BIR Form 1701Q is a tax return needed for filing and/or payment quarterly by individual taxpayer engaged in business, self-employment, freelancing, or practice of profession, regardless of if with physical office/store or doing it online.

This article will guide you on how to prepare, file and pay BIR Form 1701Q.

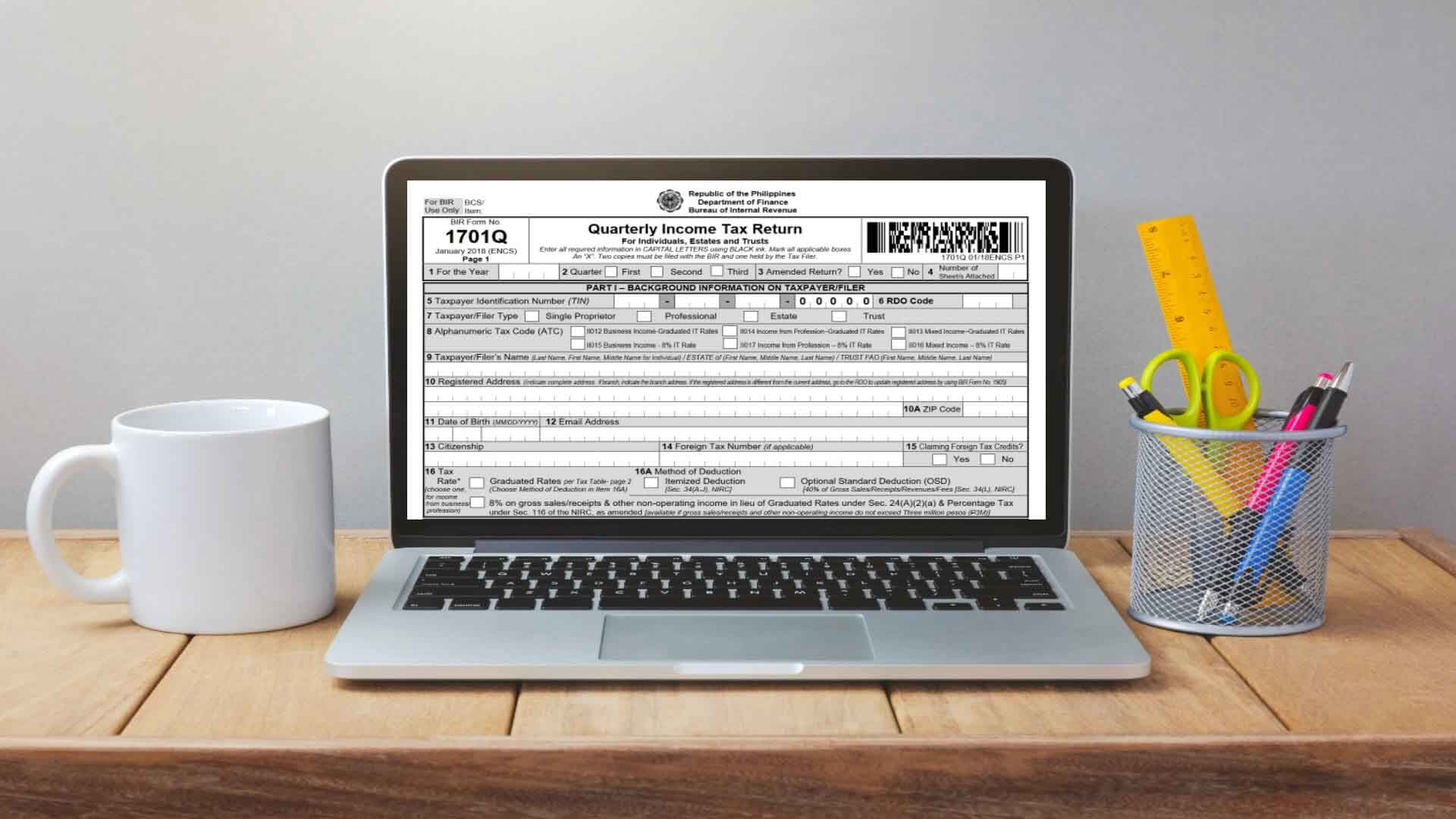

What is BIR Form 1701Q?

BIR Form 1701Q is a Quarterly Income Tax Return for Individuals, Estate and Trusts.

It is mandatory to be filed every first to third quarter of each year, regardless of if with or without income or operation, as long as you are actively registered in BIR as Individual Taxpayer engaged in business, self-employment, freelancing, or practice of profession.

Who should file BIR Form 1701Q?

BIR Form 1701Q is filed by individual income earners regardless of if resident citizen, non-resident citizen, resident alien, or non-resident alien.

If resident citizen, it covers all earning within and outside the Philippines

If non-resident citizen, resident alien, or non-resident alien, it covers all earning within the Philippines only.

But if the earning has deducted with final withholding tax, it is not mandatory to file BIR Form 1701Q.

In addition, individual employees earning purely compensation income do not need to file BIR Form 1701Q quarterly.

However, employees with business, self-employment, freelancing, or practice of profession, also known as mixed income earners, must still file BIR Form 1701Q for their business, self-employment, freelancing, or practice of profession income.

When is the deadline for filing and paying BIR Form 1701Q?

BIR Form 1701Q must be filed every first to third quarter of each year. Below is a guide if you follow calendar year accounting period:

- First Quarter covering January to March is due on or before May 15

- Second Quarter covering April to June is due on or before August 15

- Third Quarter covering July to September is due on or before November 15

What are the Income Tax Rates?

The income tax computation depends on the following types that the individual taxpayer selects every first quarter filing of the year:

- Graduated Income Tax Rate

- 8% Flat Income Tax Rate

If you choose the Graduated Income Tax Rate

The basis of income tax rate will be as follows:

TABLE 1 – Tax Rates Effective January 1, 2018 to December 31, 2022

| If Taxable Income is: | Tax Due is: |

| Not over P250,000 | 0% |

| Over P250,000 but not over P400,000 | 20% of the excess over P250,000 |

| Over P400,000 but not over P800,000 | P30,000 + 25% of the excess over P400,000 |

| Over P800,000 but not over P2,000,000 | P130,000 + 30% of the excess over P800,000 |

| Over P2,000,000 but not over P8,000,000 | P490,000 + 32% of the excess over P2,000,000 |

| Over P8,000,000 | P2,410,000 + 35% of the excess over P8,000,000 |

Table 2 – Tax Rates Effective January 1, 2023 and onward

| If Taxable Income is: | Tax Due is: |

| Not over P250,000 | 0% |

| Over P250,000 but not over P400,000 | 15% of the excess over P250,000 |

| Over P400,000 but not over P800,000 | P22,500 + 20% of the excess over P400,000 |

| Over P800,000 but not over P2,000,000 | P102,500 + 25% of the excess over P800,000 |

| Over P2,000,000 but not over P8,000,000 | P402,500 + 30% of the excess of P2,000,000 |

| Over P8,000,000 | P2,202,500 + 35% of the excess of P8,000,000 |

The computation of income tax due will be as follows:

Gross Sales/Receipts

Less: Allowable Deductions*

Taxable Income

Multiply: Income Tax Rate

Income Tax Due

*Allowable deductions pertain to either of the following:

- Itemized Deduction – it pertains to your allowed detailed expenses as shown in your financial statement or books of accounts

- Optional Standard Deduction (OSD) – it pertains to 40% of your gross sales/receipts

You need to select from either itemized or optional standard deduction (OSD) every first quarter filing of each taxable year. And once you selected, you must apply the same the entire year.

If you choose the 8% Flat Income Tax Rate

The income tax rate will be flat 8%. However, this is only applicable to NONVAT individual taxpayer.

The computation of income tax due will be as follows:

Gross Sales/Receipts

Less: Allowable Deductions*

Taxable Income

Multiply: Income Tax Rate of 8%

Income Tax Due

*Allowable deductions are P250,000 but only to purely doing business, self-employment, freelancing or practice of profession. If you are employed or mixed income earner, you must not use P250,000 in this computation

Similarly, you need to select this choice every first quarter filing of each taxable year. And once you selected, you must apply the same the entire year.

How to Fill-Up BIR Form 1701Q?

Below is a general guide on BIR Form 1701Q:

Part I and II

Item 1: put the taxable year you are filing. Example: 2022

Item 2: choose the quarter you are filing:

For example, if you follow Calendar Period, each quarter includes the following months:

- First – January to March

- Second – April to June

- Third – July to September

Item 3: choose No, unless otherwise

Item 4: you may leave this blank

Items 5 to 15: Fill in the details as applicable

Item 16: choose your income tax rate if graduated income tax rate or flat 8% income tax rate

Item 16A: Applicable only if you chose graduated income tax rate. Choose if you will do itemized deduction or 40% optional standard deduction (OSD)

Items 17 to 25A: In general, you may skip this part, if you are filing separately your income tax return from your spouse or it is not applicable.

Part III

Item 26: Is the income tax due. It is automatically computed based on your inputs in page 2, part V schedule I or schedule II.

Item 27: it pertains to the total tax credits. It is automatically computed based on your inputs in page 2, part V schedule III.

Item 28: it pertains to the tax payable or overpayment. It is automatically computed based on the difference of item 26 and 27.

Item 29: in general, leave this blank unless you missed the deadline. If via EFPS, this is automatically computed but if not, you must visit your BIR RDO for penalty computation.

Item 30: total amount income tax payable including penalty.

Part IV

Items 32 to 35: Fill-in as applicable especially if you will pay over the counter in AABs.

Part V

Schedule I – For Graduated IT Rate

This is applicable only to those who chose Graduated Income Tax Rate and VAT Individual Taxpayer.

Item 36: Input your sales net of discounts, returns and allowances for the applicable quarter

Item 37: Input your cost of sales for the applicable quarter. However, it is only applicable to those who chose itemized deduction

Item 38: this is automatically computed based on the difference of item 36 and 37

Item 39: Input your other allowed expenses or deductions for the applicable quarter. However, it is only applicable to those who chose itemized deduction.

Item 40: this is automatically computed based on 40% of item 36 – Sales, Net.

Item 41: this is automatically computed based on the difference of item 38 and 39 if itemized deduction or difference of item 38 and 40 if OSD.

Item 42: pertains to taxable income of any previous quarter filed during the taxable year.

Example: if you are currently filing second quarter, add the taxable income of filed 1701Q of the first quarter.

If you are filing third quarter, add the cumulative taxable income of filed 1701Q of the first and second quarter.

Items 43 to 44: input as applicable. In general, leave it blank.

Item 45: pertains to the total taxable income as of a given quarter

Item 46: income tax due automatically computed based on the graduated income tax bracket

Schedule II – For 8% IT Rate

This is applicable only to those who chose 8% Flat Income Tax Rate and NONVAT Individual Taxpayer.

Item 47: Input your sales net of discounts, returns and allowances for the applicable quarter

Item 48: input as applicable. In general, leave it blank.

Item 49: it is automatically computed by adding item 47 and 48

Item 50: pertains to taxable income of any previous quarter filed during the taxable year.

Example: if you are currently filing second quarter, add the taxable income of filed 1701Q of the first quarter.

If you are filing third quarter, add the cumulative taxable income of filed 1701Q of the first and second quarter.

Item 51: pertains to the total taxable income as of a given quarter

Item 52: input P250,000 if you are purely engaged in business, self-employment, or practice of profession. If you are mixed income (with employment) earner leave it blank.

Item 53: pertains to the net taxable income after deducting item 51 and 52

Item 54: income tax due automatically computed based item 53 multiplied by 8%

Schedule III – Tax Credits/Payments

Item 55: this pertains to any excess tax credits from previous year annual income tax return filing

Item 56: this pertains to BIR Form 1701Q paid during the taxable year, if any.

Item 57: this pertains to BIR Form 2307 received from customer and used as tax credits in the current year’s previous quarters filing of BIR Form 1701Q, if any.

Item 58: this pertains to BIR Form 2307 received from customer and used as tax credit in this quarter filing, if any.

Items 59 to 61: in general leave it blank unless applicable

Item 62: pertains to the total of all tax credits from item 55 to 61

Item 63: pertains to the total income tax payable after deducting all the tax credits, if any.

Schedule IV – Penalties

Pertains to penalty computation if missed filing on time.

If filed via EFPS, this is automatically computed.

If filed via EBIRFORM, you need to visit your BIR RDO for penalty computation.

Where to file BIR Form 1701Q?

You may file BIR Form 1701Q using either one of the following:

- EFPS – if required to use electronic filing and payment system (EFPS), you must file BIR Form 1701Q using EFPS. To access, visit this link: https://efps.bir.gov.ph/

- EBIRFORM – otherwise, you may file BIR Form 1701Q using electronic BIR Forms (EBIRFORMS). To download, visit BIR website.

Alternately, if not mandated to use EFPS, you may use MPM Accounting Software (MAS) for automatic creation and filing of BIR Form 1701Q directly using MAS. For mandated EFPS, you may still use MPM Accounting Software (MAS) to automate preparation of BIR Form 1701Q and other monthly, quarterly, and annual BIR Forms and books of accounts. Try it for free for 30 days here: https://mpm.ph/tax or book demo meeting via sales@mpm.ph

Where to pay BIR Form 1701Q?

You may pay BIR Form 1701Q via:

- EFPS – if mandated to use EFPS.

- AABs – Authorized Accredited Banks

- Online Payment Channels such as https://myeg.ph/services/bir

What is the required attachment to BIR Form 1701Q?

In general, the required attachment to BIR Form 1701Q are the following, if applicable:

- SAWT – Summary Alphalist of Withholding Taxes for the quarter sent via esubmission@bir.gov.ph

- BIR Form 2307 copies – Signed copies of Certificate Withholding Taxes received from your customer for the quarter

- Others – if any and as applicable.

Submission of attachment via EAFS

RMC 82-2020 prescribed guidelines of submission of required attachment to BIR Form 1701Q Quarterly Income Tax Return via Electronic Financial Statement (EAFS). Visit this link to register in EAFS: https://eafs.bir.gov.ph/eafs

You are now at the end of this article. I hope you have learned the basic information about BIR Form 1701Q Quarterly Income Tax Return. Feel free to leave your comment or share if you liked this article.

Leave a Reply