In recent months, the BIR have issued two memorandums which emphasizes the need to use official Continue Reading

Non-VAT Freelancers Guide to BIR Tax Compliance

Driven by ease in availability of technology and the comfort of working from home, many are leaving Continue Reading

BIR Registered Looseleaf Official Receipt and/or Sales Invoice

Bureau of Internal Revenue (BIR) Registered Looseleaf Official Receipt and/or Sales Invoice is a Continue Reading

How to Get Official Receipt from BIR?

If you are a person doing freelancing, self-employment or practicing profession, or you own a Continue Reading

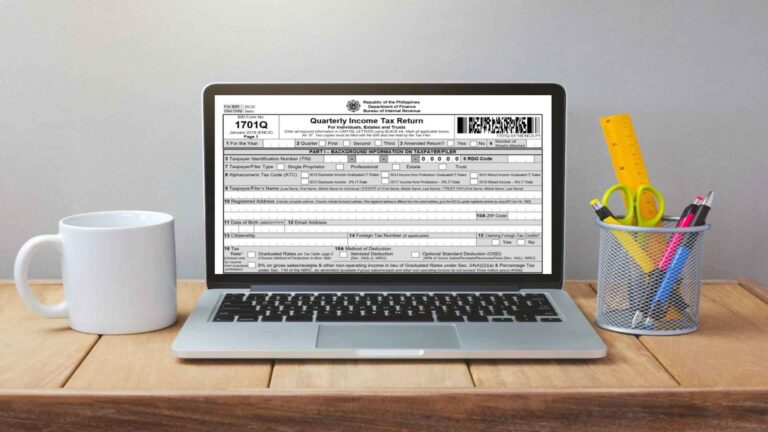

BIR Form 1701Q Quarterly Income Tax Return

BIR Form 1701Q is a tax return needed for filing and/or payment quarterly by individual taxpayer Continue Reading

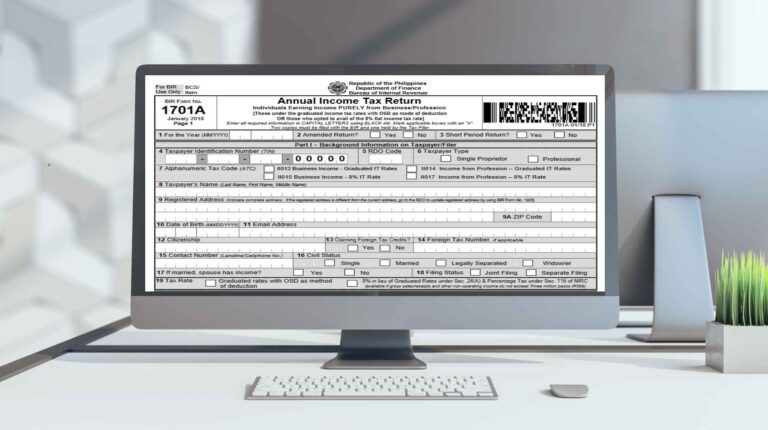

BIR Form 1701A Annual Income Tax Return for Individuals

Being your own boss can be a fulfilling and rewarding path because of its limitless potential Continue Reading

Loose Leaf Books of Accounts: Annual Submission

All registered taxpayers doing business, self-employment or practice of profession need to comply Continue Reading

2021 Year-End Compliance Reminders

2021 is ending and a new year 2022 will be coming soon. Most are either busy preparing for Continue Reading

Ease of Paying Taxes (EOPT) Act – HB 8942

Lask week, I've attended a zoom conference on Digitalization Preparedness of Business Owner's Small Continue Reading

BIR Form 0605 Annual Registration Fee

As a business owner or self-employed, I’m pretty sure you are aware that you need to do renewal of Continue Reading