As a business owner and self-employed duly registered in the Bureau of Internal Revenue (BIR), it comes with legal responsibility to comply with the tax rules in the Philippines.

Aside from complying with business tax, such as Percentage Tax or Value-Added Tax (VAT), and Income Tax, you also need to comply with the tax rules on withholding tax, one of which is the Withholding Tax Expanded or Expanded Withholding Tax.

In our previous article BIR Form 1601EQ – Quarterly Withholding Tax Expanded Return, we explained that expanded withholding tax is a method of the BIR to collect tax in advance from sellers (or income earners) by requiring registered taxpayers to withhold and remit a certain percentage or amount on payments or purchases to sellers on goods or services covered by withholding tax rules.

To know more about withholding tax expanded, you may read the following articles:

- BIR Form 0619E – Monthly Expanded Withholding Tax Return

- BIR Form 1601EQ – Quarterly Withholding Tax Expanded Return

Withholding Tax Expanded is one of the complex and tedious tax compliances. On an average, you must comply with the following:

- File and pay eight (8) monthly expanded withholding tax return (BIR Form 0619E) for the months of January, February, April, May, July, August, October and November.

- File and pay four (4) quarterly expanded withholding tax return (BIR Form 1601EQ) for the quarter ending March, June, September and December.

- Submit four (4) quarterly alphalist of payees (QAP) as attachment to the BIR Form 1601EQ for the quarter ending March, June, September, and December.

- File and pay one (1) annual expanded withholding tax return (BIR Form 1604E) for the year ended.

- Submit one (1) annual alphalist of payees as attachment to the BIR Form 1604E for the year ended.

In this article, I will focus providing basic guide on how to prepare and submit the quarterly alphalist of payees (QAP) as a required attachment to BIR Form 1601EQ.

What is Quarterly Alphalist of Payees (QAP)?

QAP is the acronym for Quarterly Alphalist of Payees.

Quarterly Alphalist of Payees (QAP) is a required attachment when you file BIR Form 1601EQ – Quarterly Expanded Withholding Tax Return.

Quarterly Alphalist of Payees (QAP) list down all the sellers, referred to as payees, that you deducted expanded withholding tax from during the applicable three months of the quarter as follows:

| Quarter | Covered Month |

|---|---|

| First Quarter | January to March |

| Second Quarter | April to June |

| Third Quarter | July to September |

| Fourth Quarter | October to December |

Republic Act (RA) No. 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN) Law introduced Quarterly Alphalist of Payees (QAP) as an attachment to the new BIR Form 1601EQ Quarterly Withholding Tax Expanded Return effective January 1, 2018, and onwards.

Who must submit Quarterly Alphalist of Payees (QAP)?

Quarterly Alphalist of Payees (QAP) is required to be submitted as attachment to BIR Form 1601EQ – Quarterly Withholding Tax Expanded Return.

It is mandatory for taxpayer who file and pay withholding tax expanded such as the following:

- Taxpayers with Withholding Tax Expanded as tax type in the BIR Form 2303 – Certificate of Registration (COR)

- Taxpayers with purchases and payments subject to withholding tax expanded like professional fee, management fee, consultant fee, contractors fee, commission, rental, purchase of goods/services (for TWA)

- Taxpayers included in the list of top taxpayer or top withholding agent (TWA)

When is the deadline to submit Quarterly Alphalist of Payees (QAP)?

The deadline to submit Quarterly Alphalist of Payees (QAP) is the same as the deadline of the BIR Form 1601EQ – Quarterly Withholding Tax Expanded Return which is the last day of the month following the close of the quarter.

For easier reference of the deadline for BIR Form 1601EQ and Quarterly Alphalist of Payees (QAP), see below table applicable for calendar period:

| Quarter | Covered Month | Deadline |

|---|---|---|

| First Quarter | January to March | April 30 |

| Second Quarter | April to June | July 31 |

| Third Quarter | July to September | October 31 |

| Fourth Quarter | October to December | January 31 |

Quarterly Alphalist of Payees (QAP) Inclusions

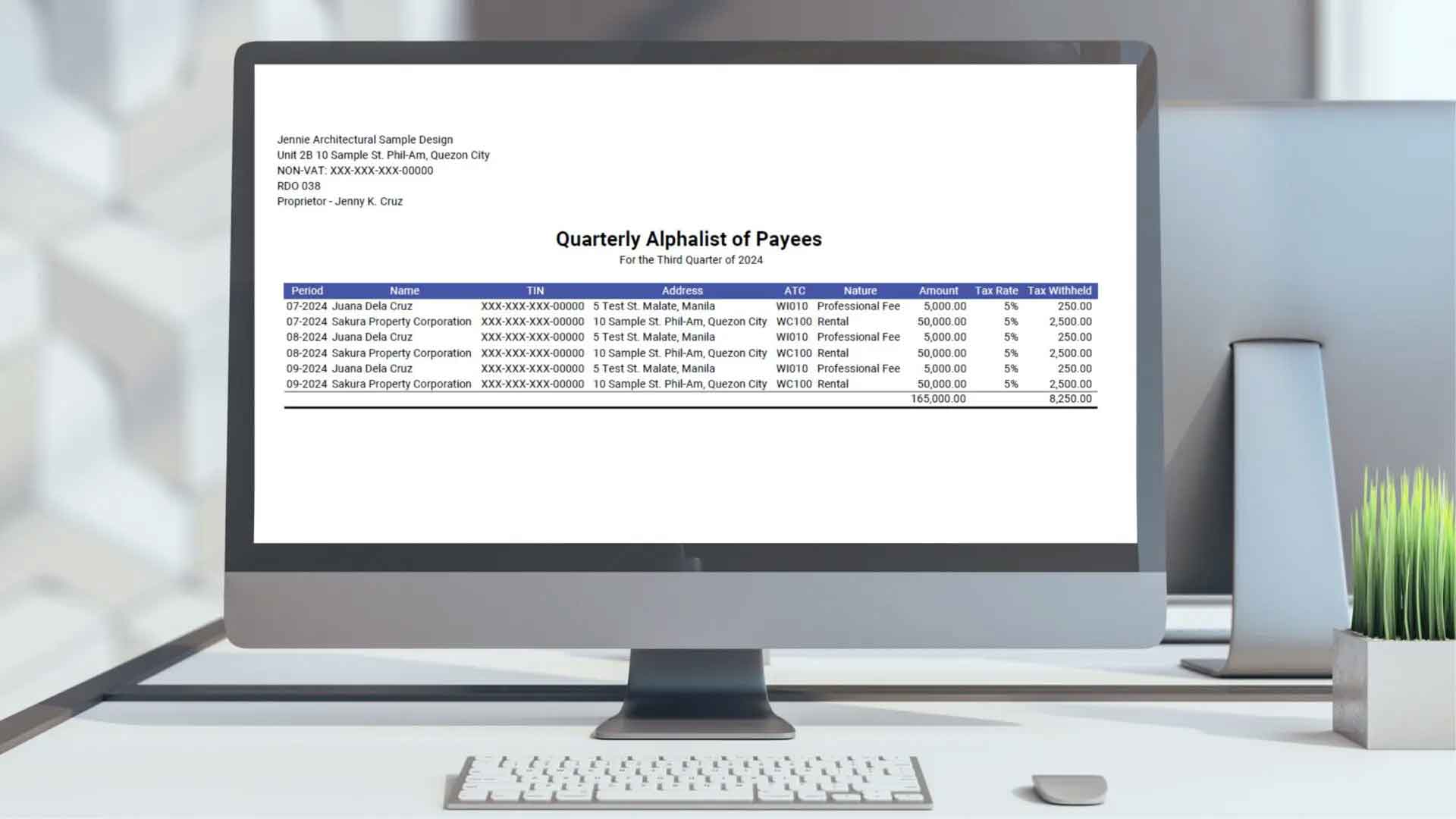

Quarterly Alphalist of Payees (QAP) shows the detailed information about the seller and the purchases or payments that you deducted withholding tax expanded from.

The following are the information you need to show in the Quarterly Alphalist of Payees (QAP):

- Period: Month and Year

- Seller Name

- Seller TIN

- Seller complete address

- Alphanumeric Tax Code (ATC) of the nature of purchase or payment

- Nature of purchase or payment

- Amount of payment or purchase

- Withholding Tax Rate

- Amount of Tax Withheld

See below sample:

How to create Quarterly Alphalist of Payees (QAP) manually?

Submission of Quarterly Alphalist of Payees (QAP) is in data (DAT) file format and emailed to esubmission@bir.gov.ph

Quarterly Alphalist of Payees (QAP) can be prepared manually using the BIR’s Alphalist Data Entry and Validation Module. Keep in mind that the module version may update and change. As such, it is advisable to monitor BIR’s website for any update.

Quarterly Alphalist of Payees (QAP) can also be automatically prepared using MPM Accounting Software. Click here to subscribe and try it.

To manually prepare the Quarterly Alphalist of Payees (QAP) data file, you may follow below steps:

1. Download and install the Alphalist Data Entry Validation Module System

If you wish to do the Quarterly Alphalist of Payees (QAP) manually, you need to download the Alphalist Data Entry and Validation System in the BIR Website, to download click here.

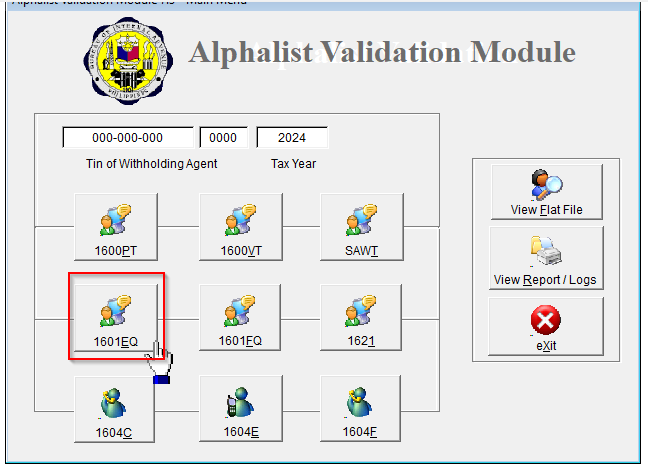

After downloading, install and run the software. You will notice that there are two software that installed in your computer as follows:

- Alphalist Data Entry – this is where you encode the required details and generate the data file.

- Alphalist Validation – this is where you upload and test the data file generated for any errors.

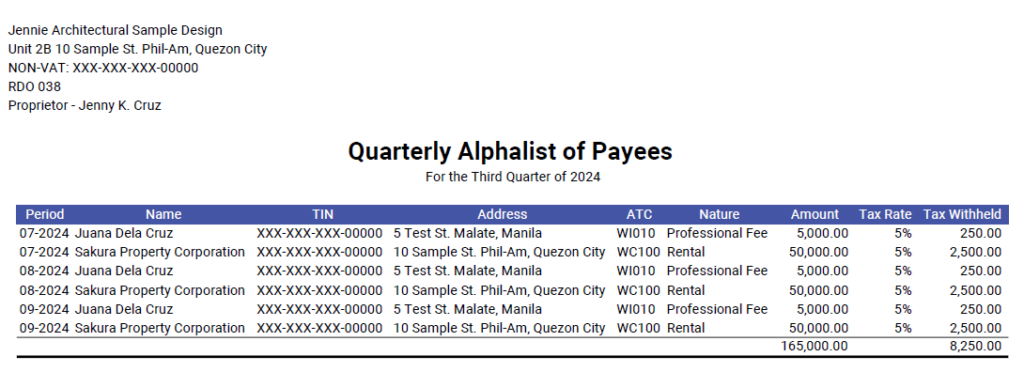

2. Encode the required information in the Alphalist Date Entry System

Open the Alphalist Data Entry System and encode the required information of each expense, purchase, or payment you deducted withholding tax expanded for the three (3) months of the applicable quarter.

See sample below:

Important note: The image shared is based on the latest software version as of time of writing of this article. Use the latest software version at the time of your submission.

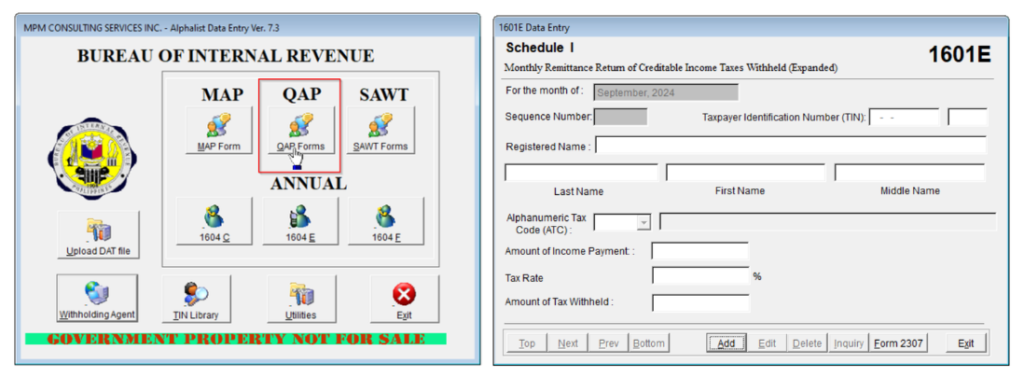

Once done encoding, generate and download the data (DAT) file for three (3) months of the applicable quarter.

See sample below:

3. Test the data (DAT) file in Alphalist Validation System for errors

Open the Alphalist Validation System and upload the data (DAT) file of all the three (3) months of the applicable quarter to test if there are any errors.

See sample below:

If there are errors shown, you need to fix it first before submitting to the BIR.

4. Email the data (DAT) file to the Bureau of Internal Revenue (BIR)

Once the data (DAT) files are tested with no errors, email the data (DAT) file to esubmission@bir.gov.ph with your information as follows:

- Tax Identification Number (TIN)

- Registered Name (if non-individual)

- Last Name, First Name, Middle Name (if individual)

- Three (3) email address

Automated Quarterly Alphalist of Payees (QAP)

You can create and submit Quarterly Alphalist of Payee (QAP) automatically using MPM Accounting Software (MAS).

All you need to do is encode the details of the expense or purchase with withholding tax expanded and once you save, the system will automatically create journal entry, the BIR Form 1601EQ – Quarterly Withholding Tax Expanded Return and the Quarterly Alphalist of Payees (QAP).

Once you filed the BIR Form 1601EQ, the submit attachment will appear to remind you to submit the Quarterly Alphalist of Payees (QAP). Once you clicked “Submit Attachment” button, the system will automatically email the data file in esubmission@bir.gov.ph And when BIR replies, it will also upload in the system.

You can try MPM Accounting Software for 30 days free trial in this link: www.mpm.ph/tax

Penalty for Failure to Submit Quarterly Alphalist of Payees (QAP)

Failure to submit the Quarterly Alphalist of Payees (QAP), as an attachment to BIR Form 1601EQ – Quarterly Withholding Tax Expanded Return, within the deadline period, can lead to payment of penalties on top of the amount of withholding tax expanded due.

The penalty for failure to submit Quarterly Alphalist of Payees (QAP) to esubmission ranges from P1,000 up to P25,000 as per RMO 7-2015 Annex A also known as the Revised Schedule of Compromise Penalty.

If you are a Micro and Small Taxpayer, the penalty lowers by 50% ranging from ₱500 to ₱12,500 based on Revenue Regulation (RR) No. 6-2024.

To know if you are a Micro and Small Taxpayer, you may read our article Revenue Regulation (RR) No. 8-2024 Classification of Taxpayer, click here.

As a conclusion, in this article, you have learned that the Quarterly Alphalist of Payee (QAP) is an important required attachment to the BIR Form 1601EQ – Quarterly Withholding Tax Expanded Return. And you must submit it an average of four (4) times a year for the four quarters of the year.

I hope this article helped you somehow. Feel free to leave your questions in the comment section and kindly share this article!