BIR Form 0619E Content Outline

- What is BIR Form 0619E?

- Who are required to file and pay BIR Form 0619E?

- When is the deadline to file and pay BIR Form 0619E?

- How to compute the amount of tax on BIR Form 0619E?

- How to fill-out BIR Form 0619E?

- How to file BIR Form 0619E?

- How to pay BIR Form 0619E?

- What is the difference between BIR Form 0619E versus BIR Form 1601EQ?

- BIR Form 0619E PDF Download

What is BIR Form 0619E?

BIR Form 0619E is a Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded).

To keep it simpler, in this article, I will refer to BIR Form 0619E as the Monthly Expanded Withholding Tax Return. It is the form you will use when you remit any expanded withholding taxes you deducted from your payments or purchases to sellers for the first two (2) months of the quarter.

For example, you are paying rent to ABC Leasing Inc. for the month of August 20XX amounting to fifty thousand pesos (₱50,000), and you deducted five percent (5%) expanded withholding tax from your payment to the seller amounting to two thousand five hundred pesos (₱2,500). Since August 2024 is the second (2nd) month of the third (3rd) quarter, you will use BIR Form 0619E in filing and remitting the amount deducted to the Bureau of Internal Revenue (BIR) amounting to two thousand five hundred pesos (₱2,500).

Who are required to file and pay BIR Form 0619E?

In general, all taxpayers engaged in doing business or self-employment, are mandated by the BIR to act as their withholding agent.

A withholding agent act as a third-party agent of the BIR to collect and remit tax from the seller by deducting a certain percentage (%) on the amount of selling price that will be paid to the seller. And the amount deducted is referred to as expanded withholding tax or withholding tax expanded.

The amount of expanded withholding tax you deducted from the seller must be remitted to the BIR using the monthly form (0619E) or the quarterly form (1601EQ).

Failure to withhold may result to imposition of penalty and possible disallowance of the expense.

To know if you are required to deduct expanded withholding tax, determine which type of taxpayer are you as follows:

a. Regular Taxpayer (Not Top Withholding Agent)

You are a regular taxpayer if you are not included in the Top Withholding Agent (TWA) list.

Refer to item b – Top Withholding Agent to know if you are included in the TWA list.

As a regular taxpayer, you only deduct expanded withholding tax on certain payments and purchases that are subject to expanded withholding tax such as the following:

- Rental

- Professional

- Artist

- Consultant

- Director

- Commission

- Contractor

- Et.al.

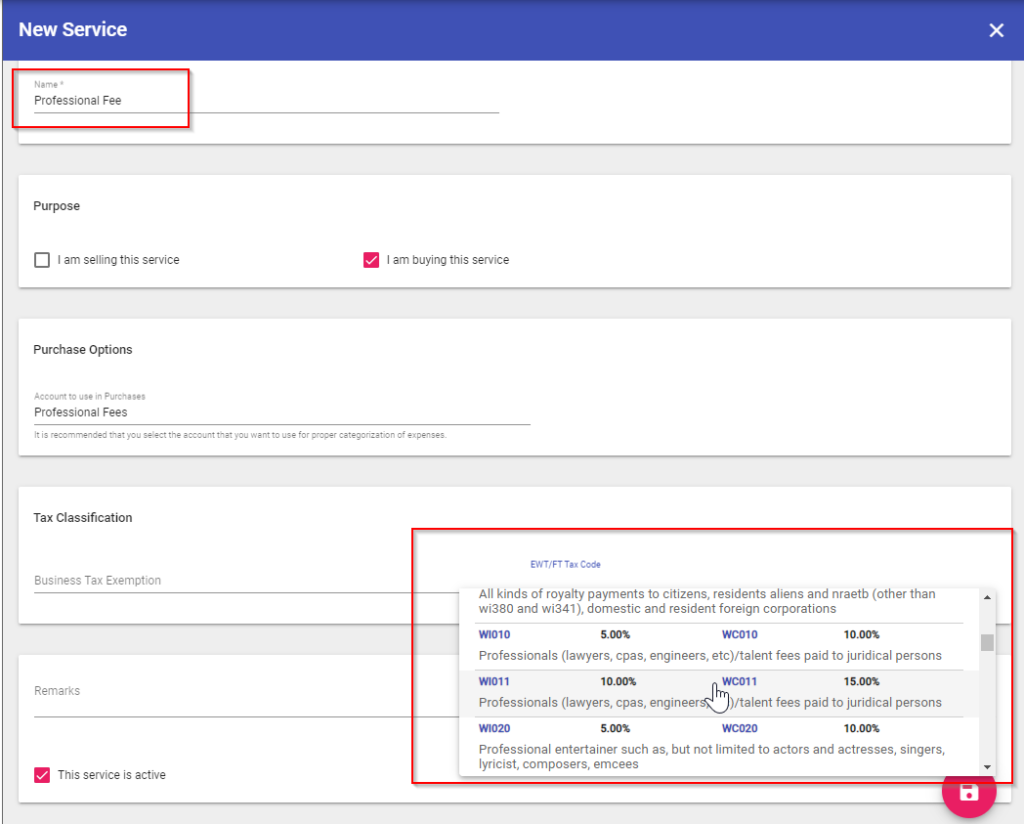

For the detailed list of payments subject to expanded withholding tax, you may use MPM Accounting Software. When you create an item for the product or service bought, you can see and select the applicable expanded withholding tax rate. See sample below:

Or you refer to the list shown in page 2 of the BIR Form 1601EQ.

b. Top Withholding Agent

To know if you are a top withholding agent (TWA), you will either:

- Receive a letter from the BIR informing you about your status as being part of the TWA, or

- Check the publish TWA list in the BIR website.

If you are considered a TWA, on top of the regular payments or purchase mentioned in item a – Regular Taxpayer, you must also withhold tax on the following payments or purchases:

- 1% – on purchase of goods

- 2% – on purchase of services

If the payment or purchase falls on any of the following:

a. The amount of payment or purchase exceeds P10,0000, or

b. The seller is your regular supplier. To be considered regular, you must have transacted with the same seller for more than six (6) times.

When is the deadline to file and pay BIR Form 0619E?

BIR Form 0619E Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded) is due for filing and payment on or before the tenth (10th) day of the following month, for the first two months of the quarter.

Below is a summary of the applicable month and deadline for BIR Form 0619E.

Summary of deadlines for BIR Form 0619E

| For the month of: | Deadline |

|---|---|

| January | February 10 |

| February | March 10 |

| April | May 10 |

| May | June 10 |

| July | August 10 |

| August | September 10 |

| October | November 10 |

| November | December 10 |

How to compute the amount of tax due on BIR Form 0619E?

BIR Form 0619E only requires you to input the total amount of expanded withholding tax you deducted from your payments to seller for the given month.

To be able to do this, you must have an organized bookkeeping of your expenses or purchases and any expanded withholding tax deducted.

For easy and automated bookkeeping of your purchases with expanded withholding tax, you may use MPM Accounting Software (MAS). With MAS, you just need to encode the details of the purchase, and the system will automatically create journal entry and tax form. You can try it here: www.mpm.ph/tax

Here is a sample computation of the amount of expanded withholding tax to be shown in the BIR Form 0619E.

For example, in August 20XX, you made the following payments to the seller which are subject to expanded withholding tax:

| Nature of Purchase / Payment | Amount of Purchase / Payment |

|---|---|

| Rental | ₱ 20,000 |

| Professional Fee | ₱ 50,000 |

| Commission | ₱ 10,000 |

Let us say that the expanded withholding tax (EWT) rate for these payments are as follows:

| Nature of Purchase / Payment | EWT Rate |

|---|---|

| Rental | 5% |

| Professional Fee | 10% |

| Commission | 10% |

Let us compute the expanded withholding tax (EWT) due based on above information:

| Nature of Purchase / Payment | Amount of Purchase / Payment | EWT Rate | EWT Due |

|---|---|---|---|

| Rental | ₱ 20,000 | 5% | ₱ 1,000 |

| Professional Fee | ₱ 50,000 | 10% | ₱ 5,000 |

| Commission | ₱ 10,000 | 10% | ₱ 1,000 |

| Total EWT Due | ₱ 7,000 |

Based on this sample computation, the total amount of EWT due for remittance in the BIR Form 0619E for August 20XX will be P7,000.

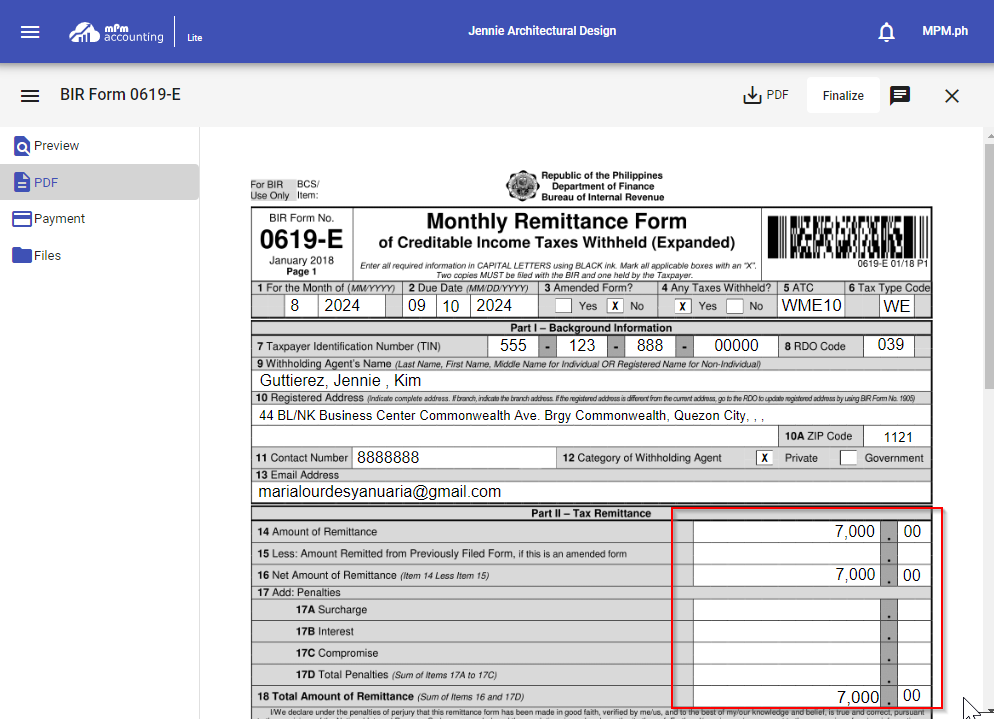

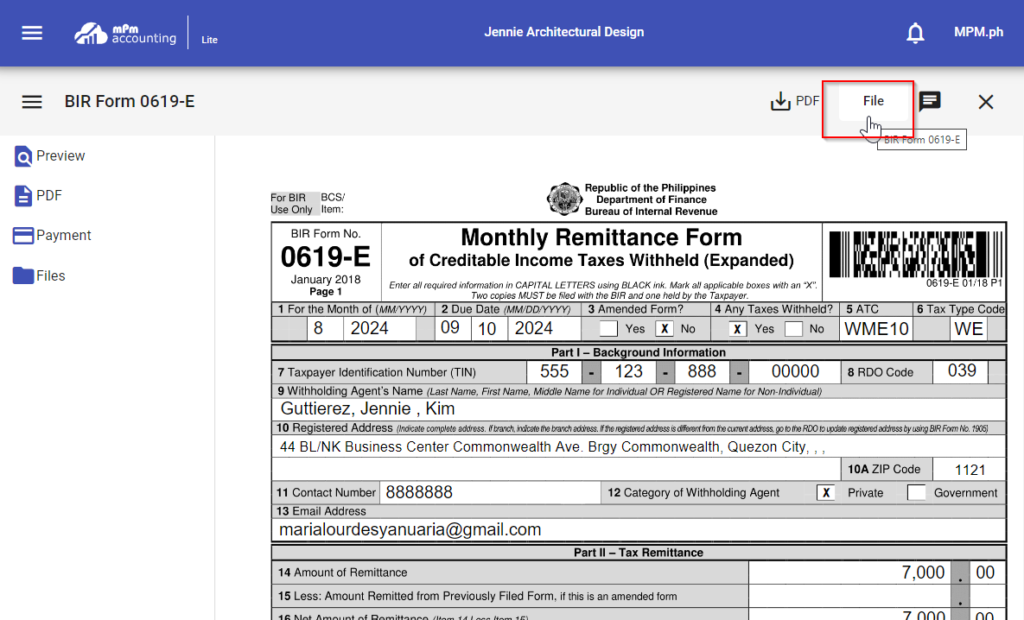

See sample amount of tax due shown in BIR Form 0619E using MPM Accounting Software (MAS):

How to fill-out BIR Form 0619E?

For automated preparation and filing of BIR Form 0619E, you may use MPM Accounting Software (MAS). With MAS, you just encode the expense or purchase details, and the system will automatically prepare the BIR Form 0619E. You can also directly file the BIR Form 0619E in MAS. Try it yourself by subscribing in this link: www.mpm.ph/tax

BIR Form 0619E Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded) is simple and straightforward to prepare.

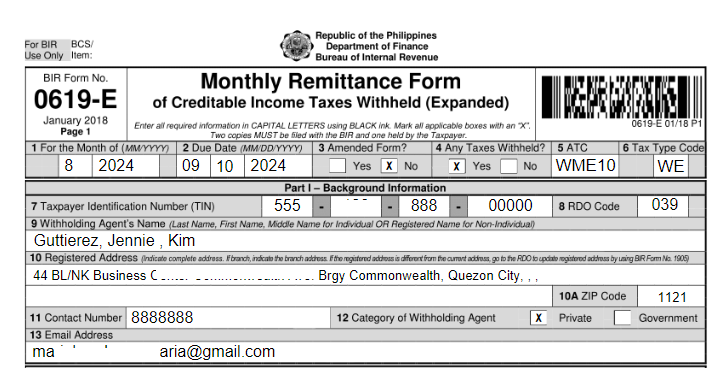

Below is a basic guide of each section of BIR Form 0619E:

Item 1 – For the month of – encode the month and year you are filing.

Item 2 – Due Date – encode the due date. Refer to the deadline table for guide.

Item 3 – Amended Return – Click “No” if first filing.

Item 4 – Any taxes withheld – click “Yes” if with amount of tax due. “No” if No transaction

Part I Background Information

Item 7 to 13 – encode your details as shown in your BIR Form 2303 – Certificate of Registration (COR) and your official contact details.

See sample below:

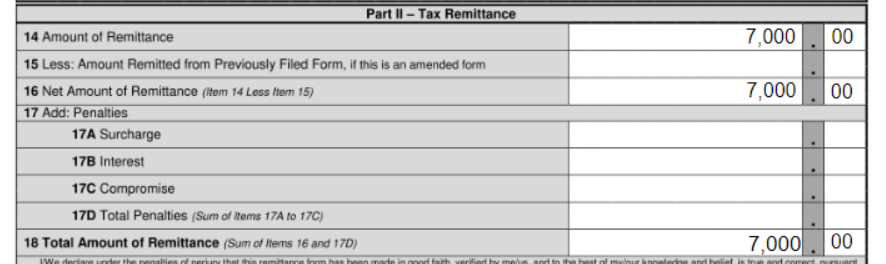

Part II Tax Remittance

Item 14 – encode the total amount of expanded withholding tax deducted from sellers for the month covered. In the sample computation earlier, the amount of expanded withholding tax to be remitted for August 20XX is seven thousand pesos (P7,000)

Item 15 – Leave it blank. Unless you are filing an amended return. If yes, type the amount of tax from the first filing.

Item 16 –pertains to the difference between item 14 & 15. If no amount encoded in the item 15 then the amount will be like the item 14.

Item 17 – Penalties – in cases of filing and paying after the deadline, you need to visit your BIR RDO for penalty computation. If not applicable, leave it blank.

Item 18 – Total Amount of Remittance – If there are penalties for late filing, amount will be based on the total of item 16 and item 17D. If no penalties, amount will be like item 16.

See sample below:

How to File BIR Form 0619E?

BIR Form 0619 can be filed using any of the following mode, as applicable:

1. Accredited Tax Software Provider (ATSP) like MPM Accounting Software (MAS)

If you are subscribed to MPM Accounting Software (MAS), you can directly file the BIR Form 0619E in MAS.

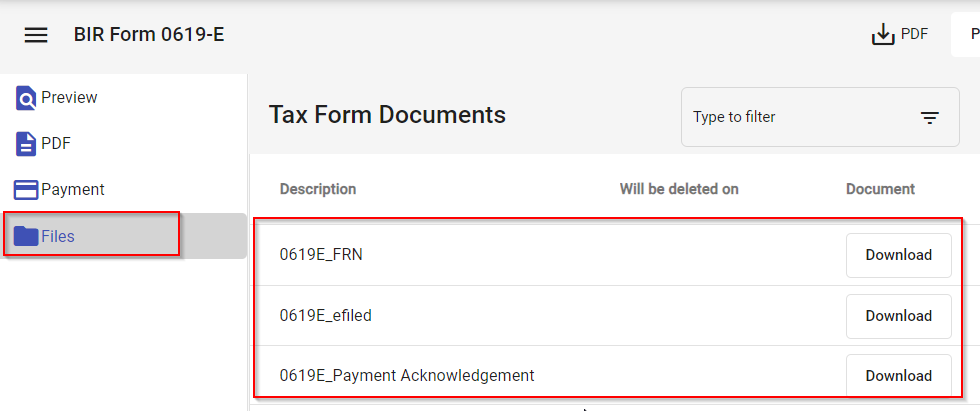

Just click “File” once you are ready to file the form. Once filed, you will receive a tax return receipt confirmation (TRRC) from the BIR as proof of filing.

See sample below:

2. Electronic Filing and Payment System (eFPS)

This is only applicable if you are an EFPS registered or included in the list of mandated EFPS users.

EFPS is a web-based and can be access via www.efps.bir.gov.ph

If you are a MAS subscriber, you still need to manually copy the details shown in the BIR Form 0619E from MAS to the website of EFPS. You can also pay the amount of tax due directly in EFPS.

Make sure to keep a file of the Filing Reference Number (FRN) and payment as proof of filing and payment.

3. Electronic BIR Forms (eBIRForm)

eBIRForm is a desktop software downloadable in BIR’s website. Once downloaded, you need to install it in your computer.

All taxpayers not mandated to use EFPS must file electronically either via eBIRform or ATSP.

You can only file the BIR Form 0619E in eBIRForm software, but the payment facility is not available. Instead, you can pay via any third-party payment facilities accepting BIR payments such as Maya, Myeg, Landbank, DBP, et.al.

Make sure to keep a copy of the Tax Return Receipt Confirmation (TRRC) email from BIR as proof of filing. If tax due is paid via third party payment facilities, make sure to keep a file of the proof of payment as well.

If you are subscribed to MPM Accounting Software (MAS), you can store all these proofs of filing and payment in the File section of the BIR Form.

See sample below:

How to pay BIR Form 0619E?

After filing BIR Form 0619E, the next step is to pay the amount of tax due, if any. If there is no amount of tax due, then you may skip this part.

If you are subscribed to MPM Accounting Software (MAS), you have plenty of options where to pay the tax due just like if you do it via eBIRForm.

You can pay the tax due in any of the following method:

1. Electronic Filing and Payment System (eFPS)

If mandated eFPS filer, you may pay the amount of tax due via eFPS facility. You must open an account to eFPS registered banks and connect your bank account to eFPS.

2. Authorized Agent Banks (AABs)

If you are using MAS or eBIRForm, you can pay any amount of tax due in any banks authorized by the BIR Regional District Office (RDO) to collect and accept payment of tax. The payment is usually physically via over the counter.

3. EPAY Services

If you are using MAS or eBIRForm, you can also pay the amount of tax due online via online payment channels of AABs such as Landbank, DBP, and Unionbank, or online payment facilities like MAYA and MYEG.

Our recommended is MYEG.ph since it also accepts payment via credit card.

What is the difference between BIR Form 0619E versus BIR Form 1601EQ?

BIR Form 0619E is used to file and pay the monthly expanded withholding tax while BIR Form 1601EQ is used to file and pay quarterly expanded withholding tax return.

The BIR Form 0619E is a temporary filing and remittance of any expanded withholding tax for the first two (2) months of the quarter. On the other hand, BIR Form 1601EQ is the final expanded withholding tax return for a whole quarter.

Since the BIR Form 1601EQ includes all months of the quarter, including the first two (2) months filed using BIR Form 0619E. As such, to avoid double taxation, the BIR Form 0619E is used as tax credits in the BIR Form 1601EQ for the applicable quarter.

For example, for the third quarter of the year covering July to September 20XX, details are as follows:

| For the month of | EWT Paid |

|---|---|

| July 20XX | ₱ 10,000 |

| August 20XX | ₱ 7,000 |

Let us say by end of the third quarter with month ending September 20XX, the total expanded withholding tax for the whole quarter is ₱30,000 as shown in the BIR Form 1601EQ. However, instead of paying the full amount of ₱30,000, the amount to be paid will only be ₱13,000, computed as follows:

| Description | Amount |

|---|---|

| Total EWT for the Quarter | ₱ 30,000 |

| Less: BIR Form 0691E payments | |

| July 20XX | ₱ 10,000 |

| August 20XX | ₱ 7,000 |

| EWT Still Due | ₱ 13,000 |

In summary, if expanded withholding tax applies to you, you need to file it with or without transaction. There will be a total of eight (8) BIR Form 0619E covering the first two (2) months of each quarter.

I hope this article have been helpful to learn more about BIR Form 0619E. If you have any questions, feel free to leave a comment below. If you have liked this article, kindly share this article!

BIR Form 0619E Pdf Download

To download the pdf format of BIR Form 0619E click here.

Leave a Reply