Calculating for your employees’ overtime, holiday, rest day, and/or night differential premiums is not a walk in the park. In fact, there are 32 different combinations at play. Moreover, work hours may fall under different categories, making computation more complex. This blog aims to take a few steps off your payroll process, giving you time to focus on more important matters.

Editor’s Note: The preceding article from this Labor Code infographic series discusses employee working hours as mandated by law. Click here to read the previous blog.

Philippine Holidays

Did you know that the Philippines has one of the highest numbers of holidays in the world? (Source: gulfbusiness.com) We have a total of 19. This is comprised of ten regular and nine special non-working holidays, still excluding proclamations for Eid al-Fitr and Eid al-Adha.

| Regular Holidays | Date | Special Non-Working Holidays | Date |

| New Year’s Day | Jan. 1 | Chinese New Year | |

| Araw ng Kagitingan | Apr. 9 | EDSA People Power Anniversary | Feb. 25 |

| Maundy Thursday | Black Saturday | ||

| Good Friday | Ninoy Aquino Day | Aug. 21 | |

| Labor Day | May 1 | All Saints’ Day | Nov. 1 |

| Independence Day | Jun. 12 | Additional Special Non-Working Holiday | Nov. 2 |

| National Heroes Day | Aug. 31 | Feast of the Immaculate Conception | Dec. 8 |

| Bonifacio Day | Nov. 30 | Additional Special Non-Working Holiday | Dec. 24 |

| Christmas Day | Dec. 25 | Last Day of the Year | Dec. 31 |

| Rizal Day | Dec. 30 |

Although this comes as a blessing to employees, business owners and payroll masters may beg to differ. Coupled with scheduled rest days and overtime, imagine the premium calculation for all these!

Infographic: Calculating Overtime, Holiday, Rest Day, and Night Differential

Below, we round up all pay rate combinations based on the Department of Labor and Employment (DOLE). Simply consult this table every payroll period for quicker calculations. Feel free to download the infographic below for your business’ payroll needs.

*Presented for simplicity

How to Use The Pay Rate Table

Step 1: Collate Attendance Info

Gather all data regarding your employees’ attendance. This includes lates, absences, and leaves.

Step 2: Get Base Pay

Salary computation banks on your employee’s base pay. Check out their records for this information.

For minimum wage earners, check out the National Wages and Productivity Commission’s (NWPC) summary per region published in June 2020.

Step 3: Plot Workdays

Next, plot your employee’s workdays on a calendar, and see if they coincide with:

- Regular Holidays

- Special Non-Working Holidays

- Rest Days

An employee’s eight-hour workday can fall under two different classifications. For example, work can start at 10:00 PM on a regular workday and end at 7:00 AM on a rest day.

Step 4: Plot Work Hours

Additionally, check if the work hours that they rendered fall under:

- Night Differential (10:00 PM – 6:00 AM)

- Overtime

Similar to workdays, work hours in one period can also be categorized differently.

For example, an employee worked from 6:00 PM to 5:00 AM the next day. Work rendered from 6:00 PM to 10:00 PM falls under regular pay. Work rendered from 10:00 PM to 3:00 AM is subject to a night differential. Meanwhile, work from 3:00 AM to 5:00 AM entitles them to a night differential coupled with overtime premium.

Step 5: Calculate

Once you have plotted the nuances of each employees’ attendance, you can move forward to computing for their salaries and wages.

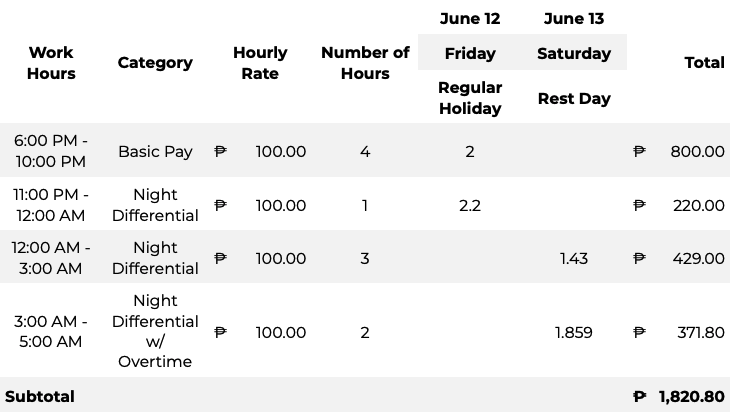

Below is a sample computation for work rendered on a holiday spilling over a rest day with night differential and overtime.

Notes:

- Hourly Rate is ₱100

- Meal break is from 10:00 PM – 11:00 PM

There you have it—a straightforward guide to calculating for overtime, holiday premiums, and more. Apply these five steps to the month’s timesheets to get your employee’s salaries and wages.

Too tedious? Click the button below to see how MPM Payroll automates this process in a few easy steps.

Up Next: Working Conditions For Special Groups of Employees

Watch out for our next article in the Philippine Labor Code infographic series, tackling government-mandated working conditions for certain employee groups.

Follow us on Facebook to get regular updates on our upcoming blogs!

[…] Calculating Holiday, Overtime, and Night Differential Premiums […]