(Important Update: Effective January 22, 2024, per Republic Act No 11976 Ease of Paying Taxes (EOPT) Act and Revenue Memorandum Circular (RMC) No. 14-2024, the Bureau of Internal Revenue (BIR) will cease collecting the BIR Form 0605 – Annual Registration Fee (ARF) from business taxpayers.

In addition, Revenue Regulation (RR) No. 11-2024 also clarified that filing and paying of BIR Form 0605 – Annual Registration Fee is no longer needed even if the Registration Fee is reflected in the Tax Type of your BIR Form 2303 – COR.)

As a business owner or self-employed, I’m pretty sure you are aware that you need to do renewal of your permits and licenses every January of each new year.

Permits such as Barangay Permit, Mayor’s Permit, Fire Permit, Occupational Permit, Health Permit, Locational Permit, Sanitary Permit, Professional Tax Receipt, etc., as applicable. Sometimes you even think why not even require Sanity Permit too. (I’m kidding with the last one)

There are indeed numerous business licenses and permits you need to think of when you are running a business or doing self-employment here in the Philippines. But there is one required annual filing or renewal that you might be overlooking, and that’s the BIR Annual Registration Fee, also known as part of the BIR Form 0605.

What is BIR Form 0605?

BIR Form 0605 stands for Payment Form. It is used for voluntary payment and per audit/delinquent account payment such as the following:

Voluntary Payment

- Self-Assessment

- Penalties

- Tax Deposit/Advance Payment

- Income Tax Second Installment for Individual only

- Others: Annual Registration Fee

Per Audit/Delinquent Account

- Preliminary/Final Assess/Deficiency Tax

- Accounts Receivable/Delinquent Account

In this article, we will focus on BIR Form 0605 for Voluntary Payment particularly Others: Annual Registration Fee.

What is BIR Form 0605 Annual Registration Fee?

Annual Registration Fee is a yearly tax filing requirement for taxpayers doing business or self-employment duly registered in the Bureau of Internal Revenue (BIR) in the Philippines.

Once filed and paid, it must be displayed in the business establishment or office premise together with other business licenses and permits.

How much is the BIR Form 0605 Annual Registration Fee?

BIR Annual Registration Fee is worth five hundred pesos (P500) each new year.

Consequence of not filing, paying, and displaying BIR Form 0605 Annual Registration Fee

Failure to file, pay and display BIR Form 0605 Annual Registration Fee will result to a compromise penalty of one thousand pesos (P1,000.00), or criminal penalty of imprisonment of not more than six (6) months based on Revenue Memorandum Order (RMO) No. 7-2015 Annex A.

So instead of five hundred pesos (P500) it will become one thousand five hundred pesos (P1,500) if you fail to file and pay on time.

How to file BIR Form 0605 Annual Registration Fee?

Now that we know what is BIR Form 0605 Annual Registration Fee, and the consequence of not filing, paying, and displaying it, let’s now discuss how can you file it

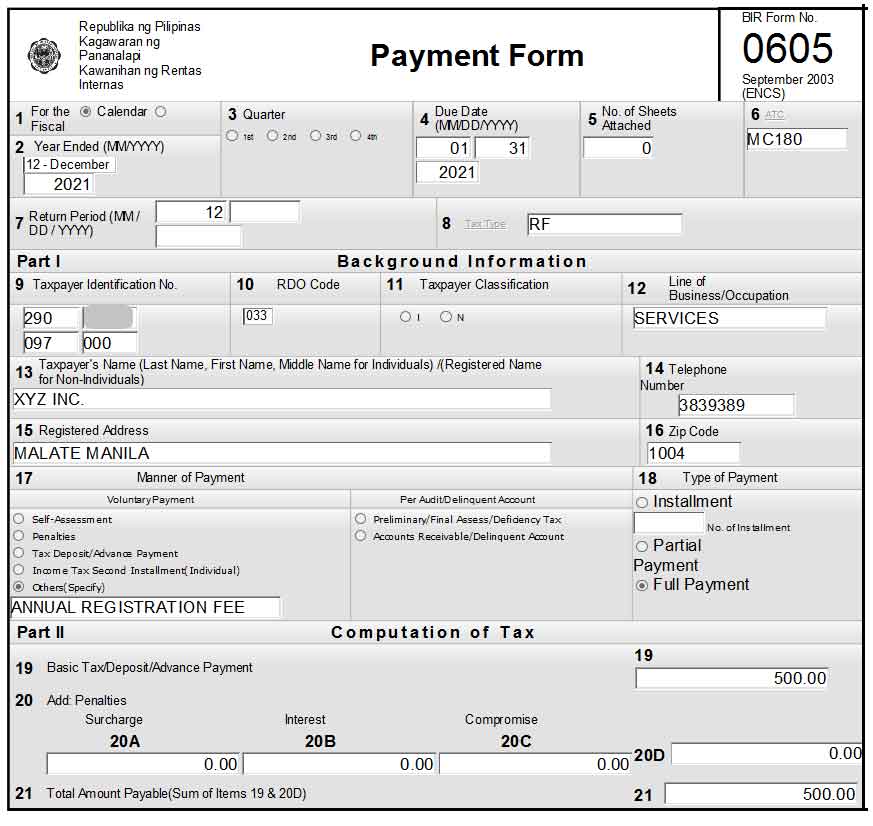

See below image for sample filled-up BIR Form 0605 Annual Registration Fee

Here is a step by step guide on how to fill-up BIR Form 0605 for Annual Registration Fee. I will be referring and using the same numbers as indicated in the form.

Item 1 – Accounting Period

Choose your accounting period of either: Calendar Year or Fiscal Year

Calendar Year means your accounting period follows the normal yearly cycle which starts on January 1 and ends on December 31 of each year.

Otherwise, you are following Fiscal Year.

The most common accounting period in the Philippines is Calendar Year, unless you are related to a foreign corporation that follows Fiscal Year.

Item 2 – Year Ended

Choose your year-ended in the format, month and year: (MM/YYYY)

If you are following Calendar Year, the month will be December and year will the year you are renewing. Example December 20XX.

If you are following Fiscal Year, the month will be other than December depending what month end are you following. Example: June 20XX

Item 3 – Quarter

You may ignore this part as it’s not applicable.

Item 4 – Due Date (MM/DD/YYYY)

For calendar year, the due date is January 31 of each new year. Example: January 31, 20XX

Item 5 – No. of Sheets Attached

You may ignore this part as it’s not applicable

Item 6 – ATC – Alphanumeric Tax Code

From the selection, choose MC180 which means Registration Fee For VAT/NON-VAT Taxpayers as the alphanumeric tax code (ATC). See sample image below

Item 7 – Return Period (MM/DD/YYYY)

Put the last date of validity of the BIR Form 0605 Annual Registration Fee which is until the end of the year. For calendar year, it’s December 31, 20XX.

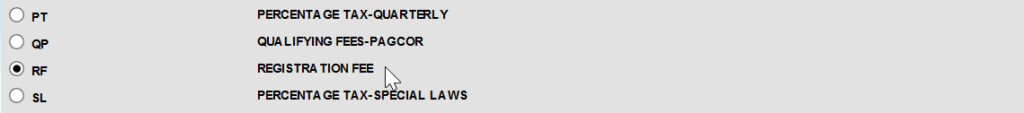

Item 8 – Tax Type

From the selection, choose RF which means Registration Fee as the tax type. See sample image below:

Item 9 – Tax Identification Number (TIN)

Type your or your company’s Tax Identification Number (TIN).

Item 10 – RDO Code

Choose the Regional District Office (RDO) where you or the company is registered. You can see the RDO in the BIR Form 2303 – Certificate of Registration (COR).

Item 11 – Taxpayer Classification

Choose I if individual N if non-individual.

Individual includes sole proprietors, self-employed, freelancers, or practicing professionals.

Non-Individual pertains to Corporations and Partnerships.

Item 12 – Line of Business/Occupation

Type your or the company’s Line of Business/Occupation which you can see in also see in the BIR Form 2303 – Certificate of Registration (COR).

Item 13 – Taxpayer’s Name

Type the name of the person or the company.

If individual, type Last Name, First Name and then Middle Name.

If non-individual, type the Corporation or Partnership registered name.

Item 14 to 16 – Telephone, Address, Zip Code

These are self-explanatory items you can input according to your company information, and as shown in also in the BIR Form 2303 – Certificate of Registration (COR).

Item 17 – Manner Payment

Under Voluntary Payment Choose Others (Specify) then type Annual Registration Fee.

Item 18 – Type of Payment

Choose Full Payment.

Item 19 – Basic Tax/Deposit/Advance Payment

Type five hundred (P500.00).

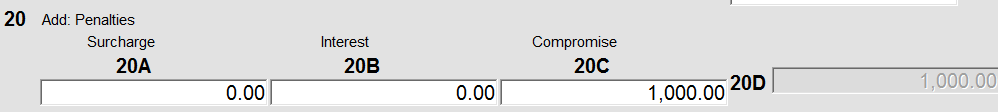

Item 20 – Penalties

Ignore this or put zero (P 0) if BIR Form 0605 Annual Registration Fee is filed and paid on time.

However, if late filing and payment, put one thousand (P1,000) under compromise. See sample image below

Item 21 – Total Amount Payable

Total Item 19 and item 20 as applicable. If using a BIR systems, such as eBIRForms or eFPS, this will be automatically computed.

That’s it, once you filled-up Items 1 to 20, you may now proceed to filing and paying the BIR Form 0605 Annual Registration Fee.

Deadline for Filing and Payment of BIR Form 0605 Annual Registration Fee

For calendar period, the deadline is on or before January 31 of each new year.

Where to file BIR Form 0605 Annual Registration Fee?

To easily file BIR Form 0605 Annual Registration Fee, you may use BIR systems as follows:

- eBIRForms – electronic BIR Forms which is a desktop application that you need to download and install in your computer. Download it in BIR website. Click here for latest version as of this writing.

- eFPS – electronic filing and payment system. This is a web-based BIR system of filing and paying tax returns. But not all our qualified to use it. If qualified, submit application to your Regional District Office (RDO), and then once approved, BIR will send you your username and password. Otherwise, use eBIRForms or an alternative system just like MPM Accounting Software for automatic creation and filing of BIR Form 0605. Try it for free for 30 days here: https://mpm.ph/tax

Where to pay BIR Form 0605 Annual Registration Fee?

If using eFPS – electronic filing and payment system, you need to coordinate with an eFPS accredited bank to link their system to your eFPS registration, for easy and automated payment of tax return.

However, if using eBIRForm or an alternative system just like MPM Accounting Software, you may pay in any online facilities such as GCASH, Paymaya, DBPPay, Peso Net, Landbank and Unionbank. For list of ePAY facilities, click here.

BIR Form 0605 Editable PDF

If you need to a BIR Form 0605 in pdf format, we created an editable pdf for your convenience which you can download here. I hope that will save you some time, but if you wish to cut down the time spent on these forms as well as to reduce errors due to manual preparation and filing, you may want consider using MPM Accounting Software. You can try it out for free.

That’s it, you just learned how to comply and file your own BIR Form 0605 Annual Registration Fee.

I hope this article gave you relevant information. Feel free to comment or ask question below. If you liked this article, please share it!

What will happen if the annual registration fee was paid via GCASH or Paymaya but the 0605 form was not submitted through eBIRForm/eFPS?

hi, it’s still considered open case (not filed) thus subject to penalty of P1,000.00.