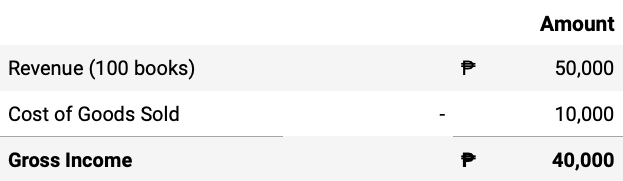

Gross Income / Gross Profit

Gross Income and Gross Profit may be used interchangeably. It refers to the remaining income when you remove the Cost of Goods Sold from your Revenue.

Continuing our example above, let’s say it costs you ₱100 to print, bind, and ship one book. That means you spent ₱10,000 to produce and deliver the 100 copies you sold in April.

Subtracting this amount from your revenue of ₱50,000, you get a gross income of ₱40,000.

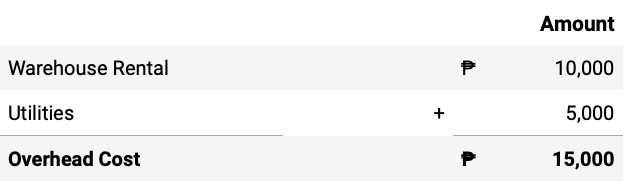

Overhead Costs

Next, we discuss Overhead Costs, also referred to as Overhead. This is the total amount of costs involved in operating the business, but does not directly affect production costs. It includes rent for your office space, electricity, water, internet connection, salaries and wages, and many others.

For our example, let’s try to simplify things. Say your company is renting an automated warehouse space for ₱10,000 a month. This production house uses electricity, water, and an internet connection to manufacture your books—no manpower required. The total utility costs amount to ₱5,000 for April.

Adding all these expenses puts Overhead at ₱15,000.

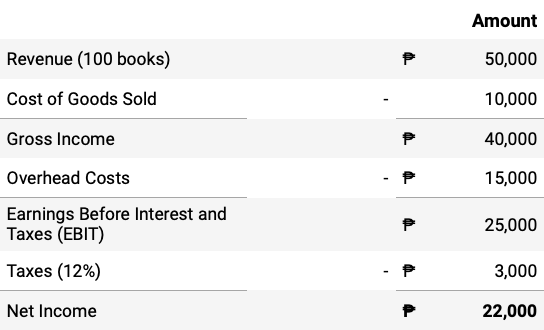

Net Income / Net Profit

Net Income comes out once you’ve removed all business expenses from your revenue. These include overhead costs, depreciation, interest payments, taxes, and several other expenses for the period.

Continuing our example, here is the computation for the company’s Net Income for the month of April.

Take note that this example is oversimplified. In the real world, businesses have other operating expenses, non-operating expenses, interest payments, and other incomes and expenses that will affect the value of Net Income.

To get a better understanding of real-world Accounting, peek into your business’s financial statements last month and see which expenses came in before you reach your Net Income.

Capital

Now, we move forward with Capital. This term simply refers to money needed to continue the business. It may come from debt (loans) or equity (investments).

Most businesses manage a ratio of debt to equity to evaluate leverage. In simple terms, leverage shows the ability of the company’s investments to cover its debts in case of a sudden business downturn. It is one of many important financial ratios that entrepreneurs use to monitor their business. It is also something that investors look into in order to estimate a business’s financial health.

Check out this article to learn more about other financial ratios that you should monitor in your company.

Equity

As mentioned above, equity is a type of capital that comes from investments. This may be through the business owners, investors, and stockholders.

In the Balance Sheet, Equity is computed by subtracting the company’s liabilities from the value of its assets. This basic accounting equation can be seen below:

Assets = Liabilities + Equity

Bootstrapping

Bootstrapping means that a business’s capital is sourced solely from equity. The business does not have debts or loans. Rather, only the pooled equity capital runs the business. This is more common in small businesses, particularly startups. However, once a startup move towards scaling, entrepreneurs usually seek additional capital in the form of investments.

After learning about these commonly used business terms, you should now be able to converse with ease with your Finance Manager and even potential investors!

If you wish to enhance your financial know-how further, read this article for 5 key accounts to monitor in small businesses.

[…] the following three ratios. Take note: if some of these terms are unfamiliar, this article on Business Terms should […]