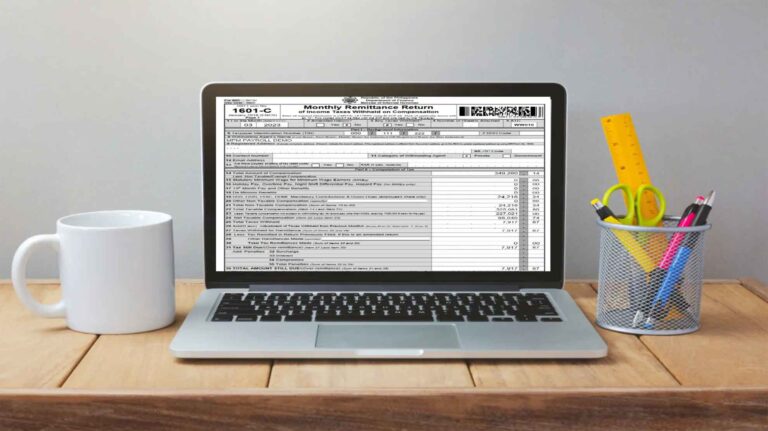

BIR Form 1601C pertains to Monthly Remittance Return of Income Taxes Withheld on Compensation. It is Continue Reading

Annual Income Tax Return Filing for Calendar Year 2022 Guidelines – RMC 32-2023

The Bureau of Internal Revenue (BIR) released on March 16, 2023 a new Revenue Memorandum Circular Continue Reading

Importance of Bookkeeping for Self-Employed Freelancers and Professionals

Self-Employment, such as freelancing and practicing profession, has been changing the landscape of Continue Reading

Benefits of Cloud-Based Accounting Software

Keeping accounting records and filing tax returns can be one of the most tedious, time-consuming, Continue Reading

BIR RMC 131-2022 – Using Official Email Address in Filing Tax Forms

In recent months, the BIR have issued two memorandums which emphasizes the need to use official Continue Reading

Non-VAT Freelancers Guide to BIR Tax Compliance

Driven by ease in availability of technology and the comfort of working from home, many are leaving Continue Reading

BIR Registered Looseleaf Official Receipt and/or Sales Invoice

Bureau of Internal Revenue (BIR) Registered Looseleaf Official Receipt and/or Sales Invoice is a Continue Reading

How to Get Official Receipt from BIR?

If you are a person doing freelancing, self-employment or practicing profession, or you own a Continue Reading

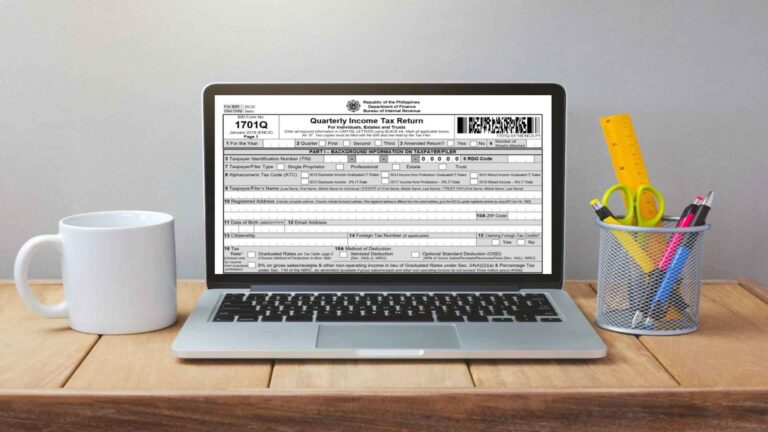

BIR Form 1701Q Quarterly Income Tax Return

BIR Form 1701Q is a tax return needed for filing and/or payment quarterly by individual taxpayer Continue Reading

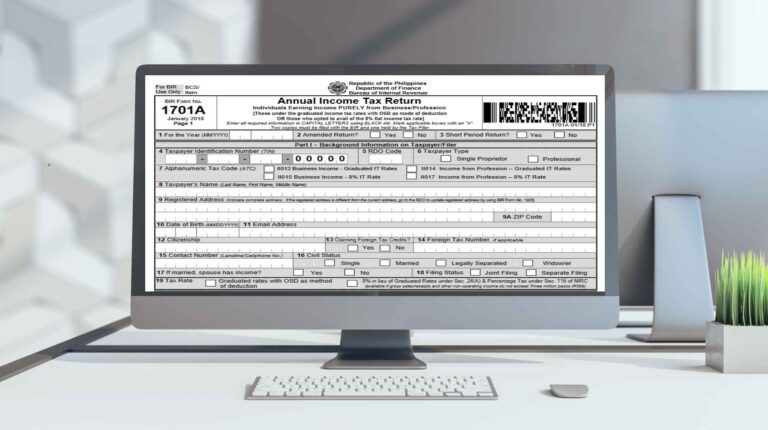

BIR Form 1701A Annual Income Tax Return for Individuals

Being your own boss can be a fulfilling and rewarding path because of its limitless potential Continue Reading