The Bureau of Internal Revenue (BIR) requires all Philippine-registered businesses to maintain records of every business transaction through books of accounts. In this article, we focus on one of the basic ones in Accounting: the General Ledger; after all, it is important to familiarize yourself with the nitty-gritty of your records. Aside from compliance purposes, these documents help determine the financial health of your business, which is something you should regularly monitor.

Use of the General Ledger in Accounting

When studying accounting, the first lesson always revolves around the double-entry system. Regardless if you are using the cash or accrual method, every business transaction has a corresponding debit and credit listing. These are maintained in the General Journal through journal entries.

Read More: What are the Books of Accounts?

In the course of running the business, transactions can reach hundreds to even thousands every month, especially for large corporations. For easier financial statement preparation for Accounting, all these journal entries are summarized in the General Ledger. This is why it is commonly referred to as the book of final entry. It contains the total amount of each account for the month. Then, after summing up each account, accountants use a Trial Balance to make sure that the debit transactions equal all credit transactions.

Filling Out Your General Ledger

Now that you’ve had an overview of how the General Ledger works in Accounting, here’s a step-by-step guide to filling it out manually for your business.

Step 1: Finalize Journal Entries

Make sure to log all transactions for the month before preparing the General Ledger to prevent going back and forth your different Accounting books. To maintain accurate records, it pays to set a regular schedule to post journal entries. This saves you from tedious bookkeeping work every month end. In addition to this, having a fresh memory of every transaction helps in proper recording, since you still remember the context behind every receipt and invoice.

Video: 5 Ways to Keep Your Accounting Records Accurate

Step 2: Post Transactions to Your Ledger

After finalizing your journal entries, it’s time to open your General Ledger. In there, create separate pages for each account. This means one for each asset, liability, owner’s equity, revenue, and expense account. Feel free to consult your Chart of Accounts as you prepare these pages.

Once you are done, post each entry from your General Journal in its corresponding ledger page. Here’s a sample transaction:

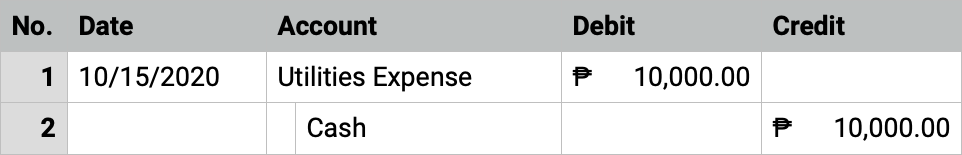

Let’s say you paid in cash for your electric bill of P10,000 this October. Here’s how you posted this transaction in your General Journal:

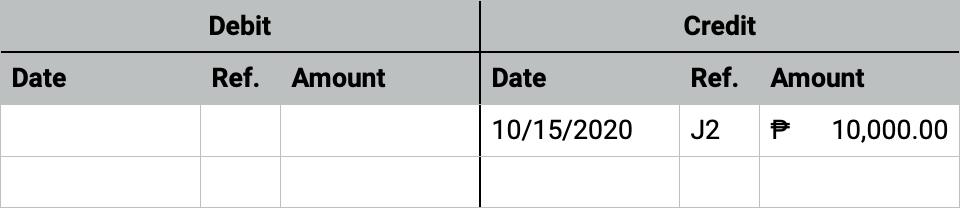

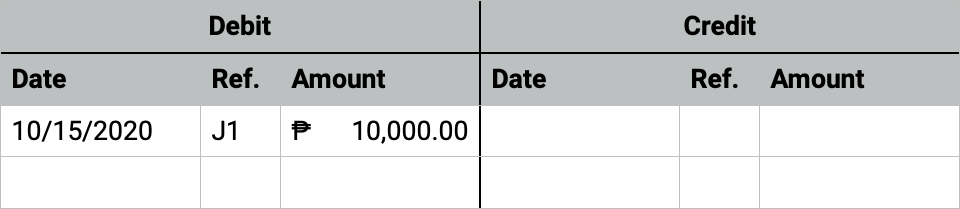

To transfer this Accounting transaction to your General Ledger, simply copy the entry into the appropriate page for each account:

The Reference portion of the General Ledger is arguably one of its most important details. As you may have noticed, it refers back to the specific entry in the General Journal from which the transaction was initially recorded. This is particularly helpful when double-checking and balancing. Through the reference column, anyone can easily refer back to the original journal entry and check whether the details of the transaction were accurately recorded.

Manual vs Automated

When you only have a handful of transactions for the month, this part can be done in a jiffy. Small businesses and freelancers may not even break a sweat. However, if your business deals with several transactions on the day-to-day, manually posting these entries can turn into a nightmare.

If this is the case for your business, we recommend that you start looking into automated accounting options. Digital platforms like MPM Accounting can easily manage your books of accounts without the errors associated with manual filing. All you have to do is double-check the entries and enjoy your prepared financial statements! Click the button below to learn more about the benefits of using MPM Accounting for your business.

Step 3: Get the Final Amounts

Decided to continue down the manual route? We got you covered. The last step is to get the final amount for each ledger account. To do so:

- Get the total of all debit transactions.

- Do the same with all credit transactions.

- Then, subtract the two amounts.

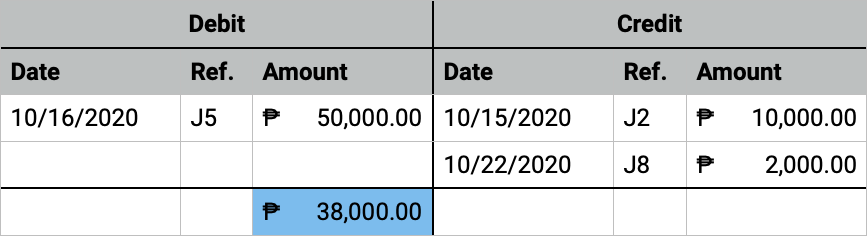

Meanwhile, if you added a balance column similar to the example earlier (Tables 2 and 3), all you need to do is take the last number as the difference. The difference must be recorded in its appropriate column. When doing so, take note of which accounts are debit accounts and which are credit accounts.

Take Table 4 below for an example. After collating all transactions, the balance of the business’ cash account for October is ₱38,000. Since Cash is a debit account, this amount goes into the debit column in the Trial Balance. In a similar manner, if the difference turns out to be negative, then it should go into the credit column.

Step 4: Check and Recheck

Finally, to make sure that every journal entry is accounted for, all these account totals will go into your Trial Balance. Since we are using the double-entry accounting system, all debits must equal all credit transactions. After all, every journal entry follows this rule.

However, when doing manual accounting work, errors prove to be quite unavoidable. In cases they don’t balance out, you will have to check your total amounts, ledger entries, and maybe even go back to your journal entries. Again, this is where having an automated accounting system does wonders. After all, with less manual work comes a lesser chance to encounter accounting mishaps.

Recall

To summarize, in Accounting, preparing a General Ledger involves four steps:

- Finalizing journal entries;

- Posting entries to the ledger;

- Getting the account totals; and

- Checking and rechecking

With this in mind, you are now ready to maintain a general ledger for your business. Just remember: technology is your friend: from spreadsheet formulas up to automated financial statement preparation. Platforms like MPM Accounting are made to help businesses like yours experience worry-free accounting and focus on running your business.

Hello! May I ask about the book of accounts, like for example, in every year, should it have its own set of book of accounts then for the following year will also have its own set?