All registered taxpayers engaged in business are provided by the Bureau of Internal Revenue (BIR) an “ASK FOR RECEIPT” signage to be displayed visibly in the business establishment.

The ASK FOR RECEIPT signage is a reminder, both to the seller and the buyer, the importance of issuing an official receipt or invoice for every sale of service or goods.

To know more about official receipts, you may read our previous post What You Need to Know About Official Receipts?

In this article, I will teach you on how to properly write and issue an official receipt applicable for NON-VAT BIR registered taxpayer. Other types of receipt and invoice will be covered in separate articles.

What is a NON-VAT BIR Registered Taxpayer?

In general, a BIR Registered NON-VAT taxpayer means that the individual or entity does not have annual gross sales or receipts exceeding the current limit. As of the date of writing, the limit is P1,919,500. For the updated amount of limit, you may visit the BIR website.

A NON-VAT BIR registered taxpayer are required to file and pay monthly percentage tax (BIR form 2551M).

3 Steps in Writing a NON-VAT Official Receipt

Step 1: Compute and collect the amount of sales

Before you issue an official receipt to your customer, you need to first consider the following:

- Ensure that you have already collected the cash payment from your customer. In case of payment via check, before you issue an official receipt wait until the check clears. You may issue BIR registered acknowledgement receipt while waiting for the check to clear.

- Consider to deduct any amount of creditable withholding tax applicable. For every withholding tax deducted, ask for a Certificate of Tax Withheld (BIR Form 2307) from your customer.

Two Types of Collection

- Without Creditable Withholding Tax (BIR FORM 2307)

For collection of sales without credible withholding tax (BIR form 2307), issuance of official receipt is pretty simple

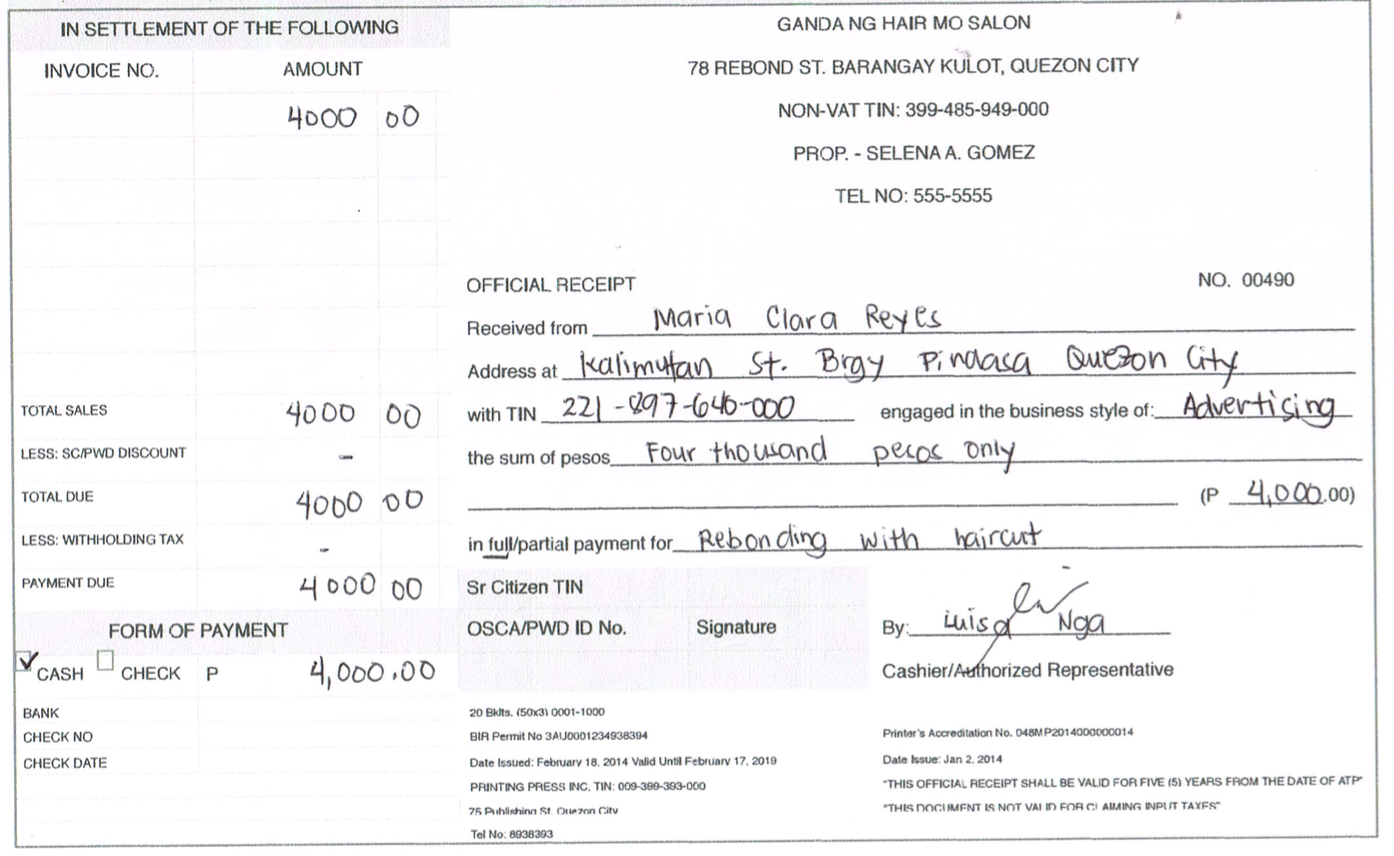

Example: Business Type: Salon Non-VAT Registered Taxpayer

Scenario: A customer purchased hair treatment worth P4,000. She paid in cash after the treatment. No withholding tax was deducted from the payment.

Amount collected: Full amount of P4,000 will be collected

- With Creditable Withholding Tax (BIR FORM 2307)

For collection of sales with credible withholding tax (BIR form 2307), computation of the amount to be collected is as follows:

- Determine the amount of gross sales

- Determine the withholding tax rate applicable

- Compute the amount of withholding tax by multiplying the amount of gross sales by the applicable withholding tax rate.

- Compute the net amount to be collected by deducting the amount of withholding tax from the amount of sales

Example:

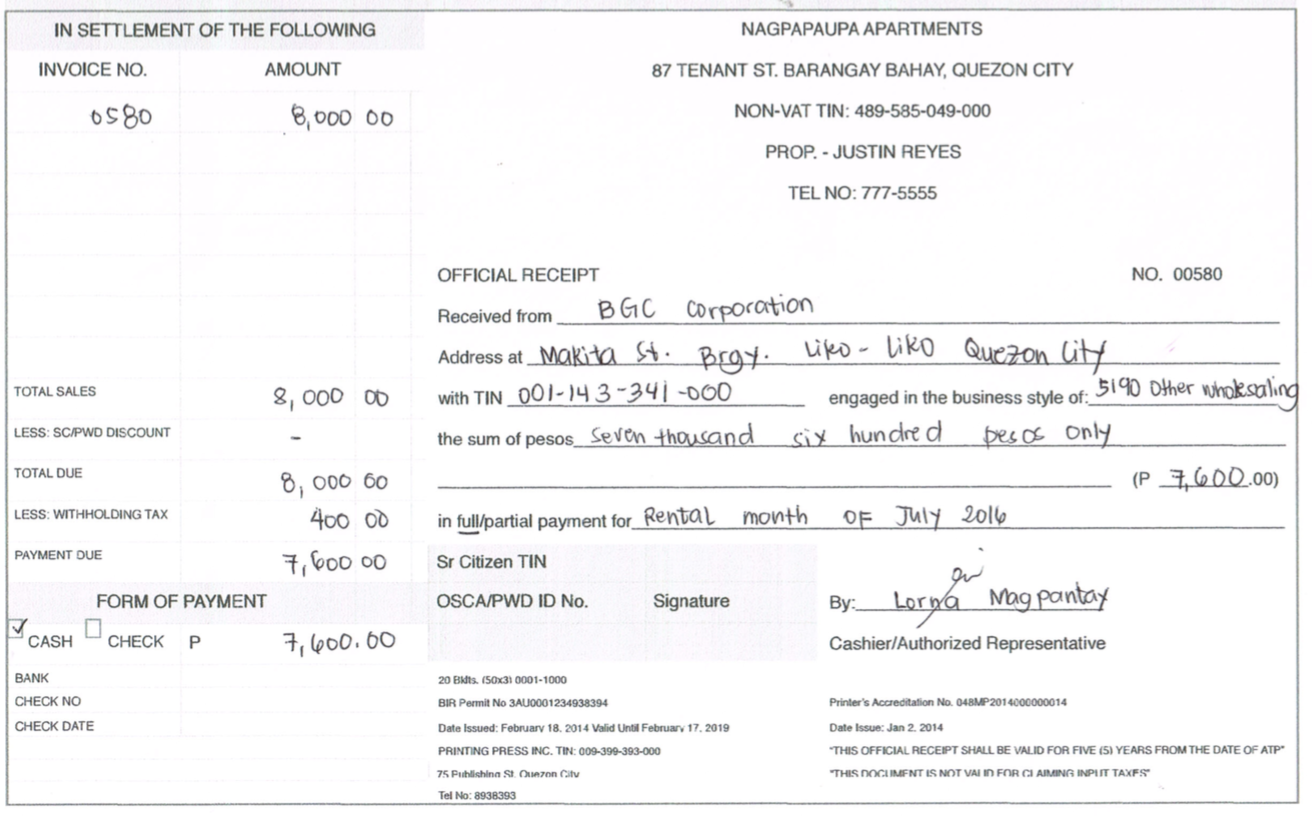

Business Type: Rental NON-VAT Registered Taxpayer

Nagpapupa Apartments is engaged in rental business. BGC Corporation rented a space for a monthly rental fee of P8,000.00

- Amount of Gross is P8,000

- Withholding tax rate applicable for rental income is 5%.

- The amount of withholding tax is P400, computed as follows: P8,000 x 5%

- The net amount to be collected is P7,600, computed as follows: P8,000 – P400

Step 2: Write down the details of the sale in the receipt

When issuing a manual official receipt, write down the following details:

- Name of Customer: Ask your customer’s complete name

- TIN: Ask for the Tax Identification Number (TIN) of the customer. If they can’t provide, write “Not Provided”

- Address: Write down the complete address or at least the city of the customer. If they can’t provide, write “Not Provided”

- Business Style: Write trade name of the customer, if different from their company name. Otherwise, write “Not Applicable” or write the name of the company.

- In the sum of: Write down the narrative of the amount collected

- Amount: Write down the numeric figure of the amount collected

- In full/partial payment for: a) Underline or circle if payment was collected in full or partial amount. Full payment means you were able to collect 100%. If partial, it means you were able to collect only a percentage of the total, such as if it’s down payment like 20%, 50% etc.; b) Write the description or nature of the service you provided.

Step 3: Breakdown the amount collected

On the left side of the official receipt, you will see that there are boxes where you’ll fill out the breakdown of amount paid as follow:

- Total Sales or Due: It’s the total price or fee of the service rendered

- Less: Wittholding tax: It’s the amount of withholding tax deducted by your customer based on the nature of the sale or service, if applicable.

- Total Payment: It’s the amount paid by your customer after deducting the withholding tax from the sale

- SC/PWD Discount: It’s the 20% discount given to senior citizen and person with disability deducted from the gross sales.

Sample Writing of a NONVAT Official Receipt

For NONVAT Sale of Service without Creditable Withholding Tax (BIR Form 2307)

For NON-VAT Sale of Service with Creditable Withholding Tax (BIR Form 2307)