Being your own boss can be a fulfilling and rewarding path because of its limitless potential opportunities. However, it also comes with risks and responsibilities, especially with regards to tax compliance. One of which is filing your own annual income tax return.

If in the past, you’ve been purely employed in a company, you probably experienced not worrying about filing your own income tax return because it is taken care of by your employer. You just simply see the tax deduction in your pay slip if there’s any.

However, it’s different now that you’re on your own and engaged in purely business, freelancing/self-employment, or practice of profession.

As an individual doing purely business, freelancing, self-employment, or practicing profession, every year, you are required to file and pay your own Annual Income Tax Return to the Bureau of Internal Revenue (BIR).

If you don’t know how to do it, this article will guide you on how to file and pay BIR Form 1701A Annual Income Tax Return if you’re an Individual Purely Engaged in Dong Business/Profession/Self-Employed.

What is Annual Income Tax Return?

There are two types of BIR Forms related to Annual Income Tax Return for Individual:

- BIR Form 1701A – use this form if you’re purely doing business, freelancing/self-employment, or practicing of profession and you are availing any of the following:

- 8% Flat Income Tax Rate; or

- Graduated Income Tax Rate with OSD as method of deduction

- BIR Form 1701 – use this form if you’re either:

- Purely Doing Business availing graduated income tax rate with Itemized deduction as method of deduction; or

- Mixed Income Earner which means you have income from employment aside from doing business/self-employment.

In this article, I will focus on BIR Form 1701A Annual Income Tax Return.

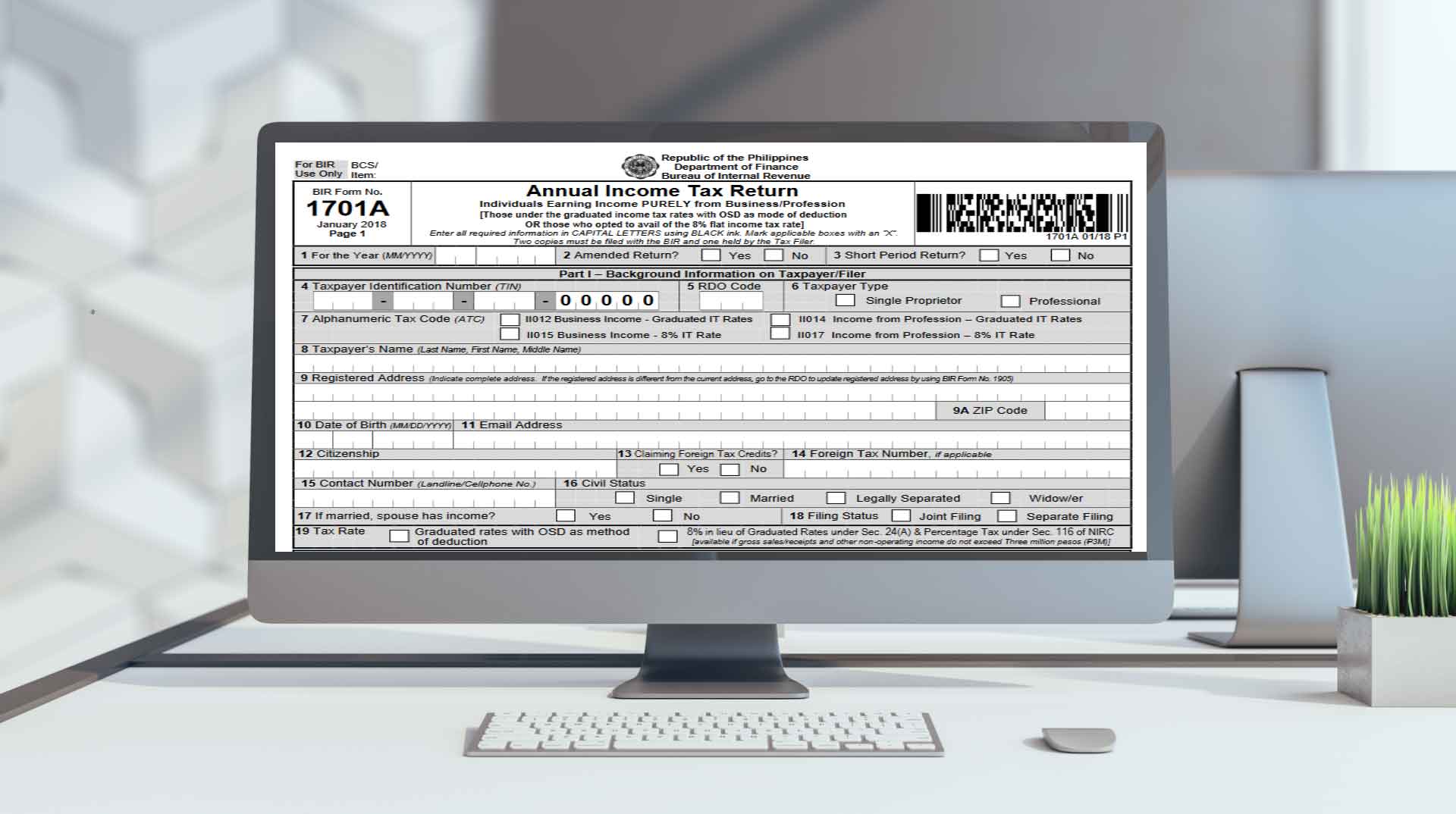

What is BIR Form 1701A?

BIR Form 1701A is an Annual Income Tax Return for Individual Engaged in Purely Business/Profession including Freelancing/Self-Employed.

BIR Form 1701A is generally used by taxpayer registered in the BIR as sole proprietor, self-employed, freelancer or professional and meets the criteria below.

Who can use BIR Form 1701A?

You can only use BIR Form 1701A if you meet both of the following criteria:

- Earning Purely from Business/Profession/Self-Employed – which means you are not employed or earning from employment; and

- Are availing either of the following:

- 8% Flat Income Tax Rate (only for Non-VAT Registered); or

- Graduated Income Tax Rate with OSD as method of deduction (both for VAT and Non-VAT Registered).

When is the Deadline for Filing and Payment of BIR Form 1701A?

The deadline for filing and paying BIR Form 1701A is on or before April 15 of the following year after the closed of the calendar year.

For example:

- Accounting Period: January 1, 2021 to December 31, 2021 (Calendar Year)

- Deadline: April 15, 2022

This article does not apply if you’re following Fiscal Year.

How to Prepare BIR Form 1701A?

Below is a general and basic guide on how to prepare and fill-up BIR Form 1701A.

Note: If you have special transactions or concerns, you must consult an accountant or tax consultant.

Item No. 1: Type “12 / 202X”. “12” means the month end (December) while “202X” means the year

Item No. 2: Click “No” in general

Item No. 3: Click “No” in general

Part 1

Item No. 4: Type your Taxpayer Identification Number (TIN) as shown in your BIR Form 2303 – Certificate of Registration (COR).

Item No. 5: Type the BIR RDO number where you are registered as shown in your BIR Form 2303 – Certificate of Registration (COR). RDO means Regional District Office. It is where you registered your business, freelancing/self-employment, or practice of profession.

Item No. 6: Choose “Single Proprietor” if you’re doing business. Choose “Professional” if you’re practicing your profession, such as lawyer, doctor, engineer, broker, accountant, etc.; or you’re a freelancer/self-employed.

Item No. 7: Choose one of the following:

- II012 Business Income – Graduated IT Rates: applicable to individual doing business who are VAT registered or NONVAT registered who did not avail the 8% flat income tax rate

- II014 Income from Profession – Graduated IT Rates: applicable to individual are professional/freelancer who are VAT registered or NONVAT registered who did not avail the 8% flat income tax rate

- II015 Business Income – 8% IT Rate: applicable to individual doing business who are NONVAT registered and has availed the 8% flat income tax rate. This is not allowed for VAT registered.

- II017 Income from Profession – 8% IT Rate: applicable to individual professional/freelancer who are NONVAT registered and has availed the 8% flat income tax rate. This is not allowed for VAT registered.

Items No. 8 to 12: kindly fill-in the information accordingly

Item No. 13: In general, check “No”.

Item No. 14: In general, you may skip this part.

Items No. 15 to 17: kindly fill-in the informatino accordingly

Item No. 18: In general, click “Separate Filing”.

Item No. 19: Tax Rates

Choose either:

- Graduated Income Tax Rate with OSD as method of deduction; or

- 8% Flat Income Tax Rate (only for NONVAT Registered)

The differences between OSD vs 8% are:

1. Manner of computation of Taxable Income

If 8%, the computation is as follows:

Net Annual Sale

Less: Allowed Deduction of P250,000.00

Taxable Income

If graduated, the computation is as follows:

Net Annual Sales

Less: Optional Standard Deduction (40% of Net Sales)

Taxable Income

2. Tax Rates

If 8%, tax rate is 8% of Taxable Income

If Graduated, tax rate is ranging from 0% to 35% depending on the amount of Taxable Income. See below tables:

TABLE 1 – Tax Rates Effective January 1, 2018 to December 31, 2022

| If Taxable Income is: | Tax Due is: |

| Not over P250,000 | 0% |

| Over P250,000 but not over P400,000 | 20% of the excess over P250,000 |

| Over P400,000 but not over P800,000 | P30,000 + 25% of the excess over P400,000 |

| Over P800,000 but not over P2,000,000 | P130,000 + 30% of the excess over P800,000 |

| Over P2,000,000 but not over P8,000,000 | P490,000 + 32% of the excess over P2,000,000 |

| Over P8,000,000 | P2,410,000 + 35% of the excess over P8,000,000 |

TABLE 2 – Tax Rates Effective January 1, 2023 and onward

| If Taxable Income is: | Tax Due is: |

| Not over P250,000 | 0% |

| Over P250,000 but not over P400,000 | 15% of the excess over P250,000 |

| Over P400,000 but not over P800,000 | P22,500 + 20% of the excess over P400,000 |

| Over P800,000 but not over P2,000,000 | P102,500 + 25% of the excess over P800,000 |

| Over P2,000,000 but not over P8,000,000 | P402,500 + 30% of the excess over P2,000,000 |

| Over P8,000,000 | P2,202,500 + 35% of the excess over P8,000,000 |

You can only choose which you will avail between OSD vs 8% every first quarter of the year. Once you choose, it should be applied the whole year.

Note: Refer to your first quarter or first filing of BIR Form 1701Q during the calendar year of filing to ensure it’s consistent and the same.

Part II

Note: In general, fill-in only Column A – Taxpayer/Filer and skip Column B – Spouse.

Items No. 20 to 22: This is automatically filled-up when you’re using eBIRForms or eFPS. It is computed based on your inputs in page 2 Part IV.

Item No. 23: In general, you may skip this part.

Item No. 24: This is automatically filled-up when you’re using eBIRForms or eFPS. Pertains to the amount of tax payable if filed/paid on time without penalties

Items No. 25 to 28: Type amount of penalty computation, if filed/paid late.

Item No. 29: Pertains to the amount of tax to be paid including any penalty, if applicable.

Part IV

Part IV.A If you chose Optional Standard Deduction (OSD)

Fill Part IV.A if you choose OSD. Otherwise, skip this part.

Item No. 36: Type your total annual sales/revenues/receipts/fees during the calendar year.

Item No. 37: Type your sales discounts/returns/allowances if there is. Otherwise, you may skip this part.

Items No. 38 to 40: This is automatically filled-up, when you’re using eBIRForms or eFPS, based on your input in items 36 and 37.

Items No. 41 to 44: In general, you may skip this part.

Item No. 45: This is the taxable income automatically computed when you’re using eBIRForms or eFPS.

Item No. 46: This is the amount of tax due for the year. It is automatically computed based on taxable income multiplied by the graduated income tax rate ranging from 0% to 35%, as applicable

IV-B If you chose 8% Income Tax Rate

Fill Part IV.B if you choose 8% Flat Income Tax Rate. Otherwise, skip this part.

Item No. 47: Type your total annual sales/revenues/receipts/fees during the calendar year.

Item No. 48: Type your sales discounts/returns/allowances if there is. Otherwise, you may skip this part.

Item No. 49: This is automatically filled-up, when you’re using eBIRForms or eFPS, based on your input in items 47 and 48.

Items No. 50 to 52: In general, you may skip this part.

Item No. 53: This is automatically computed total income.

Item No. 54: Type two hundred fifty thousand pesos (P250,000)

Item No. 55: This is automatically computed taxable income or loss.

Item No. 56: This is the amount of tax due for the year. It is automatically computed based on taxable income multiplied by the 8% flat income tax rate

IV-C. Tax Payments/Credits

For every item you fill-in in this part, ensure you attach proofs.

If this section is filled-up and the attached proofs are valid, these will help in decreasing the amount of tax due or tax payable.

Item No. 57: Pertains to previous calendar year BIR Form 1701A or 1701overpayment (tax credits) which will be carried over to the current calendar year. In general, and if not applicable, you may skip this part

Item No. 58: Type the total of amount of tax paid for the 1st to 3rd quarter of the calendar year using BIR Form 1701Q – Quarterly Income Tax Return for Individual.

Item No. 59: Type the total amount of BIR Form 2307 – Creditable Withholding Tax you received from customers for the 1st to 3rd quarter of the calendar year.

Item No. 60: Type the total amount of BIR Form 2307 – Creditable Withholding Tax you received from customers for the 4th quarter of the calendar year.

Items No. 61 to 63: In general, you may skip this part.

Item No. 64: This is automatically computed based on the total of all the tax payments/credits you input.

Item No. 65: This is automatically computed based on the difference of tax due less any tax payments/credits. This is the amount to be paid on or before April 15 unless there’s no payment required.

To save time and cost in doing bookkeeping and tax filing, including this BIR Form 1701A Annual Income Tax Return, you may automate this using MPM Accounting Software. Try it for 30 days free trial here: https://mpm.ph/tax or book demo meeting via sales@mpm.ph

What are the Required Attachments?

As applicable, the following are required attachments relating to your inputs in Part IV-C Tax Payments/Credits:

- BIR Form 1701Q paid during the calendar year. This is the supporting evidence of Item No. 58.

- Summary Alphalist of Withholding Taxes (SAWT) to be emailed to esubmission@bir.gov.ph. This is the supporting report of Item No. 60.

- Copies of signed BIR Form 2307 – Creditable Withholding Taxes. This is the supporting report of Items No. 59 and 60.

Audited Financial Statement (AFS) is no longer required to be submitted if you are qualified to use BIR Form 1701A.

Submission of required attachment can be made via eAFS or via your registered BIR RDO 15 days after the deadline of the filing of Annual Income Tax Return (in general, April 30).

Where to File BIR Form 1701A?

BIR Form 1701A can be filed using one of the following:

- eBIRForm – in general, if taxpayer is not mandated to use eFPS, BIR Form 1701A must be filed using eBIRForm. eBIRForm means electronic BIR Forms. To download, visit BIR website and look for eBIRForm or click here for the latest version as of this writing.

- eFPS – if mandated, taxpayer must file BIR Form 1701A using the electronic filing and payment system (eFPS). To access, visit this link: https://efps.bir.gov.ph/

Alternately, if not mandated to use eFPS, you may use MPM Accounting Software (MAS) for automatic creation and filing of BIR Form 1701A. Try it for free for 30 days here: https://mpm.ph/tax or book demo meeting via sales@mpm.ph

Where to Pay BIR Form 1701A?

BIR Form 1701A can be paid using one of the following:

- EFPS – if required to file using eFPS. You must enroll to a bank who have facilitates eFPS payment.

- AABs – which stands for Authorized Agent Banks. This is an over-the-counter payment in the bank accredited by the BIR Regional District Office (RDO) where your business, freelancing or self-employment, is registered

- Online Payment – you may pay BIR Form 1701A using an app such as GCASH and PayMaya; or via online banking such as with Landbank, Development Bank of the Philippines (DBP) or Unionbank. To see all online payment options here, click here.

That’s it. You’ve just learned all the fundamental information about BIR Form 1701A Annual Income Tax Return for Individual engaged in Purely Business.

I hope this article gave you relevant information. Feel free to comment or ask question below. If you liked this article, please share it!