BIR Form 1601EQ is the Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded).

To keep it short and simple, it is the BIR Form used in filing and remitting Withholding Tax Expanded for a given quarter.

In this article, I will be sharing things you must know about expanded withholding tax particularly the BIR Form 1601EQ – Quarterly Expanded Withholding Tax Return.

If you have not read it yet, you may also want to read another related article that I wrote about Expanded Withholding Tax which is the BIR Form 0619E – Monthly Expanded Withholding Tax Return.

BIR Form 1601EQ Content Outline

- What is Withholding Tax?

- What is Withholding Tax Expanded?

- How to compute Withholding Tax Expanded?

- What is BIR Form 1601EQ?

- When is the deadline to file and pay BIR Form 1601EQ?

- Who should file and pay BIR Form 1601EQ?

- How to fill-out BIR Form 1601EQ?

- How to file BIR Form 1601EQ?

- How to pay BIR Form 1601EQ?

- Submission of QAP as required attachment to BIR Form 1601EQ

- What is the relation to BIR Form 0619E Monthly Withholding Tax Expanded?

What is Withholding Tax?

Withholding tax is a tax system wherein whenever you make a purchase or payments to a seller, vendor or an employee, you must deduct a certain percentage of tax based on the cost of the purchased product or service from the seller, or taxable income of employees, multiplied by a prescribed withholding tax rate.

All taxpayers engaged in doing business or self-employment must comply with withholding tax rules if the nature of their expense or payment is subject to withholding tax. As such, taxpayers become withholding agents of the Bureau of Internal Revenue (BIR).

There are three (3) types of withholding tax such as:

- Compensation – related to employees

- Expanded – related to third party sellers or vendors

- Final – related to payments of passive income to payees

Non-compliance with withholding tax rules can result to disallowance of such expenses including any VAT on Purchases or Expense, also known as Input VAT, and payment of the withholding tax due plus penalties.

In this article, I will focus on discussing the second type, which is the expanded withholding tax, particularly the BIR Form 1601EQ – Quarterly Withholding Tax Expanded.

What is Withholding Tax Expanded?

Withholding Tax Expanded (WE), also referred to as Expanded Withholding Tax (EWT), is one of the taxes imposed on taxpayers engaged in doing business and self-employment.

Withholding Tax Expanded is an amount of tax that we deduct from our payments to our vendors or suppliers including lessors.

The most common sample payments or purchases that are subject to withholding tax expanded are as follows:

- Professional Fee such as Accountants, Lawyers, Engineers, Doctors, Architects, etc.

- Management and Technical Consultants

- Bookkeeping Agents

- Artists, Talent Fees and Directors

- Commissions such as Brokers and Agents

- Rentals

- Contractors

If considered a Top Withholding Agent (TWA), there is an additional requirement to withhold tax from your purchase of services and goods from regular suppliers and one-time purchases amounting to above ten thousand pesos (₱10,000).

For a complete list of the purchases or payments subject to withholding tax expanded, if you are using MPM Accounting Software, you can view the list when you create a vendor profile and select or add an item (expense or purchase) type.

If not yet a subscriber, you may refer to the complete list of purchases or payments subject to withholding tax expanded, click here.

How to compute Withholding Tax Expanded?

When you make certain payments or purchases of goods and services included in the list subject to withholding tax expanded, you need to deduct a certain tax rate or percentage from the amount of sales of the seller or lessor.

For example, you are renting an office space for twenty thousand pesos (₱20,000). Since rental is in the list of purchases or payments subject to withholding tax expanded, you must deduct five percent (5%) from the rental fee of the lessor.

Sample computation as follows:

| Rental | ₱ 20,000.00 |

| Multiply by: WE Tax Rate | 5% |

| WE Tax | ₱ 1,000.00 |

If the amount of rent is with Value Added Tax (VAT), or VAT Inclusive, you must first remove the VAT amount by dividing the rent amount by 1.12, before you multiple WE tax rate.

Sample computation as follows:

| Rental, VAT Inclusive | ₱ 20,000.00 |

| Divide by: | 1.12 |

| Rental, VAT Exclusive | ₱ 17,857.14 |

| Multiply by: WE Tax Rate | 5% |

| WE Tax | ₱ 892.86 |

What is BIR Form 1601EQ?

BIR Form 1601EQ is the Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded).

It is the BIR Form used to remit the withholding tax expanded deducted from the sellers or lessors for a given quarter.

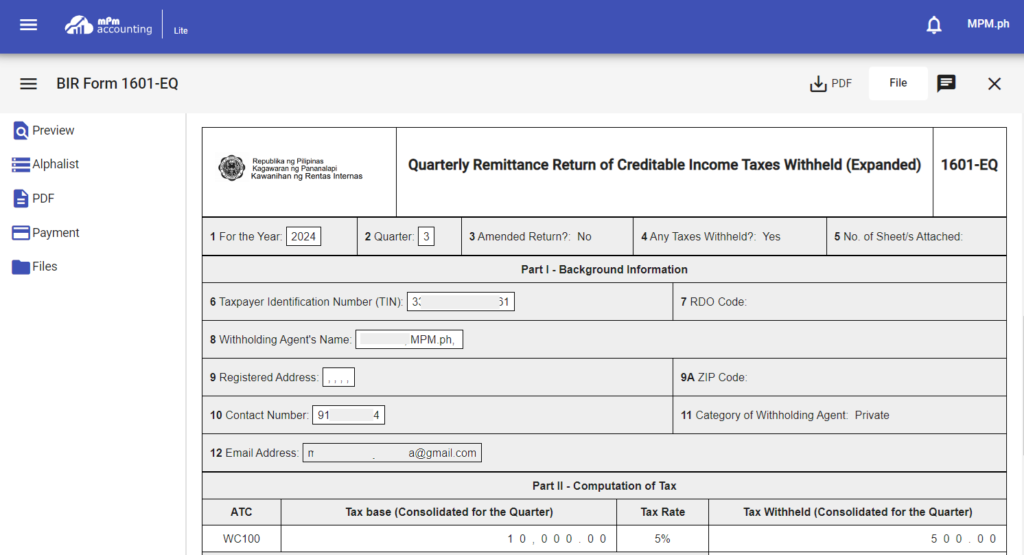

For MPM Accounting Software subscriber, you can view the automatically prepared BIR Form 1601EQ in Government > Tax Management > Quarterly > BIR Form 1601EQ.

Or in the month of deadline, on the homepage, refer to Tax Deadline for the Month and look for BIR Form 1601EQ. Click CREATE to automatically create and view the BIR Form 1601EQ due for the period.

See below sample:

When is the deadline to file and pay BIR Form 1601EQ?

In general, you will file and pay for BIR Form 1601EQ four (4) times in a year.

Below is a reference of the period covered and the corresponding deadline for those following calendar year accounting period:

| Quarter | Months Covered | Deadline |

|---|---|---|

| First Quarter (Q1) | January to March | April 30 |

| Second Quarter (Q2) | April to June | July 31 |

| Third Quarter (Q3) | July to September | October 31 |

| Fourth Quarter (Q4) | October to December | January 31 |

Who should file and pay BIR Form 1601EQ?

BIR Form 1601EQ is applicable to you if you fall on any of the following:

- In your BIR Form 2303 – Certificate of Registration (COR), there is Withholding Tax Expanded in your Tax Type, or;

- You have expenses, purchases or payments covered by the withholding tax expanded rules such as those mentioned above.

How to fill-out BIR Form 1601EQ?

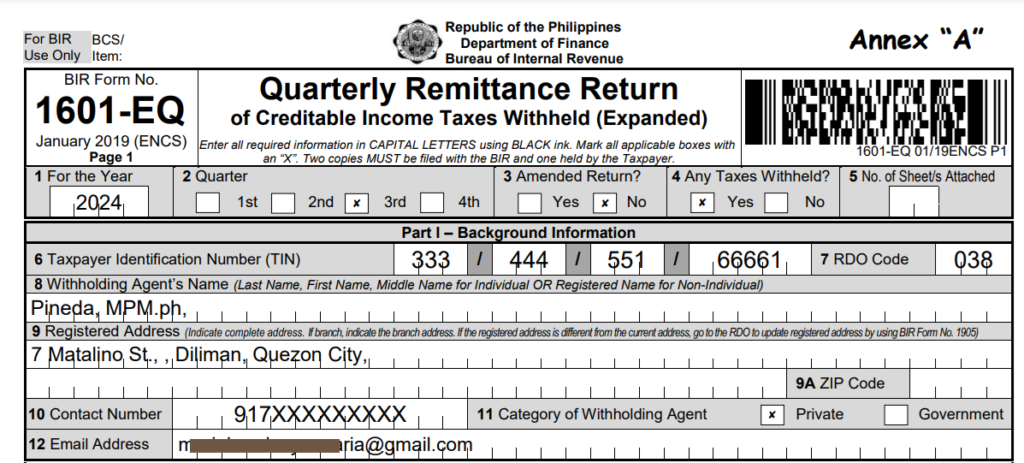

Here is an easy guide on how to manually fill-out BIR Form 1601EQ:

Part I – Background Information

Item 1: Encode the year you are filing.

Item 2: Select the quarter you are filing.

As a guide following calendar year:

- 1st Quarter covers the month of January to March

- 2nd Quarter covers the month of April to June

- 3rd Quarter covers the month of July to September

- 4th Quarter covers the month of October to December

Item 3: Click “No” if first time filing

Item 4: Click “Yes” if there’s amount of tax to paid, “No” if no transaction filing.

Item 6 to 12: Fill-out your information as applicable

See below sample:

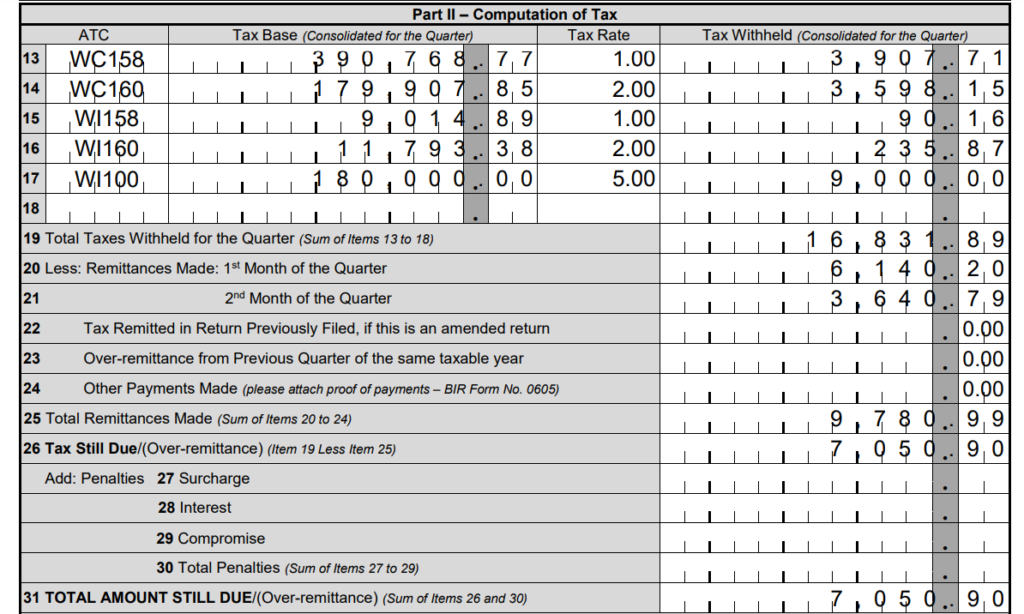

Part II – Computation of Tax

Item 13 to 18: Click ATC in the first column and select all the applicable ATC that you need to file and remit to BIR. Then encode the amount of tax base in the second column.

Item 19: Pertains to the total amount of withholding tax expanded remitted for the applicable quarter.

Item 20: Encode the amount of withholding tax paid during the first month of the quarter using BIR Form 0619E Monthly Withholding Tax Expanded

First month of the quarter are as follows:

- 1st quarter it is January

- 2nd quarter it is April

- 3rd quarter it is July

- 4th quarter it is October

Item 21: Encode the amount of withholding tax paid during the second month of the quarter using BIR Form 0619E Monthly Withholding Tax Expanded

Second month of the quarter are as follows:

- 1st quarter it is February

- 2nd quarter it is May

- 3rd quarter it is August

- 4th quarter it is November

Item 25: Pertains to the remaining about of withholding tax payable for the quarter using BIR Form 1601EQ Quarterly Withholding Tax Expanded.

Item 26: If you missed filing and paying BIR Form 1601EQ within the deadline date, you need to visit your BIR Regional District Office (RDO) for penalty computation. The BIR will be the one to put the amount of penalty that you need to pay. If EFPS filer, the penalty will automatically compute in EFPS website.

Item 31: Pertains to the total amount of tax payable including any penalty if there is.

See below sample:

For automated preparation and filing of BIR Form 1601EQ, you can use MPM Accounting Software.

How to file BIR Form 1601EQ?

File BIR Form 1601EQ using as follows:

1. via Electronic Filing and Payment System (EFPS)

You can use this if you are mandated EFPS filer. EFPS is a web-based filing and payment system of the BIR.

2. via Electronic BIR Forms (eBIRForms)

You can use this if you are not a mandated EFPS filer. It is a desktop software of the BIR which can download in BIR website and install in your computer.

3. via Accredited Tax Software Provider (ATSP)

ATSP, such as MPM Accounting Software, are tax accounting software duly accredited by the BIR. When using ATSP, the BIR Form 1601EQ is automatically prepared and filed to BIR using the software.

You can save time and cost by automating preparation and filing of BIR Form 1601EQ, including the preparation and submission of required attachment of Quarterly Alphalist of Payees (QAP), using MPM Accounting Software. Try it by subscribing for 30 days trial, click here to subscribe.

How to pay BIR Form 1601EQ?

After filing BIR Form 1601EQ, especially via eBIRForm or ATSP, such as MPM Accounting Software, pay the amount of tax due, if there is any, thru online ePAY facilities or over the counter with AABs, depending on your preferences.

Here are the available options:

1. via Authorized Agent Bank (AABs)

AABs are banks accredited by BIR to accept tax payments. This is the traditional way of paying tax due

2. Via Electronic Payment Facilities (ePAY)

ePAY are online facilities that accepts tax payments to the BIR. As such, you can pay your tax dues at the comfort of your home or in the office. Such as Maya and Myeg.ph

What I personally use and recommend is Myeg.ph

Submission of QAP as required attachment to BIR Form 1601EQ

After filing and paying BIR Form 1601EQ, there is another tax compliance that you must comply quarterly, especially if there is an amount of tax due and remitted to the BIR. And that is the online submission of the Quarterly Alphalist of Payees (QAP).

QAP is a listing of all the sellers or lessors, also referred to as payees, that you deducted withholding tax expanded from and remitted to the BIR.

The QAP must be submitted in DAT file format via email to esubmission@bir.gov.ph

The deadline for submission for QAP is like the deadline of BIR Form 1601EQ. Failure to submit on time can result in payment of penalty ranging from ₱1,000 to ₱25,000 based on Revenue Memorandum Order (RMO) No. 7-2015. If you are a Micro and Small Taxpayer, the penalty lowers by 50% ranging from ₱500 to ₱12,500 based on Revenue Regulation (RR) No. 6-2024.

To know if you are a Micro and Small Taxpayer, you may read our article Revenue Regulation (RR) No. 8-2024 Classification of Taxpayer, click here.

To learn more about how to create and submit Quarterly Alphalist of Payees (QAP), read our another related article published after this article.

Just like BIR Form 1601EQ, if you use MPM Accounting Software, Quarterly Alphalist of Payees (QAP) is automatically prepared by the software and the DAT file can be automatically sent to esubmission@bir.gov.ph To learn more about it, subscribe to 30 days free trial, click here.

What is the relation to BIR Form 0619E Monthly Withholding Tax Expanded?

BIR Form 1601EQ Quarterly Withholding Tax Expanded Return is related to BIR Form 0619E Monthly Withholding Tax Expanded Return since they are both used to file and pay Withholding Tax Expanded.

The difference between BIR Form 1601EQ versus BIR Form 0619E is that BIR Form 1601EQ is for quarter end filing while BIR Form 0619E is for monthly filing.

To avoid double payment of tax due, in the BIR Form 1601EQ, you can use any payment made during the monthly filing and payment using BIR Form 0619E Monthly Withholding Tax Expanded Return.

The amount of tax paid using BIR Form 0619E is part of the deduction in the BIR Form 1601EQ. As such, the amount of tax payable in the quarterly withholding tax expanded return (BIR Form 1601EQ) will be lower.

It is important not to forget to include the amount paid in BIR Form 0619E when you create and file BIR Form 1601EQ as shown in Item 20 and 21 above under “How to Manually Fill-Out BIR Form 1601EQ?”.

For a final note, BIR Form 1601EQ Quarterly Alphalist of Payees, is an important tax compliance that you must file and pay four (4) times in a year if it is applicable to you.

I hope this article has enlightened you on how to prepare and file BIR Form 1601EQ. If you like this article, please share it. You can also leave a comment below.

If you need to download a copy of BIR Form 1601EQ, click here.

Leave a Reply