BIR form 2316 or Certificate of Compensation Payment/Tax Withheld shows the breakdown of all the income received by an employee from his/her employer within the applicable calendar year. In addition to income, it also shows the government deductions as well as taxes withheld within the taxable period. In this article, we will answer some of the frequently asked questions about this form.

- Who Should Prepare the BIR Form 2316?

- When to Prepare the BIR Form 2316?

- When is the Deadline for the Submission of BIR Form 2316?

- What is Substituted Filing?

- Who Are Qualified to use Substituted Filing?

- Are Electronic Signatures Allowed in the BIR Form 2316?

- How to Submit BIR Forms 2316 to the BIR?

- What is the Purpose of the BIR Form 2316 from Previous Employer?

- Editable Bir Form 2316 PDF Download

- Automated BIR Form 2316 Preparation

Who Should Prepare the BIR Form 2316?

The BIR Form 2316 is prepared by the employer in triplicate (3 copies). One copy is given to the employee, one is submitted to the BIR and the original must be retained for ten years by the employer.

When to Prepare the BIR Form 2316?

The form is prepared during the end of the calendar year for each employee who earned compensation income from the company within the calendar year. It is also prepared and given to the separated employees. It is often prepared after computing the annual taxes or tax annualization.

When is the Deadline for the Submission of BIR Form 2316?

The employees must receive their BIR Form 2316 on or before January 31 of the succeeding year.

Furthermore, in cases where employee’s are covered by substituted filing, employer must file/submit to the BIR a copy of the employer/employee signed BIR Form 2316 on or before February 28 of the succeeding year.

For example if you are preparing the report for the year 2022, employees copy must be distributed on or before January 31 2023 and the BIRs copy must be submitted on or before February 28 2023.

What is Substituted Filing?

Employees who are qualified for substituted filing will no longer need to submit their own individual AITR (Annual Income Tax Return) and the BIR Form 2316 filed by their employers will serve as their AITR.

Who Are Qualified to use Substituted Filing?

To be qualified for substituted filing, all the following conditions must be met.

- Individuals who are receiving purely compensation income regardless of the amount

- Individuals with only one employer in the Philippines for the calendar year

- Individuals whom taxes has been withheld properly by their employers

- The employees spouse also complies with all the conditions above

- The employer files the BIR Form 1604C

- The employer issues the latest version of the BIR Form 2316 for each employees

Are Electronic Signatures Allowed in the BIR Form 2316?

Under revenue memorandum circular (RMC) No. 29-2021, BIR allowed electronic signatures in the BIR Form 2316. You may refer to the RMC for complete guideline.

How to Submit BIR Forms 2316 to the BIR?

The BIR Forms 2316 must be signed by both employee and employer and the electronic copies must be saved individually in a DVD, DVD-R or usb drive and it must follow the strict file naming convention as follows.

EmployeesLastName_EmployeesTin_TaxablePeriod

For example, if the employees name is Juan Dela Cruz with TIN 123456789000 and you are reporting a 2316 for 2025, the file name should be Dela Cruz_123456789000_12312025.

Required Attachments for BIR Form 2316

In addition to the employees BIR form 2316 in the dvd/usb, original copy of the following must also be submitted to BIR.

- Notarized Sworn Declaration – A sworn declaration that all BIR Form 2316 contained in the DVD being submitted are complete and exact copies of the original. You may refer to this sample or template of BIR Form 2316 Sworn Declaration for your reference.

- Notarized Substituted Filing Declaration – It contains the list of employees that are qualified for substituted filing. Here is a template or sample file of the Substituted Filing Declaration.

- Transmittal Form – It contains the list of all employees with BIR Form 2316 in the submitted DVD or usb drive. Please refer to this template or sample file of the BIR Form 2316 Transmittal Form for your reference.

What is the Purpose of the BIR Form 2316 from Previous Employer?

The BIR Form 2316 from the employees previous employer is a common requirement by employers in the Philippines from their new employees.

The 2316 from previous employer is use as reference or proof of the employees previous income (within the taxable year) as well as the taxes withheld that should be included/considered when preparing the new 2316.

Editable Bir Form 2316 PDF Download

To help you prepare your reports faster, here is an editable Bir Form 2316 PDF that you can use.

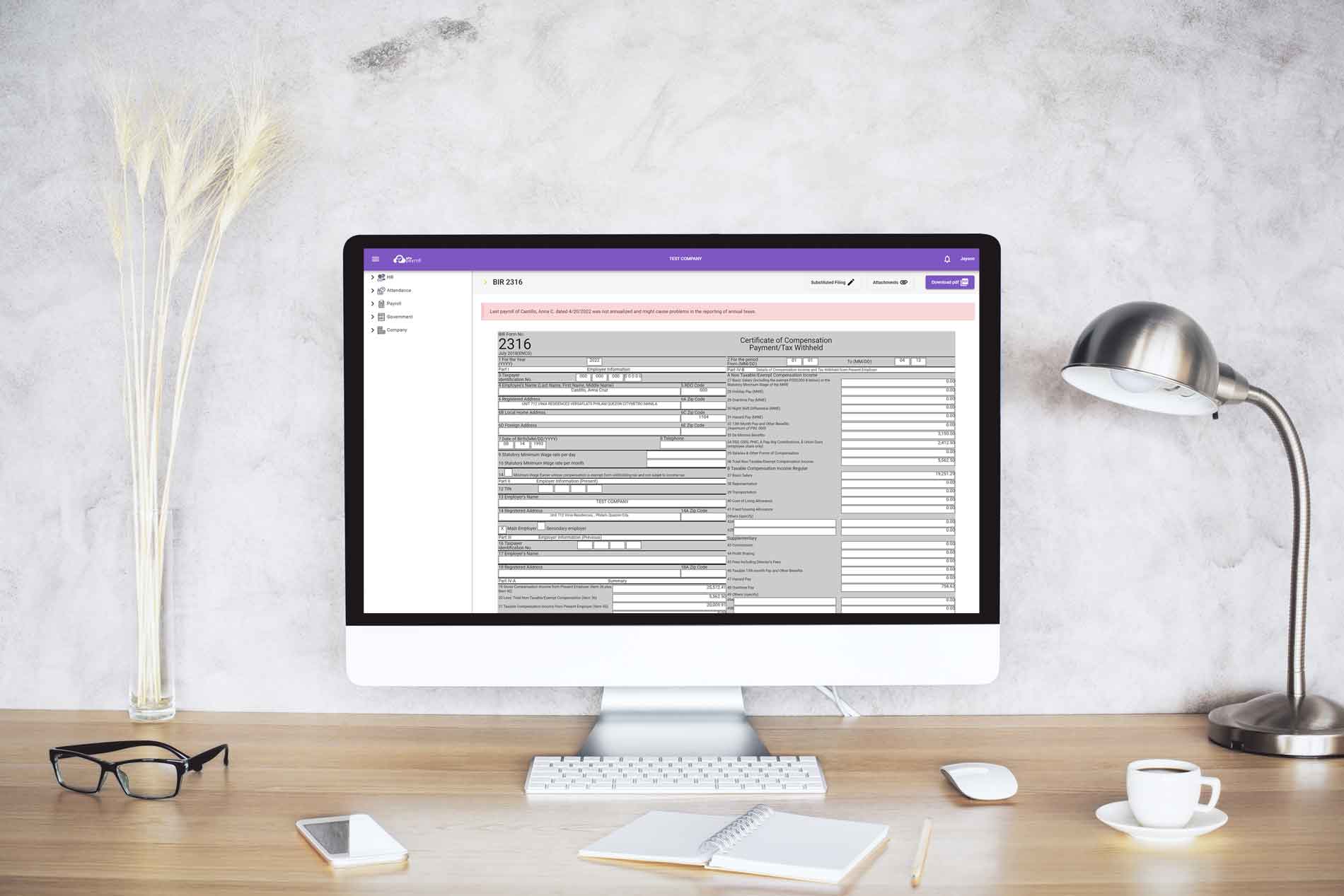

Automated BIR Form 2316 Preparation

To help you prepare your reports even faster, you can automate the preparation of your 2316 using MPM Payroll Software. Its a complete payroll system that automates many processes and reports from employees hiring to separation. The software software also provides faster way of collecting electronic signatures for the 2316. You can use it for free for 30 days

Regina Cayabyab says

Thankyou so much for the Information about BIR.

Nanette Sia says

Hi,

Good morning. Are we allowed to submit 2316 through eAFS? Thank you.

Maria Lourdes M. Yanuaria, CPA, RFP, CPP, CFC says

Hi, if you are mixed income earner and uses 2316 as tax credit for BIR Form 1701 or 1701A, then Yes it’s included in the Tax Credit to be submitted in eAFS. Hope this helps!