(Important Note: This article is written prior to the implementation of Republic Act No. 11976 entitled Ease of Paying Taxes (EOPT) Act, and Revenue Regulation No. 7-2024. For updated rules on invoice, you may refer to How to Register Invoice per RR 7-2024, Revenue Regulation No. 3-2024 and Revenue Regulation No. 11-2024)

Every company or individual doing business, or earning income from self-employment, freelancing, practicing profession or independent directors, must register receipts and/or invoices Invoice and Receipt (Per EOPT and RR 7-2024) with the Bureau of Internal Revenue (BIR), and must issue thereon for each sale transaction and/or collection from customers.

However, despite the good intention to comply to this requirement, several companies and business owners are still faced with penalties for not issuing or issuing the wrong sales documents. Because many are left confused on which sales documents is the right one to register, use and issue to customers. (Important Update: The confusion was now resolved by EOPT, RR 3-2024 and RR 7-2024. There is now only one primary sales document to issue which is invoice.)

I am writing this article to shed some light to business owners, or even accountants, who are still learning which sales document is appropriate.

Know What You Are Selling

To know which sales document you will use, first you need to know what you are selling.

In general, there are two types of sales:

1. Sale of Goods or Properties

Sale of Goods pertains to an item or product that are manufactured or bought for re-sale such as retailer, online seller of goods, wholesaler, trader, etc.

Sale of Properties, on the other hand, pertains to real estate properties held for sale such as condominium and real estate-developers.

2. Sale of Services or Lease of Properties

Sale of Services pertains to companies or individuals who provide their skills, time, expertise, experience, etc. in exchange for a fee such as freelancers, professionals, insurance agents, real estate brokers, business service companies, construction companies, travel agencies, hotels, restaurants, food kiosks, salons, spas, etc.

Lease of properties, on the other hand, pertains to owners of real-estate or equipment held as investment property, and then leased the said property to another person for a profit.

Types of Sales Document

In general, the following are the common sales documents:

- Sales Invoice

- Official Receipt

- Billing Invoice

- Collection Receipt

- Acknowledgement Receipt

To simplify, this article will focus on two sales documents, the difference between the Sales Invoice and Billing Invoice.

I will explain their difference and show which one to use on a given sale scenario.

Sales Invoice vs Billing Invoice

Here are the ten (10) differences between a sales invoice and billing invoice:

1. Sales Invoice is used for sale of goods while Billing Invoice is used for sale of service

If your company is selling goods or items, remember to use a Sales Invoice every time you have a sale to customer, regardless if its cash or on credit.

If your company is engaged in sale of service or lease of properties, you may use a Billing Invoice to detail your services and its equivalent fee (collected or) to be collected from you customers. You may opt not to register and use Billing Invoice if your sale of services are paid immediately in cash. (Updated in April 2024 per EOPT, RR 3-2024 and RR 7-2024)

2. Sales Invoice is a primary sales document for sale of goods while Billing Invoice is a supplemental sales document for sale of service (Updated per EOPT, RR 3-2024 and RR 7-2024)

Sales Invoice is considered the primary or most important document for sale of goods because it is the legal proof that a sale or transfer of goods has happened. As such, when you register your sales document to BIR, always ensure that if you are selling goods or items, you must register a Sales Invoice.

On the hand, Billing Invoice is considered a supplemental sales document for sales of services or lease of properties. It is not as important as an Official Receipt. It is usually used only to bill customers or clients without the guarantee that the sale happened or was cancelled was collected or not. As such, when you register your sales document to BIR, analyze first your company sales process if there is a need to register a Billing Invoice. (Important Update: Per EOPT effective April 27, 2024, Billing Invoice is now a primary sales document to prove sale of service or lease of property)

3. Sales Invoice can also be Cash Invoice or Charge Invoice while Billing Invoice can also be Service Invoice or Statement of Account (Updated Per EOPT, RR 3-2024, and RR 11-2024)

In general, sale of goods is supported by a Sales Invoice. However, it is also allowed to register an alternative which they refer to as Cash Invoice or Charge Invoice. Cash Invoice is like a sales invoice, but it is used particularly for cash sale of goods. On the other hand, Charge Invoice is also like a sales invoice, but it is used particularly for sale of goods on credit or on account. Which means the sale is not paid immediately but will be paid on a future date.

On the other hand, Service Invoice or Statement of Account is also alternately registered and used instead of Billing Invoice. But the three (3) two (2) have same purpose, that is to bill the client on the services to be provided, or have been provided, but is not yet collected from or paid by customer.

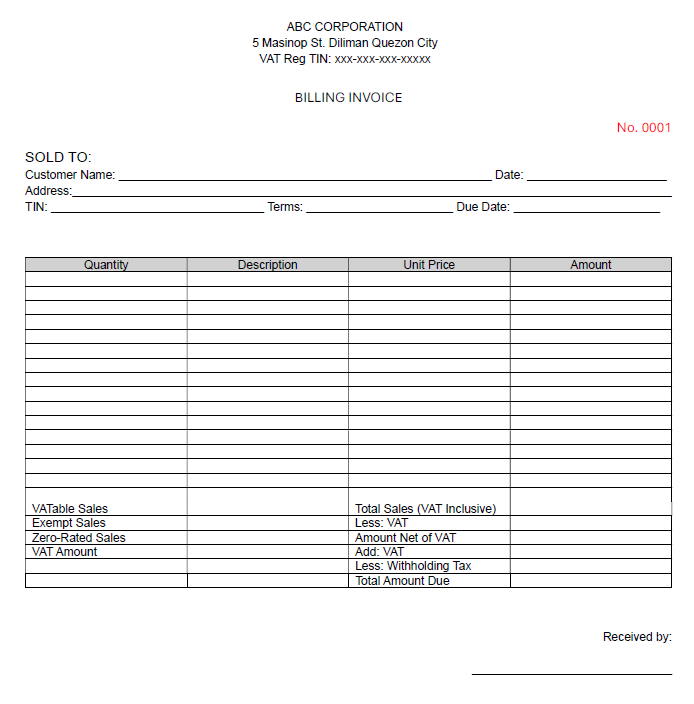

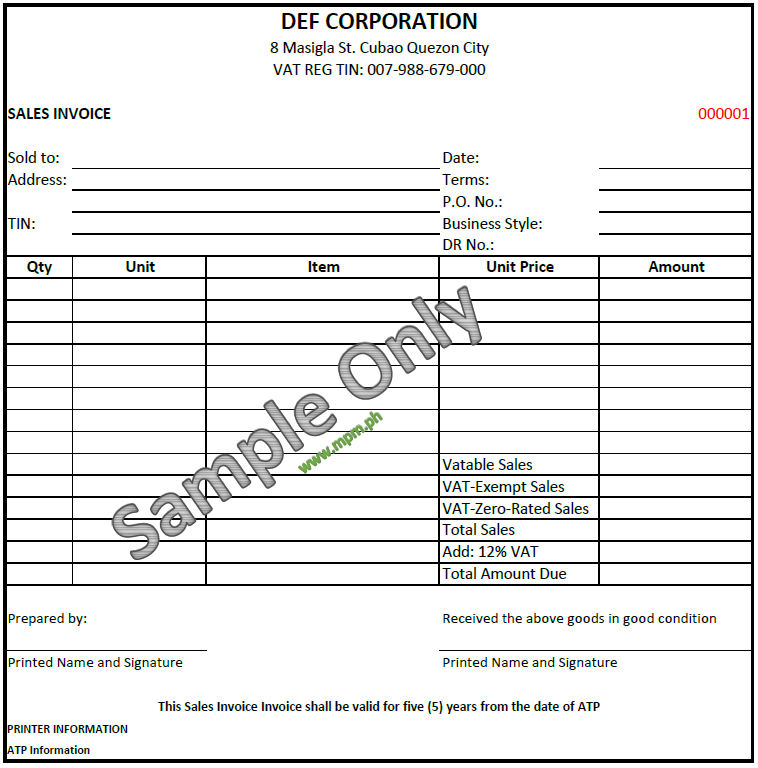

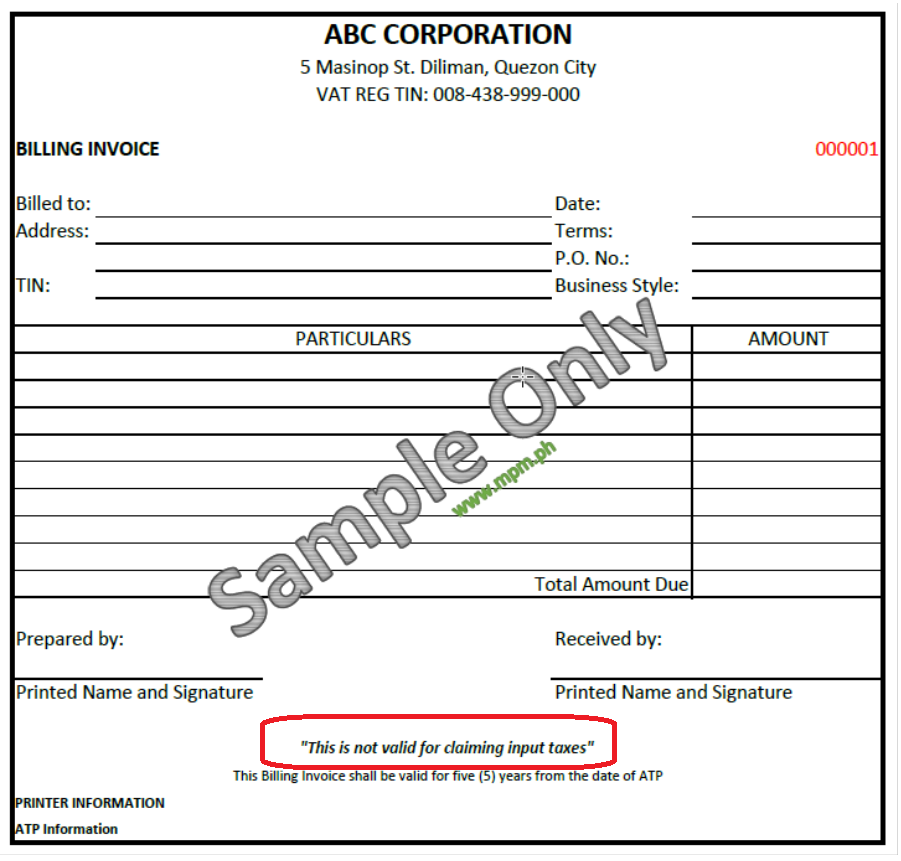

4. Sales Invoice details the goods or item sold such as quantity, unit of measurement, item or article name, unit price, and the total amount. Billing Invoice only also shows quantity, unit price, description or particulars of the service sold and the amount (Updated per EOPT, RR 3-2024 and RR 11-2024)

See below sample to differentiate the two:

BILLING INVOICE (SAMPLE)

This is the updated sample Billing Invoice effective April 27, 2024 per EOPT, RR No. 3-2024 and RR No. 11-2024.

SALES INVOICE (SAMPLE)

5. Sales Invoice is valid for claiming input tax while Billing Invoice is not also valid for claiming input tax (Updated Per EOPT, RR No. 3-2024 and RR No. 11-2024)

As a primary sales document of goods and properties, Sales Invoice is valid for claiming input tax. This is particularly important for VAT-Registered businesses who purchases goods from another VAT Registered Company.

On the other hand, Billing Invoice, as a supplemental primary sales document of services and lease of properties, is not now valid for claiming input tax. In fact, it is explicitly written at the bottom of a Billing Invoice that such is not valid for input tax. You may refer to the sample highlighted in red of the Billing Invoice below. (Important Update: Per EOPT, RR No. 3-2024 and RR No. 11-2024, Billing Invoice is now a primary sales document valid for claiming input tax).

Sample Billing Invoice (Update: Below sample is now superseded):

If you are non-VAT registered business, then this is not as relevant for you.

6. Sales Invoice is linked to Collection Receipt while Billing Invoice linked to Official Receipt or any Receipt (Updated Per EOPT, RR No. 3-2024 and RR No. 11-2024)

For those engaged in sale of goods, Collection Receipt will be issued after a Sales Invoice to document collection or payment of customer. However, it is only applicable if the sale was on credit or with future payment terms such as 15 days, 30 days, etc. And if that’s the case, then the normal sale process of those engaged in sale of goods on account or credit term will be as follows: SALES INVOICE (Upon sale of goods) > COLLECTION RECEIPT (Upon receipt of payment). If the company is only engaged in cash sales of goods, then there is no need for Collection Receipt. Sales Invoice will be sufficient.

For those engaged in sale of service, Official Receipt (Updated per EOPT: or any kind of receipt) will be issued after a Billing Invoice to document collection or payment of customer. However, it is only applicable if the sale is not paid immediately or terms future payment terms such as 15 days, 30 days, etc. And if that’s the case, then the normal sale process of those engaged in sale of services on account or credit term will be as follows: BILLING INVOICE (Upon rendering or billing the service) > OFFICIAL RECEIPT OR ANY RECEIPT (Updated per EOPT: or any kind of receipt) (Upon receipt of payment). If the company is only engaged in cash sales of services and does not need to bill their customer/client ahead of payment date, then there is no need for Official Receipt or any receipt for collection. (Updated per EOPT, RR No. 3-2024 and RR No. 11-2024)

7. Sales Invoice is a mandatory or required document to be registered with BIR while Billing Invoice is not also mandatory or required document to be registered (Updated Per EOPT, RR No. 3-2024 and RR No. 11-2024)

As a primary document, Sales Invoice, or alternately Cash or Charge Invoice, must be registered with BIR by businesses engaged in sale of goods, as it is the most important proof that an actual sale has been made.

As a supplemental document, Billing Invoice, or alternately Service Invoice or Statement of Account, are only optional and are not required to be registered with BIR by businesses engaged in sale of services or lease of properties. As a supplemental document, normally, you only register this if you have sales you bill in advance of collection date. (Updated: Billing Invoice and Service Invoice are now considered primary sales document only Statement of Account and Receipt are supplemental document per EOPT, RR No. 3-2024 and RR No. 11-2024)

8. Sales Invoice are recorded in the books while Billing Invoice may not be are also recorded in the books (Updated Per EOPT, RR No. 3-2024 and RR No. 11-2024)

Sales Invoice, as a primary document to prove sale of goods, is always recorded in the books of accounts, or accounting books, regardless if the company’s accounting method is cash or accrual.

On the other hand, Billing Invoice, as a supplemental document now a primary sales document for sale of service, may or may not be it is recorded in the books of accounts or accounting books as proof of sales depending whether if the company’s accounting method is cash or accrual. (Updated effective April 27, 2024 per EOPT, RR 3-2024 and RR 11-2024)

If the company’s accounting method is cash method, the Billing Invoice is usually not recorded, instead it is just used to bill and notify client of an upcoming deadline of payments. Only when the Billing Invoice is collected and issued with Official Receipt that it will be recorded in the books of account If the company’s accounting method is accrual method, the Billing Invoice is then recorded in the books of accounts to signify that a sale on credit has been earned. (Updated: Per EOPT and RR No. 3-2024, cash method of recording sales is shifted to accrual method. As such, if Billing Invoice is issued to customer, it must be recorded as sales whether collected or not.)

9. Sales Invoice is an evidence that a sale has happened while with Billing Invoice, sale is may have or have not happened yet an evidence of sales whether collected or not (Updated Per EOPT, RR No. 3-2024 and RR No. 11-2024)

As mentioned above, the primary document for sale of goods is Sales Invoice. As such, the Sales Invoice is only filled-up and issued to customer when the goods have been shipped or sold to the customer. As such, sales invoice is a hard evidence to prove a sale of good has happened.

On the other hand, Billing Invoice is only supplemental now a primary sales document. It is usually issued to just remind or bill the customer of services requested to be rendered or has been rendered but the sale may have not actually happened yet to be collected in future date. Therefore, depending on the accounting method since accrual method is mandatory accounting method per RR No. 3-2024; Billing Invoice are usually not used a now a primary evidence for sale of service.

10. Sales Invoice is recorded as either as cash or accounts receivable while Billing Invoice is recorded as an cash or Accounts Receivable (Updated Per EOPT, RR No. 3-2024 and RR No. 11-2024)

Last but not the least is how is the accounting entry differs between Sales Invoice and Billing Invoice.

As we already know by now, Sales Invoice is a primary document for sale of goods. It is issued regardless if the sale is cash or payable in the future. As such, when Sales Invoice is recorded, it is recorded as either cash or accounts receivable. See sample accounting entry (NON-VAT):

Debit: Cash or Accounts Receivable Pxx

Credit: Sales Pxx

On the other hand, Billing Invoice, is a supplemental now a primary sales document for sale of service. It may or may not be it can be used or issued and at the same time it may or may not be depending on the sales process and accounting method of the company recorded as sales whether cash is collected or not. Usually, the Billing Invoice is used and recorded when a service company bills their client in advance of payment in date and their using accrual method of accounting. As such, when Billing Invoice is issued, it is recorded as accounts receivable. See sample accounting entry (NON-VAT):

Debit: Accounts Receivable Pxx

Credit: Sales Pxx

I hope this article has been helpful for you in understanding the difference between sales invoice and billing invoice.

Feel free to leave a comment if you have questions or clarifications.