In recent months, the BIR have issued two memorandums which emphasizes the need to use official email address when taxpayer transacts with the BIR online and when filing their respective tax returns via eBIRForms, including eFPS Filers.

In August 2022, BIR issued RMC 122-2022 with subject Updating of Registration Information Record of Taxpayers Who Will Enroll in the BIR’s Online Registration and Update System (ORUS) which talks about the requirement of updating your email address and contact information using S1905 – Registration Update Sheet (RUS) if you wish to transact online with the BIR thru ORUS instead of doing it manually thru the physical office of the BIR Regional District Office (RDO).

As stated in RMC 122-2022, the email address written in the submitted S1905 shall be the official email address of the taxpayer. Such official email address shall be use by BIR in serving orders, notices, letters, and other communications to the taxpayers. To download copy of the S1905, click here. Email such filled-out S1905 to the RDO’s email address. List of RDO email address provided by the BIR. To view it, click here.

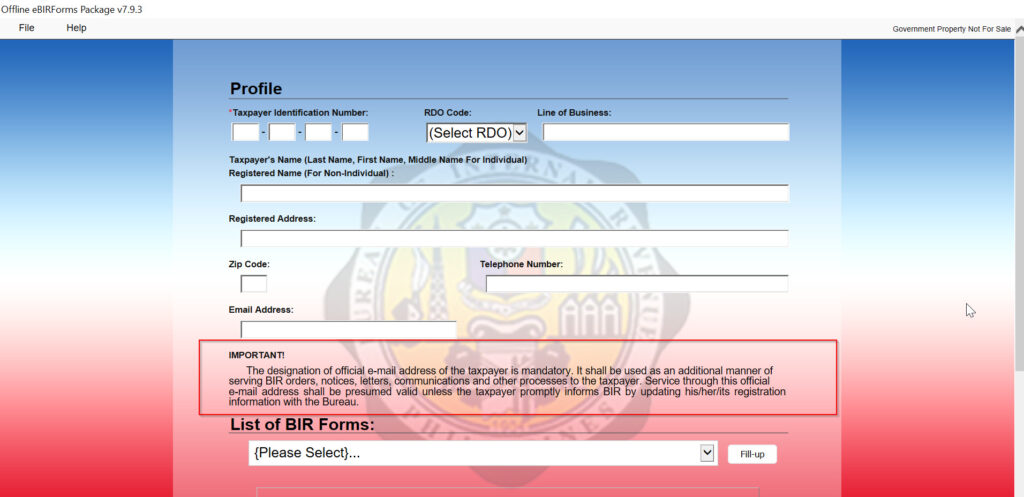

After a month, in September 2022, BIR issued RMC 131-2022 with subject Availability of Offline Electronic Bureau of Internal Revenue Forms (eBIRForms) Package Version 7.9.3 which also mentioned using official email address of the taxpayer in filing tax form thru eBIRForms. And that the BIR shall use such official email address in serving orders, notices, letters, communications, and other processes to the taxpayers.

To comply with the requirements of the BIR of using official email address, here are the steps that can be your guide:

1. Choose one (1) official email address

Ideally, the email address should be permanent and can be easily or frequently checked by the taxpayer.

Alternatively, create an official email address specifically for BIR filing and set it up to automatically forward or copy (cc) to an email that the taxpayer’s permanent email address.

If the taxpayer is hiring an employee or a third-party person/entity to file their tax returns in their behalf, the email address used by the employee or third party in filing the taxpayer’s tax return must still be the official email address of the taxpayer based on RMC 131-2022 Annex A.

2. Notify BIR of your official email address by submitting filled-up S1905

Fill-out your official email address and contact details in the BIR Form S1905 then submit it to your BIR RDO via email. To download copy of the S1905, click here and look for the email address of your RDO, click here.

Alternately, you may also notify BIR by filing up BIR Form 1905 and submit hard copy in your BIR RDO.

3. File your tax return using your official email address

Once you have chosen an official email address and have notified BIR, make sure to use the said official email address in filing your tax return.

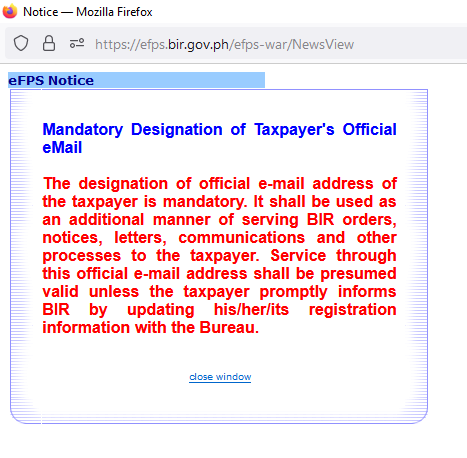

Below are sample notices of BIR pertaining to this requirement.

eBIRForm – Electronic BIR Forms

eFPS – Electronic Filing and Payment System

If you did not notify BIR of your official email address, BIR will assume that email address used in filing tax return will be the official email address of the taxpayer. BIR will use such email address as additional manner of serving the taxpayer of BIR notices, letters, orders, communications, etc. As such, service through email shall be presume valid.

In the future, should you wish to change the official email address, follow step 2 of this article, and make sure to notify BIR via emailing S1905 to your RDO’s email address provided in RMC 122-2022 Annex B or via submitting 1905 in your BIR RDO.

Based on both RMC 131-2022 Annex A the use of official email address in filing tax return is mandatory. As such, taxpayer should follow the rules of RMC 122-2022 and RMC 131-2022 to avoid any future penalty or consequence.

Hope this article have been useful for you. Please share it to anyone who you think will benefit from reading it!

Leave a Reply