In the last quarter of previous year, there's been news about the increase of the Home Development Continue Reading

Payroll and HR Tips

Philippine Holidays in 2024

Plan ahead for your 2024 travel goals! Philippine holidays for 2024 are now out!In October 13, 2023, Continue Reading

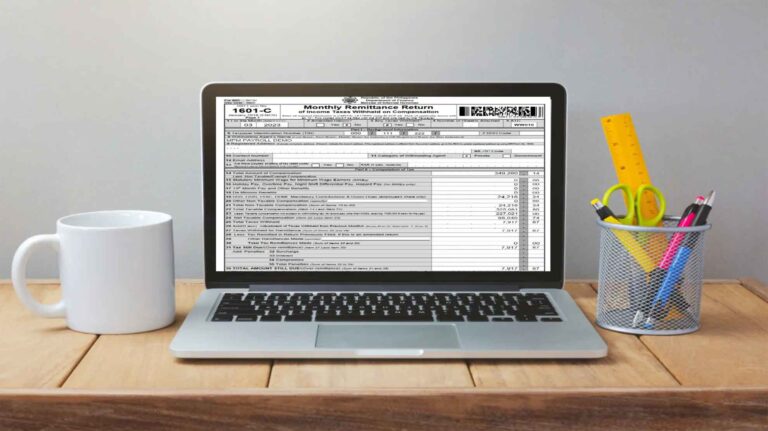

BIR Form 1601C – Monthly Withholding Tax on Compensation

BIR Form 1601C pertains to Monthly Remittance Return of Income Taxes Withheld on Compensation. It is Continue Reading

2023 SSS Table for Employer and Employee

If you are in payroll department, year-end is probably one of our busiest with the annualization of Continue Reading

New BIR Tax Tables for 2023 Onwards

The new year 2023 is fast approaching. Many are looking forward to a new start. One of the Continue Reading

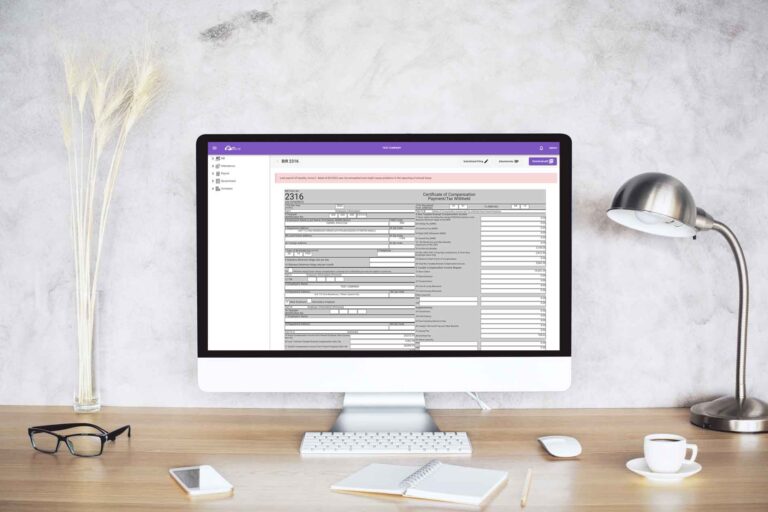

BIR Form 2316 – Certificate of Compensation Payment

BIR form 2316 or Certificate of Compensation Payment/Tax Withheld shows the breakdown of all the Continue Reading

Payroll Tax Annualization and Year End Reporting

The end of the calendar year is near and during the year-end, companies with employees will perform Continue Reading

Certificate of Employment (Template Included)

This article aims to answer some of the common questions related to the Certificate of Continue Reading

Types of Holiday in the Philippines

In the Philippines, we have different types of holiday. Not knowing the different types of holidays Continue Reading

2021 Year-End Compliance Reminders

2021 is ending and a new year 2022 will be coming soon. Most are either busy preparing for Continue Reading