All registered taxpayers doing business, self-employment or practice of profession need to comply with the tax law of keeping records of transactions, known as books of accounts or accounting books, as part of their secondary registration with the Bureau of Internal Revenue (BIR).

Books of Accounts consists of the required General Journal and General Ledger, but as an option, may also register Special Journals or Subsidiary Ledger such as Cash Receipt Journal, Cash Disbursement Journal, Sales Journal, Purchase Journal, and the like.

Types of BIR Registered Books

There are three types of books of accounts to choose from:

Manual Books

Manual is a traditional type of book that is most popular type as of this writing. Majority of Micro Small Medium Enterprises (MSMEs) uses manual books because it is the easiest to register with the BIR.

Manual Books consist of columnar books you can buy from office supplies store and then register or submit it for stamping in BIR RDO where the taxpayer has registered. Once registered, business transactions are hand-written on a regular basis.

Per RMC 3-2023, manual books of accounts are not required to be registered every year. However, taxpayers may opt to use new set of books of accounts yearly. Hence, new sets of books of accounts shall be registered before its use. (Updated: 01122024)

Loose Leaf Books

Loose leaf is the least popular in the past years. But there is an increasing awareness that this option is available.

Loose leaf is a type of book that uses Microsoft Excel or any equivalent. But before you can do so, you must apply for a Permit to Use (PTU) in BIR. You can submit your Application for Permit to Use Loose Leaf (BIR Form 1900) via BIR’s Online Registration and Update System (ORUS). However, you need to have ORUS account before you can do so. You can apply for access in ORUS in your BIR Regional District Office (RDO). (Update: 01122024)

Once there’s Permit to Use (PTU) Loose leaf, at the end of the year, print the journals/ledgers and hand-bound it. After which, submit it to the BIR RDO on or before January 15 of next calendar year online via ORUS. (Updated: 01122024 per RMC 3-2023)

Computerized Books

Large Taxpayers often uses Computerized Books. But due to rising popularity of automation and affordable software just like MPM Accounting Software, even MSMEs, self-employed or professionals are now using and registering computerized books.

Per Revenue Memorandum Circular (RMC) 5-2021, it is no longer necessary to apply for Permit to Use (PTU) computerized books, instead, you only need to complete and submit the checklist of requirements via ORUS or BIR RDO. To signify acceptance, the BIR will issue you an Acknowledgement Receipt.

But just like Loose leaf Books, every end of the year, you must submit soft copies of your computerized accounting records via ORUS or BIR RDO on or before January 30 of the next calendar year. (Updated: 01122024 per RMC 3-2023)

How to Comply with Annual Submission of Loose Leaf Books of Accounts?

Now that you know the different types of books you can register, let us now focus on requirement on Annual Submission of Loose leaf Books of Accounts to the BIR RDO.

This article is for those who already have Permit to Use (PTU) Loose Leaf or for anyone who wants to learn about this annual requirement.

It is important to note that if you do not have Permit to Use (PTU) Loose Leaf, but you intend to maintain a Loose Leaf Books, then you must first submit your application to your BIR RDO before doing the steps below.

So, without further delay, here are the steps to comply on the requirement of Annual Submission of Loose leaf Books of Accounts:

1. Print all the journals and ledgers for the covered year

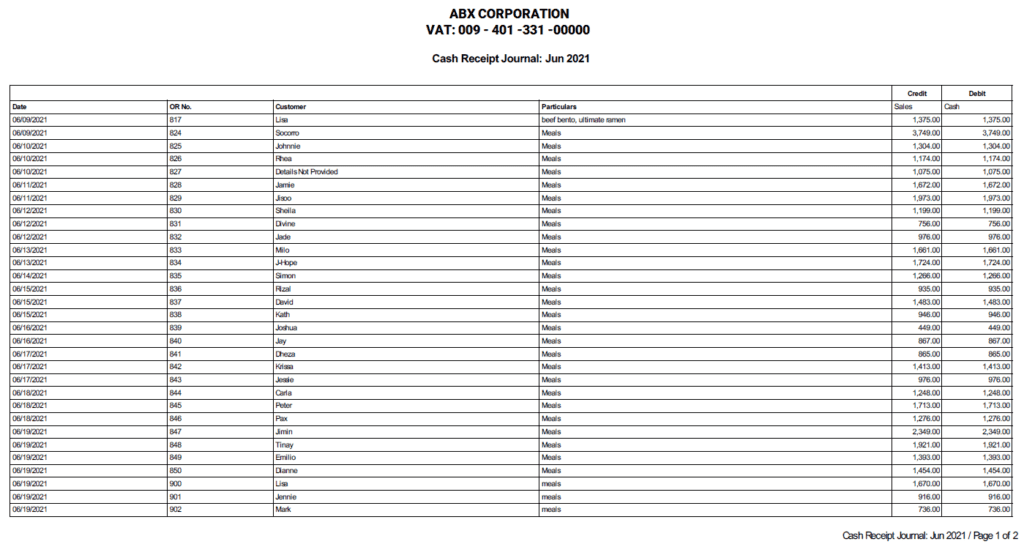

Print all the journals and ledgers for the covered year. For example, from January 1 20xx to December 31, 20xx, for the applicable books such as:

- General Journal

- General Ledger

- Cash Receipt Journal

- Cash Disbursement Journal

- Sales Journal

- Purchase Journal

See sample image below for Cash Receipt Journal:

If you do not know how to do or create these journals, you may try MPM Accounting Software which has automated preparation of Loose leaf Books. You may subscribe for 30 days free trial here: https://mpm.ph/tax/

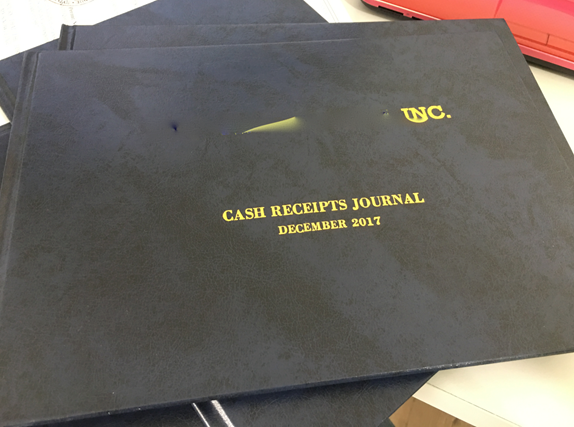

2. Hardbound all the loose leaf journals and ledgers

Have all the printed journals and ledgers hard bounded with proper cover such as:

- Company Name

- Name of the Book

- Period Covered

See example below:

3. Prepare the complete requirements for successful submission

The requirements are as follows:

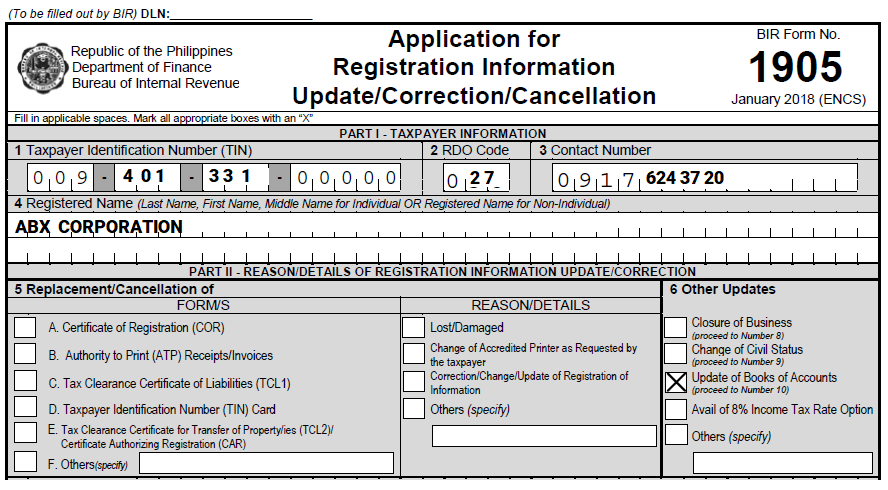

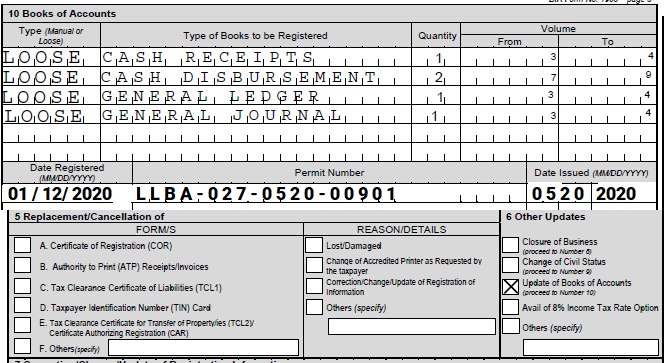

a. Filled-Up BIR Form 1905

(Updated: 01122024 per RMC 3-2023) If you submit Loose Leaf books of accounts via ORUS, you may skip this requirement. This is only applicable if you submit physically in BIR RDO.

Fill out items 1 to 4, item 6 and item 10. Then sign item 12.

See sample below:

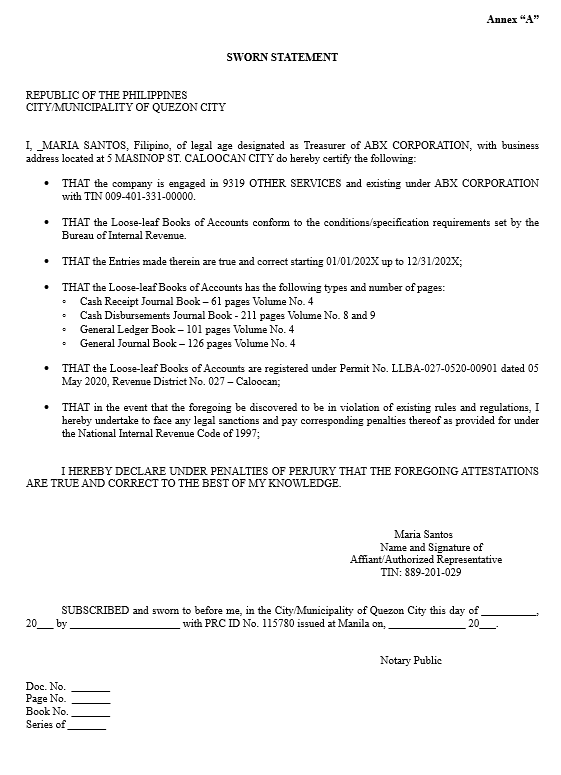

b. Notarized Sworn statement with volume and pages

See sample below:

c. Copy of Latest filed and paid BIR Form 0605 Annual Registration Fee

(Updated: 01122024 per RMC 3-2023) If you submit Loose Leaf books of accounts via ORUS, you may skip this requirement. This is only applicable if you submit physically in BIR RDO.

For sample BIR Form 0605 visit this article, click here.

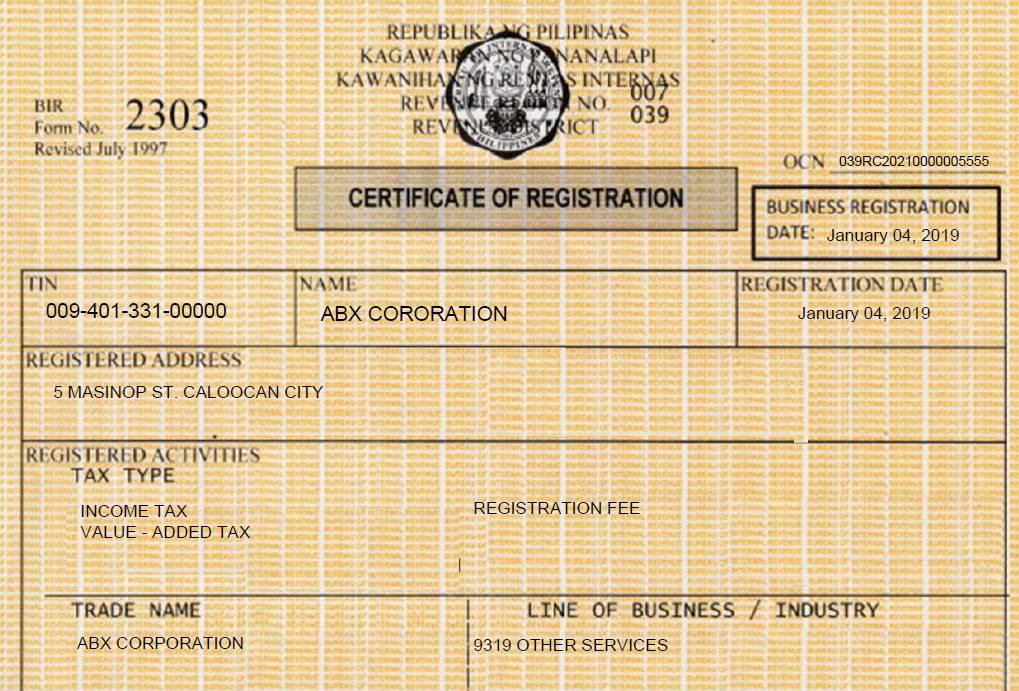

d. Copy of BIR Form 2303 Certificate of Registration

(Updated: 01122024 per RMC 3-2023) If you submit Loose Leaf books of accounts via ORUS, you may skip this requirement. This is only applicable if you submit physically in BIR RDO.

See sample image below:

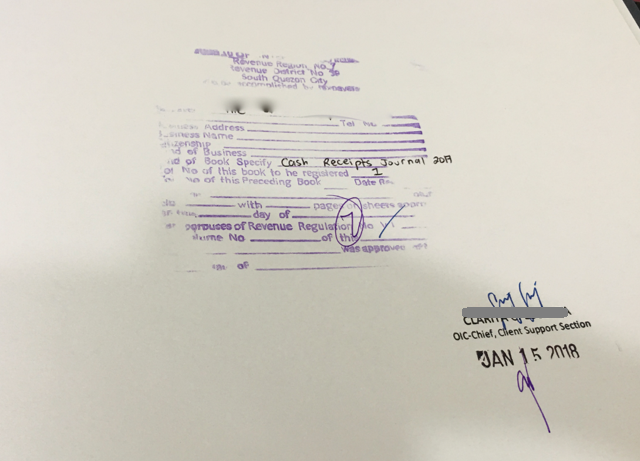

e. Copy of previous year submitted loose leaf books

(Updated: 01122024 per RMC 3-2023) If you submit Loose Leaf books of accounts via ORUS, you may skip this requirement. This is only applicable if you submit physically in BIR RDO.

Photocopy of first page with BIR stamped received.

See sample image below:

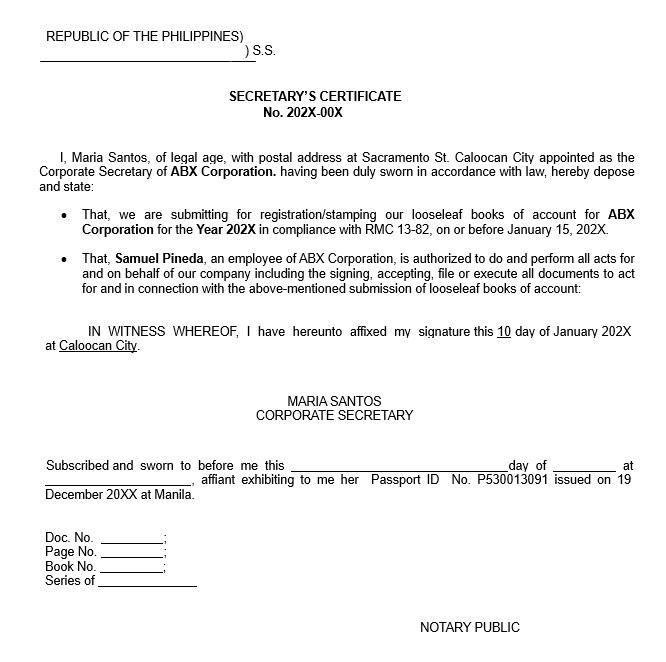

f. Notarized Special Power of Attorney or Secretary Certificate for authorized representatives

(Updated: 01122024 per RMC 3-2023) If you submit Loose Leaf books of accounts via ORUS, you may skip this requirement. This is only applicable if you submit physically in BIR RDO.

If someone else will submit your loose leaf books in the BIR RDO, prepare a notarized Special Power of Attorney (if Sole Proprietor) or Secretary Certificate (if Corporation) for the authorized representative.

See sample image below:

g. Hard-Bounded Books of Accounts of Current Year

Refer to above step 2 for example.

4. Submit complete requirements via ORUS or to the BIR RDO

Submit the hard bound loose leaf books and all other requirements via ORUS or if you encounter problem in ORUS, to the BIR RDO where the business has registered. Deadline of submission is on or before January 15 of the next calendar year.

For example: Loose leaf Books for Calendar Year January 1, 2021 to December 31, 2021 are due for submission on or before January 15, 2022. If the deadline falls on a weekend or holiday, the deadline will be moved to the next working day. In this example, since January 15, 2022 is Saturday, the deadline is moved to the next working day which is January 17, 2022.

(Updated: 01122024) If you submit via ORUS, print the QR Code and paste in the printed and bookbinded books of accounts. If you submit via BIR RDO, they will stamp your books of accounts.

BIR provided guidelines on how to submit via ORUS, click here to view it.

5. Properly Safe Keep the Loose Leaf Books

Keep and store the registered Loose Leaf Books, including all other attachments received by the BIR RDO, at the registered address of the taxpayer.

Benefits and Disadvantages of Loose Leaf Books

Loose leaf books of accounts has its benefit. First, you do not need to hand write your transaction in a manual book. Second, you can do record keeping electronically using Microsoft Excel or in a software. Lastly, you just print and book-bind the loose leaf book at the end of the year.

However, on the other hand, there are also disadvantages in using Loose leaf books. First, there is an additional cost to print and cost to book-bind the loose leaf books. Second, you need to submit the loose leaf books annually to the BIR RDO on or before January 15 of the following calendar year. Lastly, there is a stiff timeline to finalize your records and do all the other requirements before the BIR deadline for submission.

I hope this article has been useful for you in complying with the BIR requirement of annual submission of loose leaf books of accounts, or at least understand how to comply with this requirement should you choose to do loose leaf books in the future.

Feel free to leave your thoughts, suggestions, or questions in the comment box below. If you liked this article, please share it to someone you know who can benefit from it. Thank you!