BIR Form 2551Q Quarterly Percentage Tax Return is one of the tax returns filed by Taxpayers registered as NonVAT or commonly referred to as Person or Entity Exempt from Value-Added Tax (VAT).

However, it is also used to file other percentage taxes of certain industries such as the following:

- Domestic Carriers and Keepers of Garages

- International Carriers

- Franchises on radio/tv broadcasting companies and gas/water utilities

- Overseas Dispatch, Message or Conversation Originating from the Philippines

- Bank and Non-Bank Financial Intermediaries Performing Quasi-Banking Functions

- Other Non-Banking Intermediaries

- Life Insurance Premiums

- Agents of Foreign Insurance Companies

- Amusement Taxes

- Winnings

- Sale, Barter or Exchange of Shares of Stock Listed and Traded through the Local Stock Exchange

- and so on

However, this article will focus just on Percentage Taxes applicable to NonVAT Taxpayers or Person or Entity Exempt from Value-Added Tax (VAT).

Are you Qualified to be Non VAT?

Based on latest tax rules, Section 109-1(CC) of the Tax Code Exempt Transaction for Value-Added Tax (VAT), to qualify as NonVAT Registered Taxpayer, your gross annual sales or receipts must not exceed three million pesos (P3,000,000) (*). (*Note 1: The amount may change in the future)

At the same time, your BIR Form 2303 – Certificate of Registration (COR) issued by the Bureau of Internal Revenue (BIR) is classified as NonVAT Registered Taxpayer.

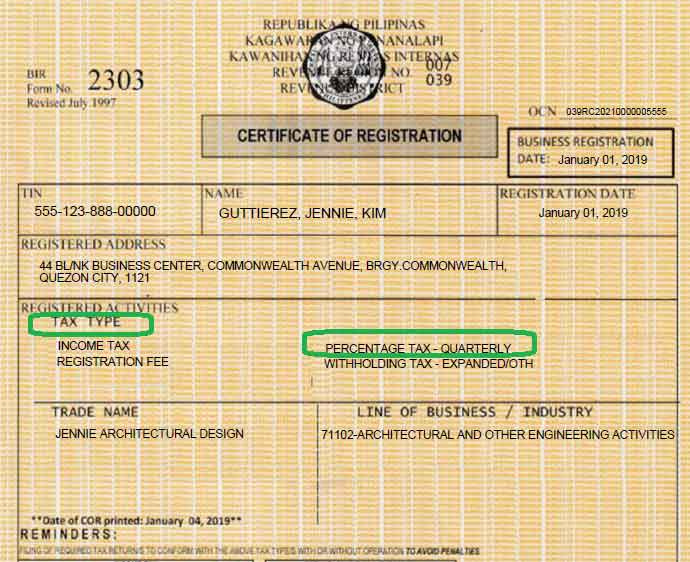

To know if you are a NonVAT Registered Taxpayer, in your BIR Form 2303 – Certificate of Registration (COR) under your Tax Type, Percentage Tax is included. Just like the example below:

Normally, NonVAT Registration is availed by many Individual Taxpayers, such as Freelancers, Professionals, Self-Employed, Online Sellers owned by a single person and Sole Proprietors. These are individuals who will usually operate in a small scale and has no plan to grow their business or self-employment beyond the NoNVAT threshold.

In addition, it is important to note that Non-Individual Taxpayers, such as Corporation, Partnerships and One Person Corporation (OPC), can also register as NonVAT, if their gross annual sales or receipts is within the three million pesos (P3,000,000) (*) and below threshold. Although it’s a rare case, because oftentimes, Non-Individual Taxpayers aims to expand and grow their business. Therefore, limiting their sales to the NonVAT Threshold of three million pesos (P3,000,000) (*) and below will not be practical. That’s why most of the time, Non-Individual Taxpayers register as VAT Registered from the very beginning even if their gross annual sales or receipts is less than three million pesos (P3,000,000) (*).

Can a Non VAT Taxpayer be Exempt from Filing BIR Form 2551Q?

Certain Non VAT Individual Taxpayers may be exempt in filing BIR Form 2551Q Quarterly Percentage Tax Return.

These are Individual Taxpayers whose gross annual sales or receipts do not exceed the NONVAT Threshold of three million pesos (P3,000,000) (*) and below, but opted to avail the 8% Flat Rate Income Tax.

Availing 8% Flat Rate Income Tax rate exempts a NonVAT Individual Taxpayer from filing and paying BIR Form 2551Q Quarterly Percentage Tax Return.

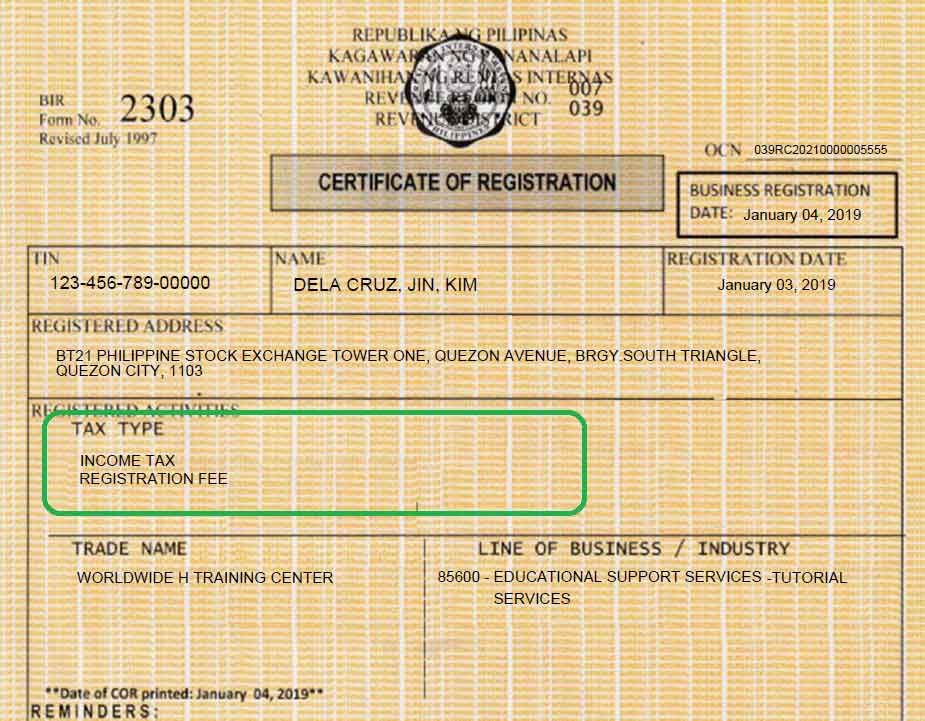

To avail 8% Flat Rate Income Tax, the NonVAT Individual Taxpayer must submit to the Bureau of Internal Revenue (BIR) Regional District Office (RDO) where it is registered, an application to avail 8% Flat Rate Income Tax. If the application is approved, the Bureau of Internal Revenue (BIR) will issue a new BIR Form 2303 – Certificate of Registration (COR) removing Percentage Tax Return (BIR Form 2551Q). Just like the example below:

Once the BIR Form 2303 – Certificate of Registration (COR) has been updated, and the Percentage Tax (BIR Form 2551Q) has been removed in the Tax Type, the NonVAT Individual Taxpayer will now be exempt from filing BIR Form 2551Q Quarterly Percentage Tax Return. Reference: TRAIN Law Sec 5 Amending Section 24 A2b of NIRC

How to File BIR Form 2551Q?

If you read this far, you might be required to file BIR Form 2551Q Quarterly Percentage Tax Return and wants to know how to do so.

To file the correct BIR Form 2551Q, you must keep in mind the following three (3) factors:

1. Basis of Computation

The basis of computation for BIR Form 2551Q is the quarterly gross sales or receipts.

Following Calendar Period, here’s the coverage per quarter:

- First Quarter – consist of the months of January, February, and March

- Second Quarter – consist of the months of April, May, and June

- Third Quarter – consist of the months of July, August, and September

- Fourth Quarter – consist of the months of October, November and December

Here’s an example, following Calendar Period – First Quarter:

| Month | Gross Sales or Receipt |

| January | P 106,183.00 |

| February | 73,795.00 |

| March | 97,079.00 |

| Total for the Quarter | P 277,057.00 |

In the example table above, the gross quarterly sales or receipts for the first quarter consist of the sales for the following month: January, February, and March.

To compute the total quarter gross sales or receipts, just add the sales of the said three months, similar to the illustration above.

2. Tax Rate for 2551Q

In general, the percentage tax rate for NonVAT Registered (Person or Entity Exempt from VAT) is 3%.

Under the CREATE LAW passed last March 2021, effective from July 1, 2020 to June 30, 2023, a lower percentage tax rate of 1% applies. After which, beginning July 1, 2023, the old rate of 3% applies.

3. How to Compute Percentage Tax for 2551Q?

The formula in computing Percentage Tax Due is as follows:

Quarter Gross Sales or Receipts x Tax Rate

Example: Percentage Tax Due for the first quarter of 2021

| Month | Gross Sales or Receipt |

| January | P 106,183.00 |

| February | 73,795.00 |

| March | 97,079.00 |

| Total for the Quarter | P 277,057.00 |

Computation: Quarter Gross Sales/Receipts P277,057 x Tax Rate 1% (**) = Percentage Tax Due P2,770.57

(**Note 2: Transitional Rate of 1% effective July 1, 2020 to June 30, 2023)

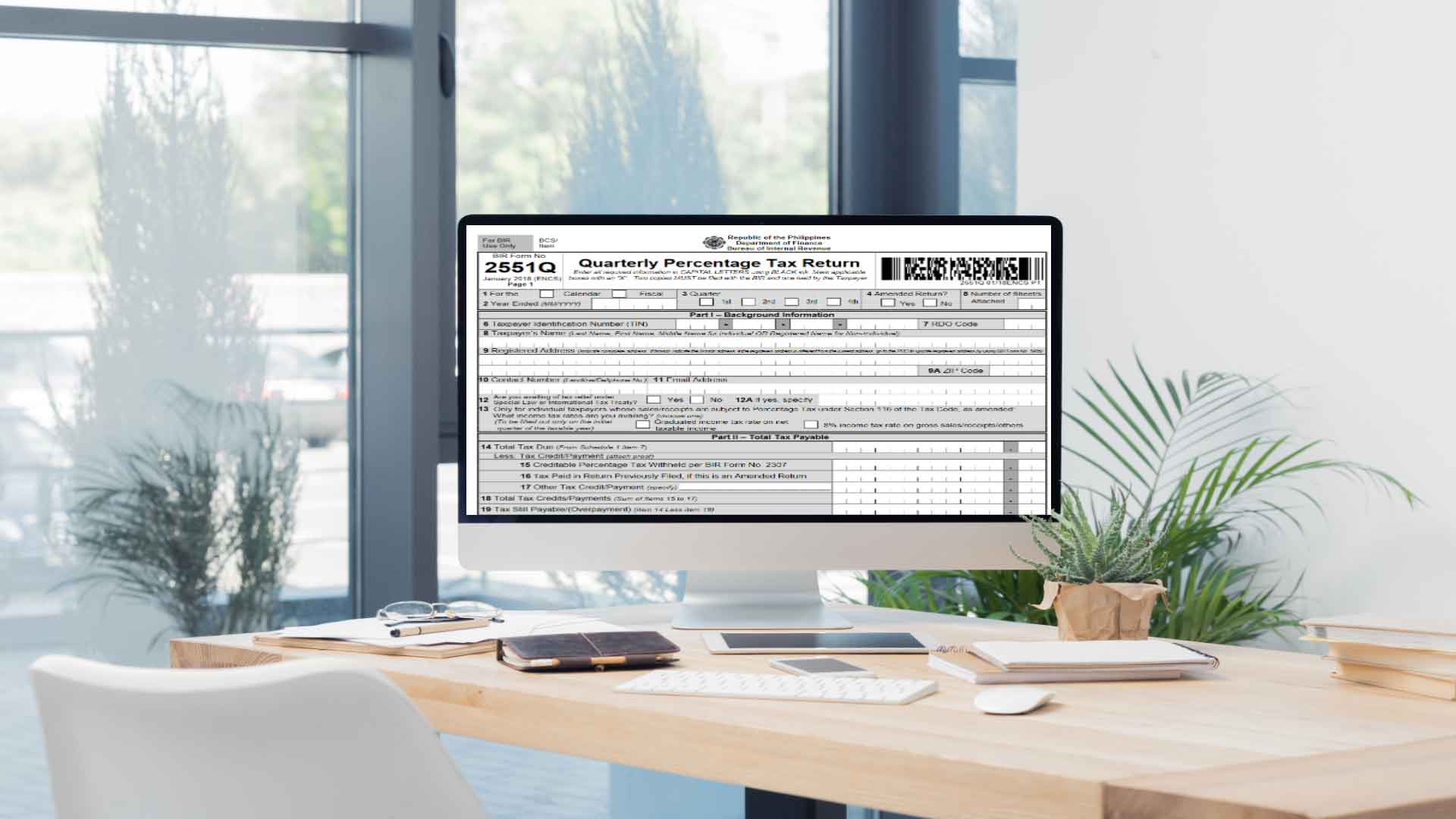

4. Fill-Up BIR Form 2551Q using eBIRForm

Now that you know how to compute percentage tax due, the next step is to fill-up BIR Form 2551Q. Here are the steps in filing up BIR Form 2551Q using eBIRForm:

- In eBIRForm application, select BIR Form 2551Qv2018 – Quarterly Percentage Tax Return

- In the form, under no. 14, click the blue font words From Schedule 1 item 7

- Under Schedule 1 item 1 column Alphanumeric Tax Codev(ATC), choose PT 010.

- For 3% rate, use PT 010 on top of the dropdown list

- For 1% rate, use PT 010 at the bottom of the dropdown list

- Under Schedule 1 item 1 column Taxable Amount, input the total quarter gross sales/receipts

- Go back to page 1, click Validate then Submit.

Just a quick note that eBIRForm cannot run in an Apple IOS such as in Macbook. However, alternately, you may use MPM Accounting Software (MAS) for automatic creation and filing of BIR Form 2551Q even using Apple IOS. Try it for free for 30 days here: https://mpm.ph/tax

When is the Deadline of Filing and Payment of BIR Form 2551Q?

The deadline for filing and payment of BIR Form 2551Q is on or before 25th of the following month after the close of the quarter.

As a guide, here’s a summary of deadline for filing and payment of BIR Form 2551Q, following calendar period:

- First Quarter ending March 31 – Due on or before April 25

- Second Quarter ending June 30 – Due on or before July 25

- Third Quarter ending September 30 – Due on or before October 25

- Fourth Quarter ending December 31 – Due on or before January 25 of next year

Where to File BIR Form 2551Q?

BIR Form 2551Q can be filed using one of the following:

- eBIRForm – in general, if taxpayer is not mandated to use eFPS, BIR Form 2551Q must be filed using eBIRForm. eBIRForm means electronic BIR Forms. To download, visit BIR website and look for eBIRForm or click here for the latest version as of this writing.

- eFPS – if mandated, taxpayer must file BIR Form 2551Q using the electronic filing and payment system (eFPS). To access, visit this link: https://efps.bir.gov.ph/

Alternately, if not mandated to use eFPS, you may use MPM Accounting Software (MAS) for automatic creation and filing of BIR Form 2551Q. Try it for free for 30 days here: https://mpm.ph/tax

Where to Pay

BIR Form 2551Q can be paid using one of the following:

- AABs – which stands for Authorized Agent Banks. This is an over-the-counter payment in the bank accredited by the BIR Regional District Office (RDO) where your business, freelancing or self-employment, is registered

- Online Payment – you may pay BIR Form 2551Q using an app such as GCASH and PayMaya; or via online banking such as with Landbank, Development Bank of the Philippines (DBP) or Unionbank. See options here: https://www.bir.gov.ph/index.php/eservices/epay.html

That’s it. You’ve just learned all the fundamental information about BIR Form 2551Q for NON-VAT Registered.

I hope this article gave you relevant information. Feel free to comment or ask question below. If you liked this article, please share it!

Eddie M. Castillo says

Dear Madam,

I got an error filing Income Tax 1701Q 1st qtr and 2nd qtr, due to lack of knowledge on how to file this BIR form, I have fail to include Part-II Computation of Tax.

On this regards may I know if there is any additional penalty for this failure. In addition how about on next 3rd qtr do I need to amend 3rd qtr due to this failure. If so or not, what should I need to do on 3rd qtr.

Thanks in advance and hoping for your kind reply.

Sincerely,

Eddie